You will find every detail of applying in IPO from every broker like Groww, Zerodha, Upstox, etc. But you won’t find any details after applying the IPO like getting an allotment, delivery of your stocks in Demat account, and especially, how to sell your IPO allotted shares in Groww, Zerodha, Upstox, ICICIDirect, etc. Today, in this post, you will find every detail of IPO after applying. Also, as a general reminder, we will discuss how to apply for an IPO and 10 things you shouldn’t do while applying for an IPO through any broker. If you are also wondering about how to apply for IPO in Groww, Zerodha, or Upstox, read till the end to know everything.

How To Sell IPO Shares In Groww, Zerodha, Upstox?

So, without making you wait too much, you can sell your IPO allotted shares in any broker like Groww, Zerodha, or Upstox exactly at 10 a.m. of the listing date. However, you will know the listing price of the IPO stock at around 9:30 or 9:45 am on the listing date. On top of this, you can place your sell order, modify it from 9:00 am to 9:45 am as pre-market order only for the listing date. Once 10 am is passed, the stock is the same as any other stock available on the market.

That was the short answer, I am sure you want to know what happens once you applied for an IPO. Every detail is available on the internet till you apply for an IPO. But, it is rare to find information on what happens after that. For this, I am writing this post based on my recent experience on the Indian Pesticides IPO which I was lucky enough to get the allotment. Let’s go through step by step after you applied for an IPO.

- Clear the payment through UPI.

- IPO application and payment confirmation.

- Cross your fingers and wait for the allotment.

- Getting the allotment message from NSE in SMS.

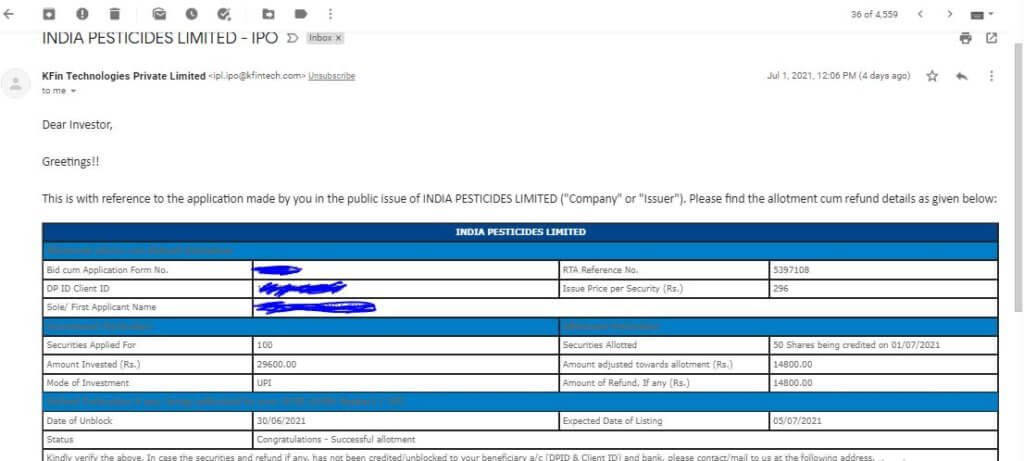

- Getting confirmation from Kfin Technologies, from your broker.

- Shares credited to your Demat account in T+2 days.

- Repeatted google search about the possible listing price.

- Placing your sell order at pre-market or on open market time.

- Milk the profit or cry the loss.

Now let’s go into detail about each point.

Clear the payment through UPI.

Once you have applied for the IPO and entered the UPI address, you must wait hours before you finally get the UPI mandate request. Once you get the UPI mandate request, open your UPI app like Google Pay, PhonePay, etc., and approve the mandate. Your requested amount will be blocked from your account and you will see payment approved status on the IPO page on your broker.

Can I enter a UPI ID different from the one I used during signup?

Yes, you can use anyone’s UPI ID.

How long does it take for the UPI mandate request?

It ranges from 4-48 hours. I received it around 6-8th hours after applying.

Where can I see the pending, rejected, and approved mandate requests?

It depends on the App you are using but they are more or less the same. For Google Pay, you can click on the profile pic icon and there you will see a mandate button. Tap on it and you will see pending, completed mandates as shown in the picture below. If you don’t have a mandate section. don’t worry because you haven’t received a single mandate request ever. I was also confused because I had the same problem. But once I received the request, that section pop out in the Google Pay App.

IPO application and payment confirmation.

