If you are already here, you might already know that you can earn interest on your crypto while HODLing all the way to the moon. YES! If you don’t know, it is correct that you can earn interest on your Crypto holdings just like you get interest on your savings account. In this post, you will know how to earn interest on crypto in India and what are such best lending platforms in India. You will also learn how to minimize fees and maximize your earnings. You will also learn about crypto-backed credit cards and cash-back rewards on such cards in the form of Bitcoin. Keep reading to know all about earning interest and the best lending platform in India.

Earn interest on Crypto in India

Before going through all the complexities, let’s learn how to earn interest in Crypto in India. The basic concept is that when you keep your hard earn money in your bank account without doing anything, banks will offer you a minimal return of your money. Just like this, some crypto lending platforms will offer you an annual return if you decide to keep your crypto on their platform. While this seems easy, there are risks you really need to know. For example, what if your bank just decides to shut down and run away or some government order came and it is not there anymore. Just like that, there are always risks that the lending platforms might just run away. Keep reading till last to know how to minimize risks on HODLING your cryptos in lending platforms.

What is Crypto lending platform like BlockFi, Nexo, Crypto.com, Celsius Network, ZebPay, etc?

Continuing with the bank analogy, we can say that the BlockFi, Nexo, Crypto.com, Celsius Network, ZebPay are the banks of the crypto world. You can keep your Cryptos on these platforms, in turn, they will offer some interest to you. But the question comes to everyone’s mind that how come they can offer such interests? Well, again, banks will lend your money to other people in the form of loans with an interest rate higher than the interest rate they are offering you a return. Similarly, such crypto platforms will offer loans to users and charge some interests and it will give you back as a return.

What are the best Crypto Lending platforms for Indians?

First thing first, you will hear a lot of platforms everywhere. Just remember that if something is too good to be true, it is best you just avoid them. I can’t tell what to and what not to invest in, I am just giving my opinions. Let’s have a look at the features of the most common lending platforms available for Indian users.

| Platform/Features | BlockFi | Crypto.com | Nexo | Blockchain.com | Celsius Network | ZebPay |

| Interest Rate (% p.a.) | 0.5-8.6 | up to 12 | up to 8 | 6 | 12 | 10% |

| Supporting Coins | BTC, ETH, LTC, USDC, LINK, PAX, PAXG, USDT, BUSD, GUSD | BTC, ETH, LTC, BCH, USDT + 50 coins | BTC, ETH, USDT,LTC, TRX, BCH + 15 coins | BTC, ETH, BCH, PAX, USDT, XLM. | BTC, ETH, BCH, USDT, + 50 other coins | BTC, ETH, USDT, Binance Coin, DAI |

| Minimum Investment | None | Too big to list all but large amount | None | None | None | BTC – 0.0005 ETH – 0.05 USDT – 10 DAI – 10 |

| Company Headquarter | USA | Hong Kong, China | London, UK | Luxembourg | London. UK | Gujarat, India |

| Indian Support | Yes | Yes | Yes | Yes | YES | YES |

| Sign-up Bonus | $10 when you deposit $100 [USE CODE: 5fb31957] | $25 when you stake $500 worth of CRO [USE CODE: kn9fdttcpy] | $10 on $100 deposit only on the link below | None | $40 when you deposit $400 (USE CODE: 1518860662) | From time to time (USE CODE: REF18996140) |

| Sign-up Link | SIGN UP HERE | SIGN UP HERE | SIGN UP HERE | SIGN UP HERE | SIGN UP HERE | SIGN UP HERE |

10 things you should remember while lending your Crypto

So, before going into full details on how to earn interest on your crypto holdings, you should also know some very important points which will help you from getting scammed or lost all your money. Some of these points are very simple while some are complex. Keep the 10 points below before spending a single paisa on crypto lending.

1. Get very clear about transaction fees

The transaction fees on some of the crypto-currency is just too high and crazy. For example, sending bitcoin has a transaction fee of $7 but it was around $30 just a few weeks back. Similarly, gas fee of ETH was around $60 just a few weeks before. Keep in mind that you know these details. Some other points are closely related to this point.

2. Don’t invest pennies (small amounts) in such lending platform

The main reason is that, at such interest rate, you need make sure that the interest you earn in a year is more than the transaction fees including the deposit and withdrawal fee. Let’s take an example, suppose you invest 0.001BTC in any of such platform at a return rate of 10% p.a. So, after one year, you will make 0.0011BTC including the principal amount. The current mining fee (transaction fee) is around 0.00019032 BTC. Considering the transaction fee remains the same, you will spend 0.00019032X2 which is more than the earning you have earned. Also, you must have the leverage to withdraw the amount whenever you want. Investing a small amount reduces the leverage. It is my opinion, for Indians, you must invest at least $1000 bucks i.e. around 80000 INR. This will cover your transaction fees. Keep in mind that I am not counting on the BTC price fluctuations.

