TradeCred is a new platform where you can invest in invoice discounting and get a stable return of 10-13% for a short period of investment with moderate risks like default on loan, and untimely payment of returns but is usually safe. With a minimum of Rs. 50,000 investment and a simple process, it is one of the best choices for someone looking for a short-term investment with a higher return than FD but lower risk than stocks. This is relatively new, and many people are asking and searching about TradeCred. In this post about TradeCred Review, you will learn everything about TradeCred, what is TradeCred, how can you sign and start investing, what are the risks, what is the minimum requirement, etc. Keep reading till the end to know everything about TradeCred.

TradeCred Review

TradeCred is the best invoice discounting alternative investment platform of India with zero default record till now where you can invest as little as Rs. 50,000 with a fixed return rate of 10-14%. It is a safe, credible, and one of the most popular alternative investment options among retail investors like you.

What is TradeCred?

TradeCred is the new way of invoice discounting. TradeCred extends the opportunity to invest in invoice discounting by the retail investors while it gives the companies to raise short-term capital from the retail investors. Thanks to the arrival of internet easy investment opportunities, TradeCred extends this to many retail investors.

For example, as a retail investor, you have some money to invest for the short term, like 90 to 180 days, but if you don’t want to invest in FD, bonds or stocks, invoice discounting may be the choice. TradeCred acts as the middle man which connects the firm that needs the fund and retail investors like you. We will discuss more in detail invoice discounting in the next section.

Once the investment period is over, the amount including the return will be credited to your wallet balance. If you chose an automatic reinvestment option, it will be automatically reinvested again. The average return ranges from 10-13%. All other details like risks, return, pros, and cons in later sections. For now, let’s just sum up with this: TradeCred is a platform where retail investors can invest in invoice discounting and firms can raise short-term capital from investors.

TradeCred Review: Is invoice discounting a good idea?

First of all, let’s know what is invoice discounting. To understand in a better way, I will try to avoid the generic definition but explain with an example from a company’s point of view as well as from an investor’s point of view.

Let’s say you run a company that sells electronics in Amazon India, and currently, you need 1 crore to order new products to sell. However, you only have 50 lakhs as of now and need 50 lakhs to raise immediately. You also know that you can pay off the 50 lakhs within four days once you sell the items on Amazon. Hence, you don’t need to take credit in the long term as it will lead to a higher interest paid to the loan. In this case, invoice discounting is often the best choice.

Since you have a lot of invoices from Amazon of items being sold on Amazon by you as a seller. These invoices can be used as collateral to raise the 50 lakhs. These invoices once paid will not be credited to your company’s account but to an escrow account. An escrow account is an account where the collateral is kept safely so that the investors’ interests are kept and so that your company can just take the amount and run away.

Usually, you have to have an amount as collateral more than the amount you need to raise. So, you sign-up to TradeCred and put your detailed requirements sign the collateral and other details, and list on their website. Now, you have to wait for the investors to invest in your company.

If you are a company that needs to raise short-term capital, click here to sign up on TradeCred to raise your short term capital. Use the referral code: TC0716, I may get some commissions.

Now, let’s see from an investor’s point of view. Consider you have some money that you won’t be using for some months but you have something plan after some months. If you don’t want it to invest in FD, Mutual Fund, or Stocks, then invoice discounting is often the choice. Considering the above example, now you are an investor not the owner of the company.

Click here to sign up on TradeCred to invest. Once you complete the process, you can choose from a range of such companies that need short-term funds. You can choose any one of them and start investing. We will discuss who can signup, how to sign up, adding funds, etc. in the sections below.

Who can sign up for TradeCred?

Any individual, company, HUF (Hindu Undivided Family), Banks, NRI, Partnership firms, LLP, etc. can sign up on the TradeCred as an investor. As a company, you can signup, but there is a betting process where TradeCred will make sure that the company is a trusted company and is not likely to default on the loans.

TradeCred Review: How to sign up on TradeCred?

In this TradeCred review, we will focus on the investors’ side. Before signing up, make sure you have the following things in hand:

- Your phone number is linked to Aadhar, PAN Card, and Bank and are the same.

- Scan copy of PAN Card.

- Downloaded copy of password-protected Aadhar and the password.