Once you approved the UPI mandate, your IPO status will change to Payment successfully confirmed. This status will remain the same for few days until the allotment date. Once the payment is confirmed, you can sit and relax as you have done everything correctly from your side. Now, only God and Luck will decide whether you will get it or not.

Getting the allotment message from NSE in SMS.

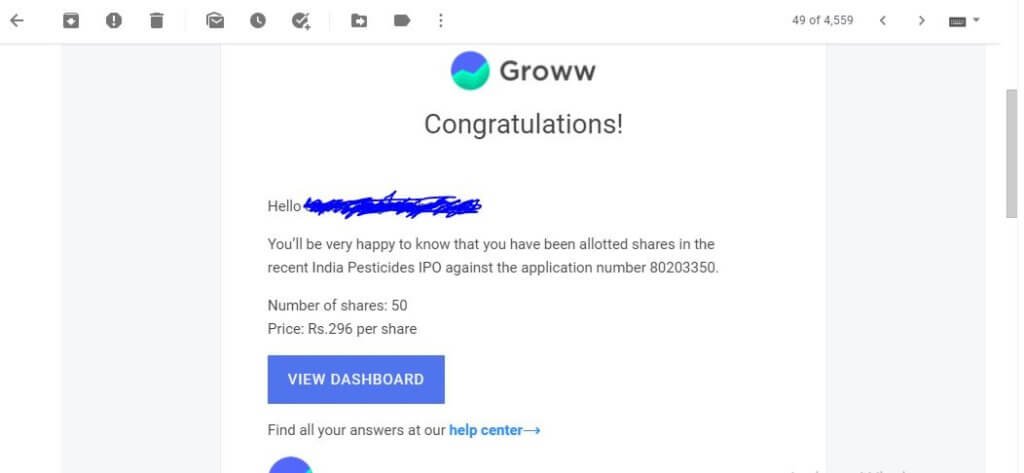

By the end of the allotment day, you will start receiving SMS and emails whether you got the allotment or not. If you are not allotted any lot, then you will receive an email from KFintech that you didn’t get any shares. If you have been allotted, then you will receive SMS from NSE about the allotment, email from KFintech, and your brokers like Grow or Zerodha or Upstox that you have been through IPO.

Shares credited to your Demat account in T+2 days.

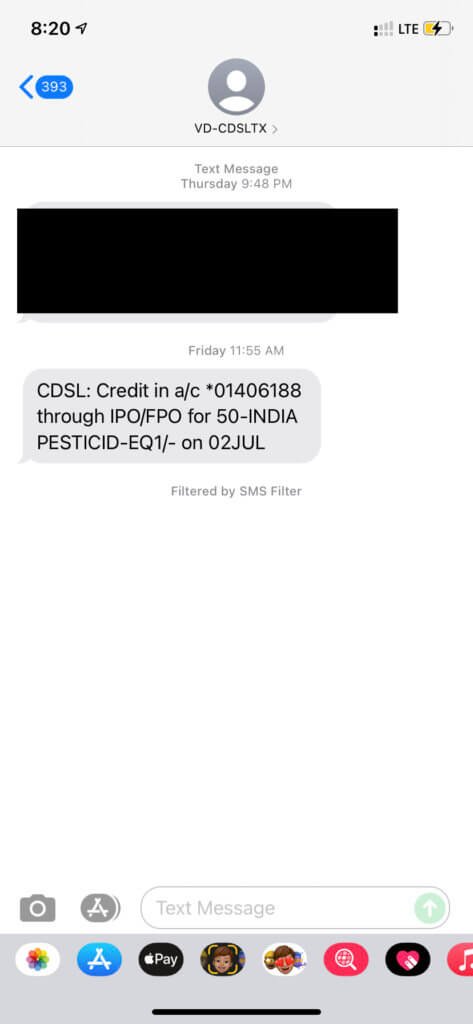

Now, you will start getting anxious about shares not credited to your Demat account. Do not worry, it will be credited on T+2 day. This means it will be credited to your account on the 2nd day after you get the notification of allotment. You will receive SMS as shown in the photo above.

Why I don’t see my IPO allotted shares in my holdings in Groww, Zerodha, or Upstox?

If there is a holiday or if it is on a weekend, then you have to wait till the start of another working day. Please note that the credited shares will not be in the holdings for some time. Rest assured it will pop up before the listing date. In my case of India Pesticides, it was credited on Friday night but I can see the share in my dashboard only on Sunday night.