3. Choose a crypto with the least fee

Inline with the above points, it is just normal to think that you must choose a crypto with the least fees. I use XRP to transfer cryptos and then use the exchange of the platform to convert the crypto you sent to the crypto you want to earn interest.

One thing you have to remember is that while choosing the least fee crypto, you need to make sure that the coin you have chosen is supported by the lending platform.

4. Don’t invest everything in only one platform

You might be thinking that I have already told that minimum investment is around Rs. 80000 in one platform and again not to put all the apples in one basket. Yes, crypto is a high risk investment and you are already taking a huge risk and you have to minimize the risks.

Let’s say that you have a total of 200000 INR to invest in crypto and you decide to invest on only one platform. If that platform is vanished after sometime, your 2L is gone in a second. But, if invested the 2L in two different platforms, even if one platform is gone, the other one is still there. So, decide wisely where and what amount to invest.

5. Don’t invest all your crypto in lending platforms

Again, to reduce your risks, you should always remember that all such platforms can go bankrupt or just decides to vanish, your money will go away with them. The only and the safest way to store your crypto is to store in a paper or hardware wallet. For those who don’t know, if you are holding your crypto in an exchange or in some lending platforms, your holdings are with their main wallet not your own wallet. So, if anything happens to them, chances are high that all your bitcoins will be lost.

To minimize such risks, you should always store your cyrpto in your own wallet. If you are confused, just download any wallet app like blockchain.com, Jaxx Liberty, Bitcoin.com, etc. The only thing you need to do is write down the secret key in a safe place. Remember, if you FORGOT or LOST that secret key, your balance is LOST forever. There is no option such as forgot password. Another way is to store all your crypto in a hardware ledger. This is the safest mode to store your crypto. It is just like a Pendrive or a hard drive that syncs and stores your wallet data and you can keep it in a safe place. Nano ledger is one of the most popular hardware wallets. You can buy it by clicking here. If you buy a pack of three, 23% OFF is there. Check out while the offer is there.

6. Always remember, you are getting the return in whatever crypto you are investing not in fiat money

Since we are so accustomed to using fiat, we will always convert whatever is there to fiat amount. But, the returns you will be getting in lending platforms like Crypto.com, blockfi, Celsius, ZebPay are in the crypto-currency you deposited. So, when you see the fiat amount it will change as the prices of such coins keep changing.

7. Always be careful and be honest when you invite your friends into the crypto lending world

YES! It is very tempting to invite your friends because both you and your friends get some sign-up bonuses. However, you should always make sure that your friends are aware of the risk involving in this world. Do not try to force them to invest unless they are comfortable with it. Also, make it clear that you will receive a bonus when they sign up under your link. Similarly, if you guys use the links above, I will receive some bonuses and you will also get the bonuses. This will support me and help in writing more content.

8. A fix term lending will give you more return but your balance is locked for that period

Just like in banks, if you create a fixed deposit, the return rate is a little higher than your normal savings account return rate. However, you can’t withdraw it until the period is over. Similarly, the crypto lenders will offer you such schemes. Just remember, some (most) of such platforms will lock your holdings and you can’t withdraw them.

9. You can also take loan from such lending platforms

Again, just like banks, you can take loans in such crypto lending platforms but you need to deposit crypto assets as collateral. Once you take the loan, your assets are locked, and failing to replay will result in the loss of your assets.

10. Invest based on your risk appetite

This is a universal thumb rule in every investment sector. Just make sure you know the risks and your risk appetite. Never invest beyond comfort. Always be ready to lose at any time in any investment due to any reason.

How to earn interest on Crypto in India?

You can earn interest on your crypto holdings in India by depositing your crypto holdings in the above-mentioned lending platforms like Crypto.com, BlockFi, ZebPay, Celsius, etc. ranging from 2.5-17% p.a. Some of such platforms are insured by real assets and collateral offered by the borrowers. This is a clever method to earn some extra bucks while you HODL your bitcoin, eth, dogecoin with your diamond hands. Let’s discuss them one by one below

