Hello everyone! You will know everything about the new ZebPay Lending platform and how to earn fixed returns on your crypto holdings like Bitcoin, Ethereum, USDT, Binance Coin, and DAI up to 12% per annum. You will also learn about what is crypto lending, should you invest here? Is ZebPay safe and illegal in India? Is bitcoin illegal in India? and many other important topics you will have in mind.

What Is ZebPay Lending?

ZebPay Lending is the newest feature in the Indian Crypto-currency exchange platform ZebPay where you can create a fixed-term deposit or open term for a fixed return on your crypto holdings up to 12% per annum. It is as simple as creating a fixed deposit in your bank or simply keeping your money in your savings account and you get a fixed interest rate for it. Except in the case of ZebPay, the currency is crypto-currency. ZebPay currently supports Bitcoin, Ethereum, DAI, Binance Coin, and USDT.

What are the return rates of Bitcoin, Ethereum, Binance Coin, DAI, and USDT in ZebPay Lending?

Currently, ZebPay offers a return rate of 3% for Bitcoin (BTC), 7% for Ethereum, 9% for Binance Coin, 7% for DAI, and 12% for USDT. Keep in mind that USDT is offering the highest return but it is a stable coin where the chances of appreciating the asset are minimum. For those who don’t know about stable coins, it is a coin connected to an asset or a stable currency which value is the same as the asset it is connected to. USDT is the stable coin of USD and it will remain the same value as the United States Dollar.

In the case of other assets like BTC, ETH, BNB, and ADAI, the chances of increasing value are there. For example, the price of BTC at the start of 2021 was around 27 lakhs and it shot up to 51 lakhs around April of 2021 and back to 27 lakhs in June. So, if the price of BTC increases at the end of your term, you will get a fixed return of 3% plus the percentage increase of the value of BTC.

Which Crypto should you invest in ZebPay Lending?

First of all, I am not a financial advisor and it is purely my opinion. Based on your risk appetite, divide your holdings to some ratio where your loss due to decrease in crypto price is cancelled by the high return due to USDT. But again, don’t put maximum investments to USDT because, your returns you will be very minimum in case crypto-currencies like BTC, ETH price is increased. Let’s see the following cases carefully to understand the process:

For example, you have Rs. 1,00,000 to invest in ZebPay Lending Platform and you want to know how to minimize your risk and maximize your returns. See the following possible cases:

Case 1: You invest all Rs. 1,00,000 in USDT and you get 12000 as a return after one year. There will be a chance that the value of INR has changed another 1% over the last year which means you will get Rs. 13,000 in total. There is no chance of losing your invested amount. This is the least risky investment option in the ZebPay Lending platform.

Case 2: Now, you are thinking that in the next year, there is a high chance that ETH has the highest chance of increasing its price. So, you decided to invest all Rs. 100000. By the end of next year, you will get Rs. 7000 worth of ETH. Luckily, the price of ETH has also increased by 50% then your return rate is 50+7=57% which is Rs. 57,000. But, if the price of ETH has decreased by 50%, your return rate will be (7-50)%.

Case 3: Now, you are thinking, there is a chance that prices of crypto will go up and down but the return of USDT will remain the same. With this, you have decided that 50000 will go to USDT and 50000 will go BTC because you think you can handle whatever loss or profit BTC will offer in the next year. And you will get a fixed return of 13% from the investment of 50000 in USDT. With this, you are thinking that a 13% loss in BTC will be covered by the return from the USDT.

Case 4: Again there are many other possibilities like invest in a mixture of other crypto assets. For example, 50% in USDT, 20% in BTC, 10% ETH and 10 in BNB. Now you are thinking that the loss in crypto price will be covered by the price appreciation in other crypto assets. But, your return will not be the highest due to over-diversification.

There are many ways to distribute the investment. You shouldn’t follow someone’s recommendation but you should think and decide how much risk you can manage and invest based on your risk. There is no clear cut answer on which crypto to invest but if you at the historical data, if you hold your cryptos for a long term, the values of BTC, ETH have been increasing 100s of times even though if you look in a short time frame, the price fluctuates.

How to sign up on ZebPay Lending?

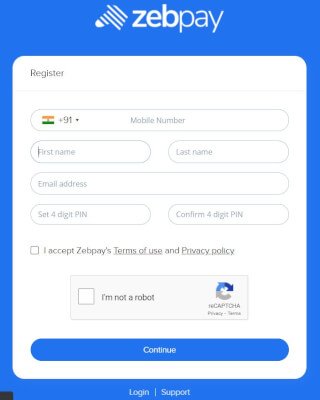

Signing up on ZebPay Lending is a very simple process. First, click here to sign up on ZebPay. Enter your correct mobile number, name, and PIN number you will use to log in. After that, you will need to verify your mobile number and complete KYC. Please remember that KYC is mandatory to complete the signup process. USE the code: REF18996140 in the promo code section and win some exciting prizes. If you are having difficulty while signing up, please follow this link to know everything about signing up on ZebPay.

During the KYC process, you will need to submit your PAN Card, and one address verification document like Aadhar, Driving license, or passport. You don’t need to worry about it because KYC is necessary everywhere.

What are the fees for using ZebPay?

ZebPay has some fees for trading, holding, and transferring money to ZebPay. There is a monthly fee of 0.0001 BTC which can be avoided by trading once a month even in the crypto to crypto. Personally, this is an outdated feature and many new exchanges don’t have this feature. On top of this fee, there is a fee for market price and limit price order which is 0.15% and 0.25% respectively. It will also charge another 0.1% for intraday.

