Bleeding your hard-earned money during this stock market crash and recession? You have taken the first step in searching for Win Wealth review for alternative high-return investment options. Wint Wealth is a bond investment platform that lets you invest in carefully curated senior secured bonds that beat inflation, starting at just ₹10,000.

In this Wint wealth review, you will learn more about what is Win Wealth, how and why to invest in Wint Wealth, are the 9-11% return justified, its advantages and disadvantages, how much of your portfolio should be exposed in the bond market, risks and safety, etc. Read the full article to know about other alternatives.

- What is Wint Wealth?

- Wint Wealth Review

- How To Invest In Wint Wealth?

- Disclaimer

- My Favorite Stock Trading/Investment Tools

What is Wint Wealth?

Wint Wealth is a NBFCs (Non-Banking Financial Companies) platform that lets you invest in senior secured bonds offering 9-11% fixed returns. It gives fixed returns on carefully curated senior secured bonds that beat inflation and FDs, starting at just ₹10,000.

This is aimed at retail investors for alternative investments with very small amounts and businesses that need to raise money. Investment platforms like secured bonds, invoice discounting, and lease financing are popular options when the stock market is down.

Before going any further, click the link below or here to sign up on Wint Wealth and get an extra 1% return only when you signup with the link below. I am giving my referral link; with this, you get an extra 1% return for free, and I get Rs. 25,000 if 5 of you signup through my link and invest in Wint Wealth.

What are senior secured bonds?

According to financialexpress, a senior secured bond is backed by a pool of security, such as gold, automobile, or property loans and other assets. In a senior secured bond, “senior” denotes that bondholders have first priority to be repaid if the NBFC defaults. If the bond-issuing NBFC fails to make a payment, the entity will be forced to file for bankruptcy, which will be governed by the applicable laws and regulations that protect the investor’s interest.

Wint Wealth listing only senior secured bonds means you are the first priority and have the preference in case anything goes wrong. However, till now, there have been no cases of any default in any of the bonds listed in Wint Wealth.

Wint Wealth Review

After this overall Wint Wealth review, I would say that it is an attractive way to invest in bonds with relatively low risk with a fixed return with a much better return than FD. It is also one of the best ways to diversify your investment portfolio and not put all your eggs in a single basket, especially during this stock market downtime.

Let’s be frank that you shouldn’t invest all your money in a single place and diversify it to minimize risks. Win Wealth is a perfect option for this. Personally, invest in mutual funds, individual stocks, and other alternative options like TradeCred, GripInvest, and Win Wealth. Depending on your risk factor, you should invest in Wint Wealth for a fixed return that is more than an average stock investor.

Why And What Are The Features of Wint Wealth? – Wint Wealth Review

Bonds might be right for you if you’re interested in building wealth slowly over time. There are different types of bonds to invest in, but finding the right one can be tricky. Wint Wealth makes it easy by providing quality advice on investing in bonds and walking you through the pros and cons of each type to help you figure out what’s right for you.

This review of Wint Wealth will take you through the process step-by-step so that you know just what to expect from your investment in bonds and Wint Wealth before you make any decisions!

When it comes to investing, the key is safety and consistency. With Wint Wealth, you get both. You can invest in a number of different options, including bonds, stocks, ETFs, and more. This means that if one investment falls out of favor with the market, you will have other options for positive returns.

The amount of risk you are willing to take should be part of your decision when considering investments. Those who are conservative might want to stay away from high-risk investments like stocks.

On the other hand, those who are looking for aggressive growth may want to consider them. No matter your goals or preferred level of risk tolerance, Wint Wealth has an option that will work well for you. You can even pick which types of investments to make up your portfolio as well as how much time you’d like them to last before they expire.

Bonds give investors a sense of stability because their value doesn’t fluctuate as wildly as others, such as stocks or commodities.

1. Stable and fixed returns with much lower risks than the stock market.

The stock market is highly volatile, which means big upsides and downsides. If you invest all your money in the stock market and it crashes, then all your money is gone. Keeping some of your money on fixed returns is a great choice every great investor do.

Wint Wealth offers a fixed return after all charges that prevent you from market volatility. You should try it, review it for yourself and hedge yourself.