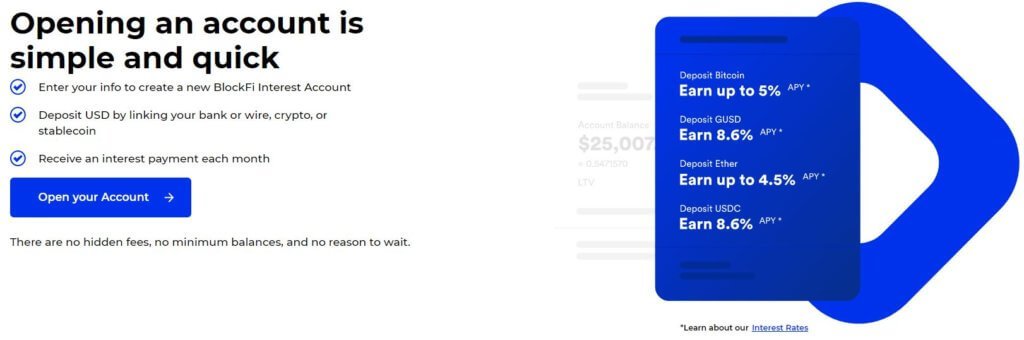

Earn interest on BlockFi.com

BlockFi is a US-based company and the US is one of the most trusted places for such business. BlockFi is one of the pioneers in this game of offering returns for your crypto. They claim that the loans are secured through the assets of the clients and in this way your investments are safe. BlockFi is offering you a 5% return on BTC, 8.6% in GUSD, 4.5% on Ether, and 8.6% USDC. There is no minimum deposit and no hidden fees. The interest is incurred daily but paid monthly. You can get full details by following this link from BlockFi.com.

Apart from the interest, BlockFi also offers a credit card with a 1.5% cashback offer on all your spending. You can join the wait-list and move up your positions by referring your friends. Many others on the list also offer credit cards. It is my understanding that Indians are not allowed to get such cards due to some RBI guidelines. Not only such cards but other cards like Payoneer card, PayPal, etc. are not allowed in India. Nevertheless, I signed up, and currently, I am in the low 6 digit waiting list. If you help me by signing up using the link below, my ladder will climb up. Please follow the link here to sign up for BlockFi credit card. Please remember that this is totally different from the BlockFi lending account. Even if you already sign up for the BlockFi lending platform you still need to sign up for a credit card. In case you haven’t signed up for the BlockFi lending platform, click here to sign-up with a $10 bonus when you deposit $100 worth of BTC by using the code: 5fb31957.

The only thing I don’t like is that some other platforms offer a much higher return rate. Also, their app is so simple and there is nothing to see there and it is just too little information to be in an app. Other than these, everything looks good. Many millionaires are also using it. I don’t want to name them you will know if you are in this space.

Earn crypto [BTC, ETH, USDT, etc.] interst on Crypto.com

Crypto.com is one of the most popular crypto lending platforms. It supports more than 30 cryptocurrencies apart from Bitcoin, Ethereum, USDT, CRO, Binance, Litecoin, BitcoinCash, and many others. You can see the full list in the below photo. Unlike the BlockFi app, the Crypto.com app is an all in one App, like lending, loan, card, pay, supercharger, etc.

However, the minimum amount is large and some of you might be too much. However, keeping the points mentioned above, large amount investment means higher return. Also, your crypto is locked for the agreed period of time. This means, you can’t cash out if there is any emergency.

Crypto.com offers a signup bonus of $25. When you enter the referral code of kn9fdttcpy, you will get $25 instantly but is locked as CRO token. To unlock, you will need to stake at least $500 worth of CRO and reserve a card offered by Crypto.com. CRO is the token of Crypto.com just like the Binance coin. Click here to sign up on Crypto.com and use the code kn9fdttcpy and get $25 for free.

There are other features like the superchargers and Crypto.com cards. Similar to BlockFi cards, crypto.com cards also offer cash back. But, it has many tiers, and based on the tiers you will get different rewards. The benefits are unbelievable like the premium Spotify, Netflix, Amazon Prime, AirBNB, etc. However, to get these cards, you need to stake different amounts of CRO for 180 days starting from 500 CRO to 5000 CRO. If you are already investing in a lending platform, chances are high that you don’t have enough money to stake another $500 to get these cards.