Placing your sell order at pre-market or on open market time.

Here comes the most important and awaited part. How do you sell your allotted IPO share on the listing date in Groww, Upstox, or Zerodha? As mentioned above, there are two types of selling your IPO allotted shares: (a) sell in the pre-market order, 9:00 am to 9:45 am, (b) sell from 10 am onwards like any other shares.

(a) Sell IPO shares in the pre-market order

This is valid only for the listing day. After that, the shares will be just like any other listed shares. Especially on the listing day, IPO shareholders are allowed to make pre-orders from 9:00 am to 9:45 am. During this time you can place, edit, cancel orders at the price of your desire. In my case, the listing price was shown only at around 9:50 am. Even though you can place orders, your orders will be executed only if there is a matching price.

For example, India pesticides was listed at Rs. 350 but if you placed a sell order at 500, there will be no one to fulfill your sell order and hence it will be canceled. After 9:45 am, you will see a message like this – buy/sell not allowed on your Groww panel. Once this time is crossed, you have to wait for 10:00 am.

(b) Sell from 10 am onwards like any other shares.

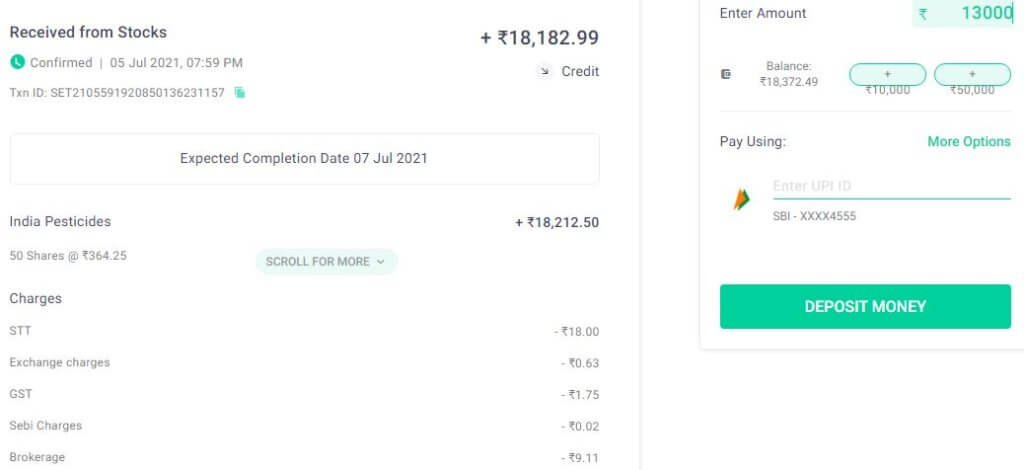

Once 10:00 am is passed, trading of the IPO share will start just like any other already listed shares. There is no difference. You can go to your dashboard and place a sell order both market and limit order just like any other shares. Once your sell order is executed the money will be credited to your account as shown in the photo below. Please note that you don’t have to instantly sell at 10 am on the listing price. I will discuss the reasons in the following sections.

When can I sell IPO shares in Zerodha?

You can sell your IPO shares in Zerodha in the pre-market session (9:00-9:45 am) and in the live market (from 10 am onwards.)

How to sell IPO on listing day in Zerodha?

You can sell your IPO shares on the listing day in Zerodha by following the steps below:

- Login to your Zerodha account.

- Go the holdings.

- Click on the three dots (…) on the IPO share that have been credited and click exit.

- Select either market or limit order and enter the price you want and click ok or sell.

- Your order will be executed instantly if you chose market order or when matching buyers are found if you selected limit orders.

How to sell IPO shares in ICICIDirect?

The process of selling IPO shares in ICICIDirect is similar to selling any other shares except you can sell only after 10 am on the listing day. Click on the holdings and then select the IPO and click sell or exit position. Enter your selling details like market or limit orders and complete the process.

How to sell IPO shares in Sharekhan?

To sell IPO shares in Sharekhan, you need to go to your holdings and select the IPO share you want to sell and select exit or sell positions. Enter the selling price and place the order. Your order will be executed once the matching price is found. Your order will be executed instantly if you place your sell order as a market order. Remember that you can your IPO allotted shares only after 10 am.

How to sell IPO shares in Angel Broking?

Selling IPO shares in AngelBroking is similar to selling any other share but it starts from 10 am on the listing date. Go to your holdings and select the IPO share and select sell or exit. Enter the selling details like the order type and selling price. Your IPO share selling order will be executed based on your order types.