2. Returns are higher than Fixed Deposits and quite possibly higher than most investors

The emergence of Wint Wealth results from the steadily declining returns on fixed deposits. Given that it is a safe and secure fixed-income product, a senior secured bond is akin to an FD. However, on average, they offer 9% to 11% better yields than FDs.

3. Secure investment with asset backings

Buyers are frequently reluctant to make direct investments because of widespread fraud in banking industry. Wint only provides investors with the most secure options by filtering out the best companies in order to combat this.

4. Minimum Risk

The risk associated with senior secured bonds from Wint Wealth is considerably lower than that of the stock markets. If you have a low-risk tolerance or wish to protect your major investment, Wint’s investment solutions can be your best choice.

5. Small Ticket Size (small minimum amount to invest) in Wint Wealth

Unlike traditional bond investments, Wint enables regular customers to invest as little as Rs. 10,000 in these fixed-income instruments. As a result, investing in these assets doesn’t have to cost a lot of money; you may start little and get big returns.

6. Peace Of Mind

Unlike the stock market, you don’t keep refreshing and waste time watching your investments deep and high. Investing in bonds via Wint Wealth gives a fixed return and peace of mind.

The Wint Wealth program is designed for people who want to protect and grow their assets over the long term. It’s also suitable for those risk-averse, as it invests primarily in fixed-income securities such as bonds. The focus on fixed-income securities makes it a relatively conservative option with low volatility that seeks stable returns.

It aims to preserve capital but may not offer as much upside potential. And, of course, there are no commissions or account fees associated with opening an account.

You can choose to withdraw funds at any time without penalty. Withdrawals will incur trading costs, though – so make sure to factor that into your decision!

How Is Wint Wealth Taxed?

If the units are held for > 12 months, you will be taxed as per the rate applicable on LTCG, i.e. maximum of 10% on the capital gains. If you stay invested in the units for < 12 months, you will be taxed as per your income slab.

Why Buy Bonds Through Wint Wealth?

The most important thing to know about bonds is that when you buy one, you’re lending the issuer money, usually for a set period of time. This usually is backed with assets from the company so that in case of anything goes wrong, the money can be recovered by selling the assets. With Wint Wealth, you are the preferred customers because all the bonds in Wint Wealth are senior secured bonds. The issuer agrees to pay back the bondholder at an agreed-upon date with interest. While there are many different types of bonds, corporate and government bonds are the most common.

When deciding whether or not to purchase bonds, it’s important to consider the following things: What kind of risk profile do you want? What will my bond funds be for? When do you need the funds? And lastly, how much do you have to invest?

All these questions should help you decide what type of bond suits your needs best. If any other question comes up, don’t hesitate to give contact. In general, bonds are considered illiquid, meaning you can’t withdraw the invested money instantly. You have to find a buyer first, and then you can sell. Win Wealth follows the same. You can request an immature withdrawal, but Wint Wealth has to find a buyer first.

What are bonds?

Bonds are an agreement involving money where a company/borrower agrees to take money from investors and return it with interest after a certain amount of time. This usually involves the company’s assets as collaterals.

Wint Wealth App

Currently, only Android users can download the App. iOS users have to wait a little longer. The app is simple and light, giving you all the functionality you can do in the web version. Click here to download the App.

Wint Wealth Vs Golden Pi

The biggest difference between Wint Wealth and Golden Pi is that Wint Wealth is much more selective in their asset listing and hence less choice to investors but gives a sense of security, whereas Golden Pi lists bonds with higher risks and higher returns with much more choices. Investing in either of them completely depends on the investor and their risk profile. If you want a more secure loan with a lesser return, go for Wint Wealth, or if you want a higher return with higher risks, go for Golden Pie.

Wint Wealth Vs TradeCred

Wint Wealth is a bond investment platform, while TradeCred is an invoice discounting platform. The Wint Wealth bonds are senior secure, meaning higher security, TradeCred also offers back guaranteed deals. You can instantly withdraw from a deal in TradeCred with zero fees, and a buyer usually buys the deal within an hour.

Wint Wealth Charges

All the indicated returns in the Wint Wealth are after all the charges. However, a 10% TDS is deducted, and you can recover during your income tax filing.

Is Wint Wealth RBI Approved?

The genre of investment services that Wint Wealth offers is not something that needs RBI approval but they are under the rule of NBFCs (Non-Banking Financial Companies).

How To Invest In Wint Wealth?