Since we are focused on ZebPay Lending, not ZebPay exchange, we will talk only about fees applicable here. First of all, you can trade even Rs. 50 or the smallest possible crypto amount once to avoid the monthly fee. Assuming you have completed this every month, let’s forget the monthly fee of 0.0001 BTC. Now, there are two ways to place your order: buy or sell the crypto at the current market price. This is called the market order or taker price. Another way is to enter a specific amount and make the order. In this case, the order will be executed once it reaches the price you entered. This is called limit order or maker price. You decide which is the best situation for you. The intraday fee is the fee when you buy and sell on the same day. Don’t do it to avoid this fee.

There are deposit and withdrawal fees as well. There is a flat Rs. 10 fee for withdrawal in INR and there are different rates for different cryptos. You can check them all by clicking here

*All crypto deposits are free.

Fiat deposit fees

| Deposit Method | Fee |

|---|---|

| Net Banking | 1.77% |

| Bank Transfer | ₹7 |

How to deposit money, buy and invest BTC, ETH, BNB, DAI, USDT on ZebPay Lending?

Once you complete KYC, you will have to add your bank account details. After that click on the portfolio button, Now, you will see list of options available to deposit money from your bank account to ZebPay wallet. Select the method you prefer (usually netbanking) and enter the amount. Now complete the process as any other transactions.

Usually, the deposited amount is reflected within minutes but please wait for sometime. Once your amount is credited to your ZebPay wallet, you can buy the crypto you want invest or create a fix term deposit. Remember, as of now, only BTC, ETH, BNB, DAI and USDT is eligible to get a fix return for holding it on ZebPay Lending platform.

Once you buy the crypto of your choice, click on the lend tab and choose the crypto you want to lend or invest in. Now, a popup will appear to choose the amount of crypto to invest, choose either open term or fixed term. The open term means you can withdraw it at any time you want while fixed-term means the amount is fixed and you can not withdraw till the term is completed.

What are the risks of ZebPay Lending?

First things first, there is always a chance that ZebPay will stop its services suddenly due to some reasons and all your investments are gone overnight or stuck in legal procedures. So, please do your own research before investing anywhere. ZebPay has been here for more than 3 years.

Second risk: as already discussed, chances are there that the prices of the crypto you are investing has crashed and your invested value is next to nothing. However, keep in mind that bitcoin and other crypto assets have recovered from 30-40% crash over the years. If you are not thinking about holding a long time then, think carefully before investing.

Third, there is always a chance that something happens to the wallet where your investments are stored like hacking. Since you are investing your money in ZebPay lending or exchange, it is storing your money with them, the money is not with you. If someone hacked the wallet then decides to transfer all the coins, then you will have to wait for ZebPay to refund you or it may never refund you.

I am not saying all these to scare you but saying all the possibilities so that you can reach to an informed decision. Such chances are there in the normal banks. Just see the YES bank fiasco and many other companies that wen bankrupt.

Is there any alternative to ZebPay Lending?

Yes, there are many alternatives to ZebPay Lending. In fact ZebPay is late in this business model. Some of the famous ZebPay alternatives are BlockFi, Crypto.com, Celsius network, Nexo.com, Blockchain.com, etc. I have written a detailed post about how to earn interest on your crypto investments where I have compared each one of them including ZebPay. Click here to check the post.

Is bitcoin and crypto illegal in India?

Bitcoin and crypto are not illegal in India. The government of India has formed many committees to decide what to do with crypto-currencies. Earlier RBI has banned crypto in India but a supreme court order quashed it and currently, as it stands, bitcoin and crypto are legal in India at the time of writing this article.

I hope you liked this post. Don’t forget to share or comment below to know more details. If you are searching for different ways to invest, you can check out invoice discounting. If you haven’t heard what is invoice discounting, it is a short term opportunity for investors with a stable return rate of 10-13% per annum. I have written a detailed post on how to invest on invoice discounting using TradeCred. You can check it out by clicking here.

My Favorite Stock Trading/Investment Tools

TradeCred Review – Best Invoice Discounting Platform In India?

Best stock brokers for beginners in India.

Smallcase subscriptions for free.

Best broker and mutual fund investment for beginners – Groww – Click here to signup, activate your Demat account & Get Rs. 100 for free.

Best stock brokers for day trading –Upstox, Fyers.in (Free account, Free AMC)

Best charting platform – TradingView.com

Trusted Forex broker for Indians – Exness.com (Zero swap charges).

Become a crorepati just by investing 5k per month in mutual funds.

Busting the myths of investing in US Market.

How to increase your credit card limit temporarily?

How to invest during a market crash?

Why you should never use PhonePe to invest in Mutual Funds.

Invest in Indian startups using TykeInvest.

Disclaimer: All investment strategies and investments involve risk of loss. Nothing contained in this website should be construed as investment advice. Any reference to an investment’s past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit. Any ideas or strategies discussed herein should not be undertaken by any individual without prior consultation with a financial professional for the purpose of assessing whether the ideas or strategies that are discussed are suitable to you based on your own personal financial objectives, needs and risk tolerance. This website expressly disclaims any liability or loss incurred by any person who acts on the information, ideas or strategies discussed herein. The information contained herein is not, and shall not constitute an offer to sell, a solicitation of an offer to buy or an offer to purchase any securities, nor should it be deemed to be an offer, or a solicitation of an offer, to purchase or sell any investment product or service. Everything discussed here is only for educational purposes. Do your own research before investing.

2 thoughts on “What Is ZebPay Lending | Earn Fixed Returns On Your Crypto Holdings”