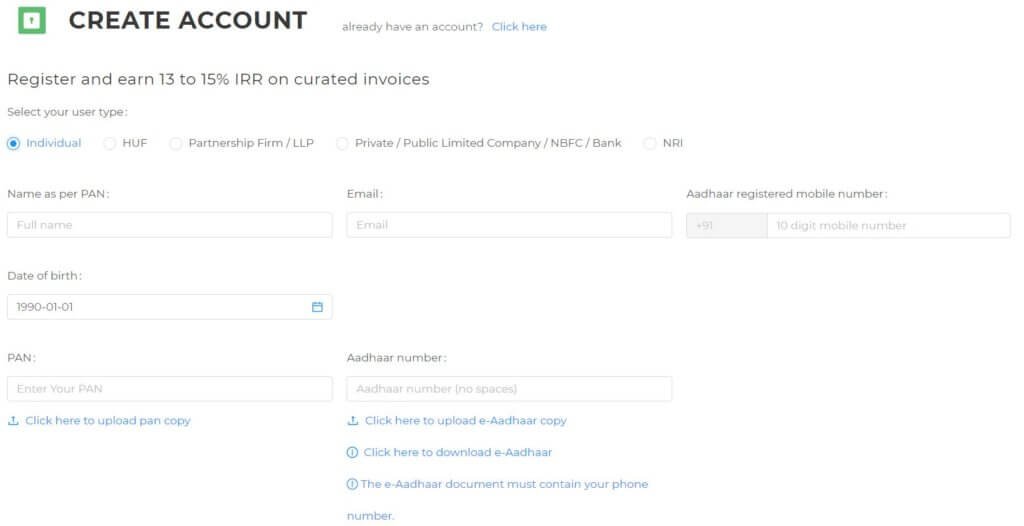

Now that you have the required documents click here to sign up on TradeCred as an investor. You will need to choose one of the following: Individual, LLP, HUF, Company, Bank, and NRI. Choose your appropriate category.

On the next page, you will need to enter your full legal name, email, mobile number, DOB, PAN number, and Aadhar number. Also, you will need to upload the PAN card and password-protected Aadhar card as well as the password. You can download your Aadhar card by following the link on the screen.

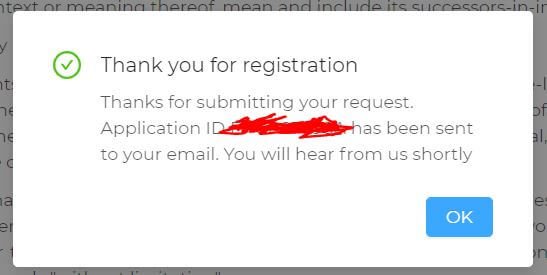

Once you complete it, you will get a notification that your application is underway and within minutes, you will receive an email that your account is now active.

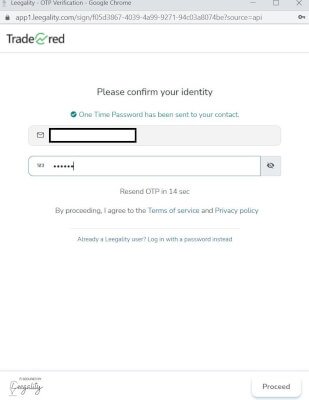

Now you can log in using your PAN number and OTP from your mobile number. Once you logged in, before start investing, you will need to sign the master agreement and verify your bank details. You can find the master agreement on the dashboard tab. Once you complete the master agreement, you will get another email saying that you have successfully signed the master agreement.

In my case, the link to sign the master agreement was not working for some time. I sent an email asking for support. Before the reply came, it worked just fine. Within 10 hours, I received a reply to the support email. The reply was not satisfactory. It said like the team is working. Why not work out the problem and send the reply with what happened and what needs to do instead of a simple message that the team is working on the problem? This reply can simply be an instant auto-reply when I sent the email.

The next step is to verify your account details. Keep in mind that this account number should be in your name and are linked to your PAN card to the one you have submitted here. After successful verification, your account will be credited with Re. 1. Once this is over you can easily add funds to your account using the bank you just submitted.

Add funds to TradeCred

Click the add fund or deposit button once you complete your KYC process. When you click on it, you will see the account details where you should deposit the amount. You can transfer the money by using NEFT, IMPS, or UPI payment. You can expect the deposited amount credited to your wallet balance within minutes, but you need to wait up to 48 hrs before raising a ticket.

TradeCred Review: How to invest in TradeCred?