To invest in Wint Wealth, you must sign up and verify your KYC. After your account is verified, you can deposit your funds and start investing in any of the bonds listed currently.

Signing Up And Investing In Wint Wealth

Signing up and investing in Wint Wealth is super easy, it is like signing up for any other financial-related platform. You must follow the link below (EXTRA 1% return) and complete the KYC process. The KYC process is completely online, and you can add funds to your wallet and start investing instantly.

- Click here to sign up in Wint Wealth.

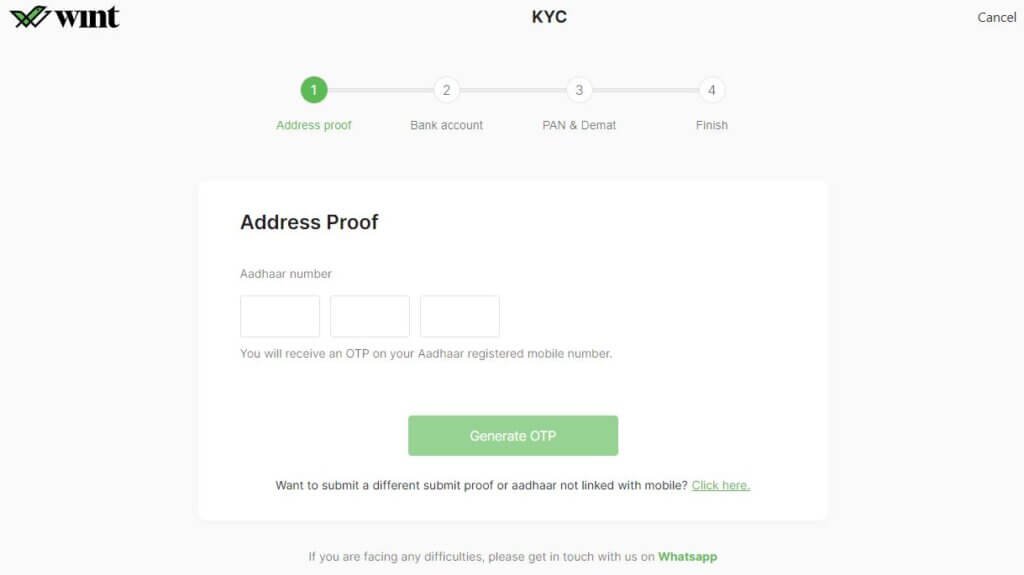

Enter your mobile/email. Complete the email and phone number verification. - Start and complete the KYC process.

You must enter your Aadhaar, Bank, and PAN Card details just like any other singing process. You know the drill if you have signed up for any of the brokers. This is nothing new.

- Now, it is time to add money to your wallet. You can do it by UPI or NEFT.