Can you buy and sell an IPO in the same day?

No, you can not buy and sell an IPO on the same day. IPO has different date and timeline: IPO issue dates, allotment date, and listing date. You can buy and sell the shares of the IPO on the listing date. From that date onwards, the IPO share is similar to any other shares in the market.

10 things you shouldn’t do while applying for an IPO through any broker.

There are some important things you shouldn’t do while applying for an IPO through any brokers. I have listed down 10 very important things and common mistakes you should avoid when applying for an IPO.

- Never apply from multiple brokers and also multple applications from single broker using a single PAN Card.

- Don’t apply for an amount more than Rs. 2,00,000.

- Cancel your application in the last minute because you didn’t your UPI mandet request.

- Never apply in the 1st day of IPO.

- Don’t apply for more than 1 lot both in under subscribed and over subscribed IPOs.

- Placing sell order in the pre-market without knowing the listing price.

- Placing sell order instantly at 10 am when market opens.

- Waiting too long to sell thinking price will go up.

- Selling your profit holdings just to apply for an IPO.

- Don’t apply any IPO blindly.

Now, let’s discuss each point in detail on things you should avoid while selling your IPO allotted shares on a listing day in Groww, Upstox, Zerodha, etc.

Never apply from multiple brokers and also multple applications from single broker using a single PAN card number.

SEBI rules don’t allow multiple applications from a single PAN card. Your IPO application will get rejected and you won’t even get the chance for the allotment lottery. Basically only one application per PAN card. If you are thinking of applying for multiple applications, try using your parents, company, and relatives’ account.

Don’t apply for an amount more than Rs. 2,00,000

IPO applications below Rs 2 lakhs are considered as retail investments and the winning weightage is treated as the same. Once you crossed the limit, your chance of winning an allotment will be treated based on the amount you invested. If you have crores to invest and apply for IPO then that’s another story.

Cancel your application in the last minute because you didn’t approve your UPI mandet request

Do not cancel your IPO application just because you haven’t received the UPI mandate till now. It will come when it is ready and you can pay the fee even after the deadline is over if you applied before the deadline. Just wait and approve the UPI mandate.

Never apply in the 1st day of IPO

Yes, you can apply on the first day. But it better you check the subscription rate. After 2 days of IPO, you will get a sense of how popular that IPO is and you can assume about the issue price and listing price. More details will be discussed in the following points below.

Don’t apply for more than 1 lot both in under subscribed and over subscribed IPOs

After thinking a lot, I have decided not to apply for more than one lot in any IPO. Let’s consider two cases: (a) under-subscribed IPOs and (b) over-subscribed IPOs.

(a) under-subscribed IPOs

If an IPO is undersubscribed, it means that it is not popular in the market which means its listing price will probably below the issue price. This means you will likely incur a loss. So, why would take more risks of losing when you already know that chances are high you will have a loss. So, it is best if you apply for only one lot if you wish to take the risk anyway.

(b) oversubscribed IPOs

Government rules say only one lot should be allotted to each retail applicant if the IPO is over-subscribed. So, why apply for more than one lot when you already know you will get only a lot if you are lucky. This way you can have more cash in hand to invest in other opportunities.

Placing sell order in the pre-market without knowing the listing price

It’s like asking a seller to pay an amount before the seller telling the current price. You should at least wait for the listing price of the IPO so that you can have a gauge about the probable price fluctuations.

Placing sell order instantly at 10 am when market opens

See the price movements for a minute or two. If the price is moving up, place or sell order in a price more than the listing price. However, this poses the risk that the price will move down and never be above the listing price again. It depends on your risk management.

Waiting too long to sell thinking price will go up

This is somehow related to the above point. Again these are all speculations and you should take your decisions wisely but not based on your emotions thinking that your IPO allotted stocks share will go up and up or it will come up from going down and down.

Selling your profit holdings just to apply for an IPO

Let’s say you really want to apply for an IPO and you think the listing price will be more than the issue price. But, you don’t have any cash on hand to apply for. So, you have decided you sell some of your current holdings which happens to be in profit in all your holdings. It is best not to do it because one is speculation and the other is already there in front of your eyes. However, again it depends on your choice.

Don’t apply any IPO blindly

In short, all over-subscribed IPOs don’t mean their listing price will be higher than the issue price and all under-subscribed IPOs don’t mean that their listing price will be lesser than the issue price. Research on fundamentals and other common issues before applying for an IPO.