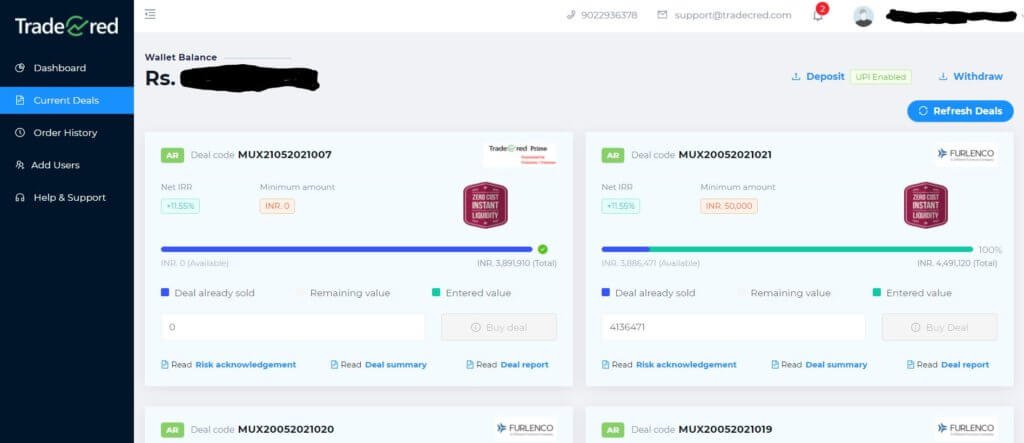

On the current deals tab, you will see the currently active deals, which company, duration, return rate, the amount needed, amount invested, amount available, risk acknowledgment, deal summary, deal report, etc.

In the deal summary, you will know the details like timeline, credit details, investment, returns, etc. Enter the amount you want to invest and just click the buy deal button. Once you click to buy, an OTP will be sent to your registered mobile number. Confirm the OTP and you will deal purchased successfully. I am showing the screenshots from my mobile but the process for the desktop is the same.

Once you complete it, that’s it, you have successfully invested in that deal. You can withdraw from that deal anytime but, there will be a charge depending on the deal as you are withdrawing before the agreed time.

Wait for some minutes, you will receive an email with the details attached in it like deal details, completion date, company details, etc. For deal cancelation or withdrawal requests, you have to wait at least 7 days. For deals with auto-renewal (AR), there is no cancelation fee.

In the dashboard, you will see your investment details. In the order history, you will all your order history – purchased, withdrawal, etc.

PLEASE remember that simply adding money to your TradeCred wallet doesn’t mean you have invested. You must invest in a specific deal using the money in your wallet.

How to liquidate an ongoing deal and withdraw money from TradeCred?

You can liquidate or cancel any deal you have invested at any time after 7 days of the initial investment. There is a thing or two you need to know about liquidating a deal before the official mature date. You can cancel anytime but if there is no buyer of the deal you are canceling, then you can’t sell it. There needs to be a buyer on the other side for your deal to be liquidated. Do not worry, I have tried this and everything is automatic and I waited only about 10-20 mins.

You need to verify that you want to cancel the deal with an OTP to your registered mobile number. Once verified, you will get an email saying that the deal is in the marketplace and once another buyer subscribes to the deal, your deal will be liquidated. Check out the two emails below I received – one for liquidation request and another one confirming the liquidation.

Once your liquidation is confirmed, it will take some minutes to reflect the balance in your account. You will also get the interest you earned to date. Withdrawing money is also pretty simple. You can request a withdrawal by clicking on the withdraw button, and it will take 1-2 hrs to reflect on your bank account once you request the withdrawal from the TradeCred dashboard. I have done many liquidations during this TradeCred review without any hassle or problems.

If you have any problem with your account, send me an email with the details, I will contact with TradeCred and will try to solve it.

TradeCred Review: Is TradeCred safe and legit?

TradeCred is completely safe and legit. The company has had a zero defaulted deal since its existence. It conducts a heavy betting process on new clients. As per the co-founder of TradeCred, TradeCred doesn’t own the money in its account but in an escrow account managed by the ICICI bank. This prevents TradeCred from arbitrarily removing money and running away. Keep in mind that legit and risk are two completely different topics, but the general public often mixes these two words.

Legit is if TradeCred is running the business legitimately without the intention of taking investors’ money and running away with it. For risks involved while investing in TradeCred, check out the next topic.

TradeCred Review: What are the risks of TradeCred?

Before looking at the risks of TradeCred, you should remember that every investment always has some kind of risk. There is no such thing as a risk-free investment. It depends on your risk appetite and how much risk you can take. Usually, higher risk means a higher return.