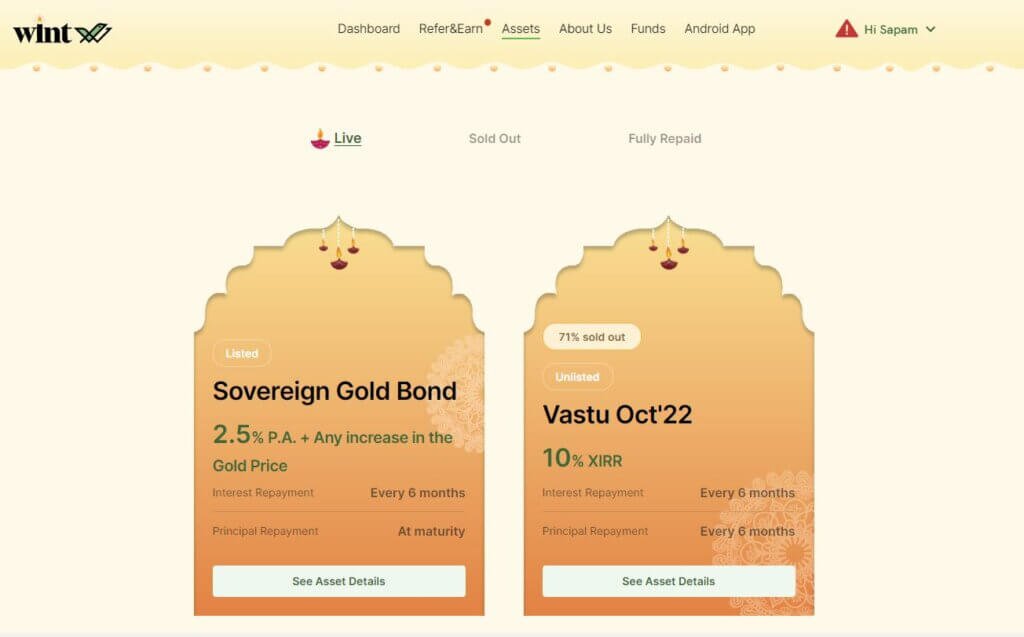

- The next step is to go to the assets and select the bond you want to invest in.

- Click on any asset you want, you will get all the information you need: issuer, return rate, estimated timeline for payouts, details about the firm, etc.

- You will see 3 instructions or information about Bonds, risks, and different investment methods before investing.

- After agreeing, you can invest in.

- Once invested, leave it and wait for the repayment.

Risks Involved Investing In Wint Wealth.

Investing in the stock market is a risky endeavor with the potential for big rewards but also the possibility of losing it all. There’s no risk of losing all your investment capital, but there’s also less opportunity for growth if interest rates fall. The only risk is that the issuer might not be able to repay you at the maturity date.

So if things go wrong, this type of investment will be worth less than what you initially invested at the maturity date.

Is bond investing right for you?

Bond investing is one of the safest ways to invest because bonds are backed by collateral, such as government bonds and mortgages. This makes bond investing a good choice for those who may not have the time or inclination to manage their portfolio on a day-to-day basis. If you have some extra cash that you want to invest and you’re looking for a low-risk option, bond investing may be right for you.

Am I investing in Wint Wealth?

Currently, I have no plan to invest in Wint Wealth. I am ready to take more risks now, and I am looking for more rewards. Having said that, I will be investing in the near future, especially if the current market trend continues. I invest in TradeCred and Grip Invest, and my portfolio allows me to stay invested in Stock market.

The final decision depends on you, but one thing is clear, you need diversification, and Wint Wealth is one of the best options available.

Who should invest in Wint Wealth?

Anyone looking to minimize the high risks should invest in Wint Wealth and other fixed-return schemes like TradeCred and Grip Invest.

If you are a senior citizen with a low-risk capacity, you should invest in Wint Wealth.

Anyone with any age range looking for some short-term investments can invest in Wint Wealth.

CLICK HERE TO SIGN UP ON WINT WEALTH AND GET 1% EXTRA RETURN.

How does Wint Wealth Make Money?

Wint Wealth makes money by charging a percentage of the bonds listed on the website. Even though it does not charge the users, it charges from the vendors. Wint Wealth may introduce other services or premium services directly chargeable to the users.

My Favorite Stock Trading/Investment Tools

TradeCred Review – Best Invoice Discounting Platform In India?

Best stock brokers for beginners in India.

Smallcase subscriptions for free.

Best broker and mutual fund investment for beginners – Groww – Click here to signup, activate your Demat account & Get Rs. 100 for free.

Best stock brokers for day trading –Upstox, Fyers.in (Free account, Free AMC)

Best charting platform – TradingView.com

Trusted Forex broker for Indians – Exness.com (Zero swap charges).

Become a crorepati just by investing 5k per month in mutual funds.

Busting the myths of investing in US Market.

How to increase your credit card limit temporarily?

How to invest during a market crash?

Why you should never use PhonePe to invest in Mutual Funds.

Invest in Indian startups using TykeInvest.

Disclaimer

Disclaimer: All investment strategies and investments involve risk of loss. Nothing contained in this website should be construed as investment advice. Any reference to an investment’s past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit. Any ideas or strategies discussed herein should not be undertaken by any individual without prior consultation with a financial professional for the purpose of assessing whether the ideas or strategies that are discussed are suitable to you based on your own personal financial objectives, needs, and risk tolerance. This website expressly disclaims any liability or loss incurred by any person who acts on the information, ideas, or strategies discussed herein. The information contained herein is not, and shall not constitute an offer to sell, a solicitation of an offer to buy or an offer to purchase any securities, nor should it be deemed to be an offer, or a solicitation of an offer, to purchase or sell any investment product or service. Everything discussed here is only for educational purposes. Do your own research before investing.