Which broker is the best for applying IPO?

Personally, I have tried Upstox and Groww, I prefer Groww. In Groww you can feel that IPO is an integral part of the App or dashboard. Other platforms like Upstox, Zerodha, Fyers, etc. you will feel that you are going to a totally different section. Groww also does an excellent job of providing every possible detail like the timeline, subscription rate, fundamentals, a detailed video, advantages, and disadvantages, etc. In Groww you can apply even aftermarket hours i.e. 3:30 pm which you can’t do in Upstox.

Based on the above points, I use Groww to apply for IPOs. It is also free and most importantly, it offers Rs. 100 for new users when you sign up under someone’s invitation link. Please use my invitation link below to get Rs. 100 when you complete the signup, verify your profile and get verified. Please remember that you can apply IPOs from Zerodha, Upstox, Fyers, etc. and the allotment process is the same.

Did you know that you can create another account in Groww and open a Demat account using your parents or your siblings? This way you can apply for an IPO from two different accounts with two different PAN card numbers. This will increase the chance of getting the IPO allotment. Open a free account below to apply from different accounts so that you can increase your chances.

Click here to sign up on Groww and get Rs. 100 for free.

Click here to sign up on Fyers.in.

Click here to sign up on Upstox.

How to apply IPO in Groww, Upstox, etc.?

Applying for an IPO is really simple in Groww. Just go to the IPO section from the explore>stocks section. There you will see a list of active IPOs, upcoming IPOs, and already completed IPOs. If there is any active IPO, click there to see the details or click apply now directly. Fill in the required details like the number of lots, bidding price, and your UPI ID.

Click on the IPO – Initial Public Offerings and you will see a list of IPOs and click any active or upcoming IPO. In this case, I have clicked on Clean Science. Since the date is yet to come, apply now is disabled. You can apply once it is activated on the IPO date. Fill in the details mentioned above and wait for the UPI mandate request. Once the mandate request is approved, the next steps are already mentioned in this post.

Are you tired of tracking all your investments in stocks, mutual funds, bonds, loans, credit card bills, etc.? Then you should use the INDMoney app which tracks all your portfolios automatically. You will also get INDMoney coins which can be used to buy cryptos and redeem them into real money in your bank account. Click here to know the full details or follow the link below.

Are you searching for alternative investment options for short terms? Have of heard of TradeCred? TradeCred is an investment platform that allows you to invest in invoice discounting for the short term and get a fixed return higher than FD and lower risks than stocks and mutual funds. If you don’t what is invoice discounting, I have written a detailed review on TradeCred, click here to check it out or follow the link below.

Another alternative is the GripInvest. You can check the full review of GripInvest by clicking the link here.

My Favorite Stock Trading/Investment Tools

TradeCred Review – Best Invoice Discounting Platform In India?

Best stock brokers for beginners in India.

Smallcase subscriptions for free.

Best broker and mutual fund investment for beginners – Groww – Click here to signup, activate your Demat account & Get Rs. 100 for free.

Best stock brokers for day trading –Upstox, Fyers.in (Free account, Free AMC)

Best charting platform – TradingView.com

Trusted Forex broker for Indians – Exness.com (Zero swap charges).

Become a crorepati just by investing 5k per month in mutual funds.

Busting the myths of investing in US Market.

How to increase your credit card limit temporarily?

How to invest during a market crash?

Why you should never use PhonePe to invest in Mutual Funds.

Invest in Indian startups using TykeInvest.

Disclaimer: All investment strategies and investments involve risk of loss. Nothing contained in this website should be construed as investment advice. Any reference to an investment’s past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit. Any ideas or strategies discussed herein should not be undertaken by any individual without prior consultation with a financial professional for the purpose of assessing whether the ideas or strategies that are discussed are suitable to you based on your own personal financial objectives, needs and risk tolerance. This website expressly disclaims any liability or loss incurred by any person who acts on the information, ideas or strategies discussed herein. The information contained herein is not, and shall not constitute an offer to sell, a solicitation of an offer to buy or an offer to purchase any securities, nor should it be deemed to be an offer, or a solicitation of an offer, to purchase or sell any investment product or service. Everything discussed here is only for educational purposes. Do your own research before investing.

1 thought on “How To Sell IPO Shares In Groww, Zerodha, Upstox On The Listing Day?”