In my opinion, the risk of TradeCred lies somewhere between bonds and mutual funds. It has a higher risk than bonds but a lower risk than mutual fund. It is based my opinion, different people may say different things.

If you invest in AAA-rated bonds, it is very likely that your investments are safe. Invoice discounting, however, is only for short-term investments and the return rate can change within a short period of time. For bonds, the return rate is locked for that investment period. If there is no defaulting, your return is guaranteed. However, if you are investing in mutual funds then there is always a risk of the market going down and losing your investment amount. It also has the potential to earn a higher return than invoice discounting. This is why I consider invoice discounting has a higher risk than bonds but a lower risk than the mutual fund.

Is there any fee for TradeCred?

As per the co-founder of TradeCred, there is no fee from the TradeCred side. The return shown is the final amount you will receive after every fee. During this extensive TradeCred review, I find no fees as of now.

What happens when the borrower defaults on the investment amount on TradeCred?

As per the co-founder, when a company fails to pay the amount, they will contact the company first and will give them some days to pay the amount. If it still fails to pay the amount and the amount is available on the escrow account, TradeCred will contact the escrow account and try to pay the investors from it. In case the amount is deposited on the invoices, TradeCred will follow the legal path. If this stage reaches, you can expect a long time before you get your investments back. But keep in mind that till now, there is not been one case of defaulters on TradeCred as of writing this article.

What are the alternatives of TradeCred?

KredX is one of the major alternatives to TradeCred. There was some controversy on KredX with some defaulters. GripInvest is also another popular alternative investment option dealing with lease financing. Click here to know more about it where I have written a full review.

https://themreview.com/gripinvest-review/

TradeCred Vs KredX

Honestly and based on history and facts, TradeCred is a better option between the two as KredX has had some defaults and customers complaining about losing money due to those defaults on deals. I personally invest in TradeCred. Having said that KredX has transformed a lot.

Is there any TradeCred referral code?

YES! Use the code: TC0716. I don’t know if you will receive your incentives. But from time to time TradeCred runs promotional offers. If there are any promotions, you will receive the offer if you used the referral code above. I will also get something if you use the code. It will be great if you use the code above and after all, there is no loss in using it.

TradeCred Review: TradeCred Refer And Earn

TradeCred has introduced a refer and earn scheme where you can earn money for referring your friends while your friends earn 1% more on their investments. More details of TradeCred refer and earn scheme are given below:

Benefits of TradeCred refer and earn

You earn 0.50% p.a. on the actual average investments by your friends over the first 365 days they are successfully onboarded with us. We double your referral incentive for FY 2022-23 if your Referral Incentive for FY 2022-23 is more than INR 25,000.

India’s first, No Limit on Referral Incentive that can be earned by you.

For your friends: they earn an Extra 1.0% IRR on the first 6 investments done within the first 6 months of getting onboarded by your referral, with no capping on the investment amount or the tenure. So, help them invest more and longer.

* Referral Program available till 31st Mar 2023.

Terms and conditions:

Apply How to refer Refer your friends, using your Referral Code or your Referral Link: While registering on the TradeCred platform, your friend has to enter your Referral Code TCXXXXXX (‘TC’ followed by the last 6 digits of your TradeCred escrow account number) in the text box which says Referral Code.

What is the TradeCred minimum investment?

The minimum investment amount of TradeCred is Rs. 50000 in most of the deals. Some deals start at Rs. 1,00,000 also. However, you can invest any amount you want. Some deals also ask for 10,00,000, but most of the time, it starts from 50k to 100k. During the tradecred review, recently TradeCred introduced deals with a minimum of Rs. 10,000 too.

Lately during my TradeCred review and investing in TradeCred, it has introduced 10,000 minimum investment deals. I have invested to test and it is same as others. Check out the deal below as an example.

TradeCred Review: There are no current deals in TradeCred?

TradeCred deals are very popular and many investors are in line to invest the moment a new deal is available. Also, TradeCred brings new deals very often like many times a day. If you missed out on a deal, wait for more to come. One of the best ways to wait is by installing the app and wait for new deal notifications. However, they don’t always send notifications, best is to browse the app or website once in half an hour or every 10-15 mins to check if deals are available.

If you can’t wait for more deals to arrive, you can invest in alternative investment platforms. You can check out GripInvest and I have written a detailed review of it. Just make sure you know that it is a different business model, risks, and rewards offered by GripInvest.in. Click here to know the full review of GripInvist (Rs. 1,000 coupon included in the link).

Investing in cryptocurrency is another very popular alternative. Vauld is one of my favorite apps to trade, invest in crypto because it gives me an interest rate of up to 12.68 per annum. Click here to read more about Vauld and also receive some kickbacks on using my code.

TradeCred Review: What is the final verdict on investing in TradeCred?

I really liked the user interface and business structure. It also has a perfect deal history as of now. I am sure the owners would like to continue the same history. It totally depends on your investment strategy and risk appetite. As of now and with the company’s history, it seems a good investment chance and another option apart from Equity, Gold, and real estate.

Considering the website, the website doesn’t have a functioning FAQ section, it doesn’t have an easy contact us support ticket system but you have to send an email. It doesn’t do a good job of explaining the business model. Other than that, I believe the founders are genuine watching their interviews. If you are looking for some investment options in short term with a higher return than the FD or bonds, then you can definitely consider investing in TradeCred.

Also, don’t forget to install the mobile app. It is available for iOS and Android. It will send notifications whenever new deals are available. This will make sure that you won’t miss any deals. The UI is also very simple and very good.

Guys, I have a request for you all. Please fill the Google Form by following this link. This is required because some of you have a wallet balance just lying around after an investment deal has matured and the returns are credited to your wallet. I think many of you have forgotten that you have a mature investment. I will inform you of such cases using the email you have given using this Google form.

Click here to fill up the Google form when you signup on TradeCred.

What is Income Tax Liability on the interest income from TradeCred?

The return or the interest on the TradeCred investments are taxable as per your income tax slab. However, GST is not applicable to the income from TradeCred. In this TradeCred Review, I have got email confirmation from TradeCred and in fact, it is written in the email as below:

TradeCred Review: Frequently Asked Questions (FAQs)

These are the most frequently asked questions about TradeCred Investment on invoice discounting.

If you are considering investing in the equity market and stock market, you can click here to sign up on Upstox & get Rs. 300, and here to sign up on Groww to start investing and get Rs. 100 as a sign-up bonus. If you are interested in more details about investing in the stock market, comment down or send an email, I will try to post about it.

Are you tired of updating your excel sheet to track all your investments in different areas under different platforms? Check out INDMoney App where you can track and invest all your investments like stocks, mutual funds, bonds, PPF, FD, US Stocks, and many more. Click here to check it out and also get 250 INDCoins for free when you sign up with the link in the post.

That’s it for now. Before you leave, if you are looking at how to buy dogecoin, SHIBA INU coins in India, check out the links below:

Also, if you are looking for best laptop for work from home under Rs. 50000 in India, check out the link below:

If you are looking for best SSD laptop below 50k, check out the link here.

My Favorite Stock Trading/Investment Tools

TradeCred Review – Best Invoice Discounting Platform In India?

Best stock brokers for beginners in India.

Smallcase subscriptions for free.

Best broker and mutual fund investment for beginners – Groww – Click here to signup, activate your Demat account & Get Rs. 100 for free.

Best stock brokers for day trading –Upstox, Fyers.in (Free account, Free AMC)

Best charting platform – TradingView.com

Trusted Forex broker for Indians – Exness.com (Zero swap charges).

Become a crorepati just by investing 5k per month in mutual funds.

Busting the myths of investing in US Market.

How to increase your credit card limit temporarily?

How to invest during a market crash?

Why you should never use PhonePe to invest in Mutual Funds.

Invest in Indian startups using TykeInvest.

Disclaimer

Disclaimer: All investment strategies and investments involve risk of loss. Nothing contained in this website should be construed as investment advice. Any reference to an investment’s past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit. Any ideas or strategies discussed herein should not be undertaken by any individual without prior consultation with a financial professional for the purpose of assessing whether the ideas or strategies that are discussed are suitable to you based on your own personal financial objectives, needs, and risk tolerance. This website expressly disclaims any liability or loss incurred by any person who acts on the information, ideas, or strategies discussed herein. The information contained herein is not, and shall not constitute an offer to sell, a solicitation of an offer to buy or an offer to purchase any securities, nor should it be deemed to be an offer, or a solicitation of an offer, to purchase or sell any investment product or service. Everything discussed here is only for educational purposes. Do your own research before investing.

16 thoughts on “TradeCred Review: Best Invoice Discounting Service In India?”