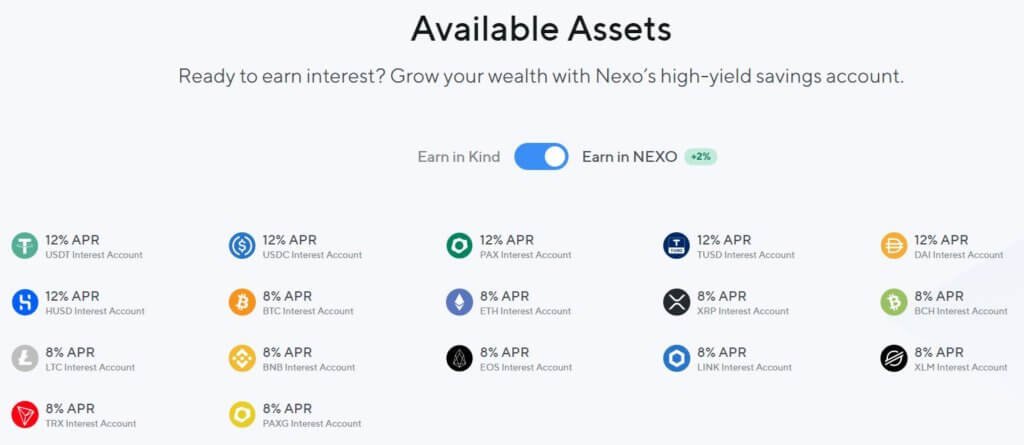

Earn crypto interest on Nexo.com

Nexo.com is a simpler and much more friendly platform than any others. It supports around 15+ crypto and stable coins. The interest rate ranges from 8% to 12%. 8% return rate on bitcoin is one of the highest in the market. There is no minimum amount and the interest is paid daily. There is a minimum of 6 network confirmations for the funds to be credited to your wallet. A fixed-term is also there and it offers a higher return. It took around 40 mins for me for the amount to reflect in my account. Click here to signup and get $10 when you deposit $100.

Earn interest on Blockchain.com

Even though blockchain.com is late to this game, at least it is stepping up. Just recently, it has introduced the earn interest on crypto holdings for major crypto-currencies like Bitcoin BTC, Ethereum ETH, Bitcoin Cash BCH, Stellar XLM, Tether USDT and Paxos PAX. The BTC interest is 4.0%, 5% on ETH, 6% BCH, etc.

When can I withdraw my crypto? You can withdraw from your interest accounts after 7 business days. How often do I get paid? Your earned interest accrues daily and is paid out monthly. Your earnings will be paid directly into your Interest Accounts. How do I get access to this feature? Gold Level is required to transfer to an Interest Account. To upgrade, in most cases we only require a government issued ID or passport. Can anyone earn interest? No. Due to local laws, Blockchain.com cannot offer interest bearing products to users in Japan or Canada. Also, some US states do not allow crypto transactions. To check your eligibility, click here.

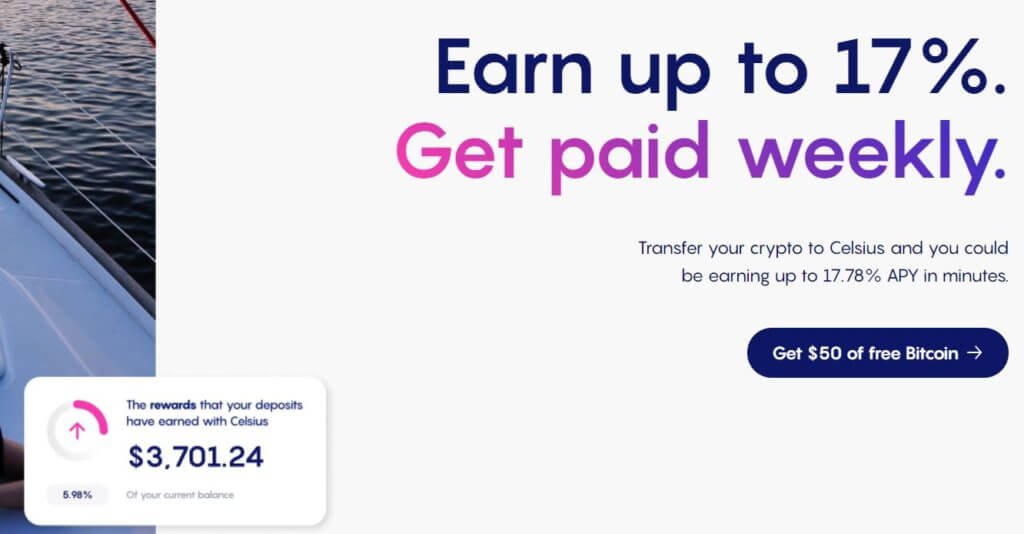

How to Earn crypto interest on Celsius Network?

Earning crypto interest on the Celsius network as easy as depositing your money to your bank account and you earn interest automatically. It offers the payout weekly with an interest rate of 17% p.a. One of the advantages of Celsius network is that the international users (Outside the US) including Indians, are offered a higher interest rate. The list of interest rates is just too long to list here. BTC is 4.4%, 6.35% for ETH, 13% MATIC. Again, you should check out the list yourself before investing.

Earn crypto interest on ZebPay

ZebPay is one of the earliest Indian crypto exchanges in India. The only thing I don’t like is that it will charge your account for not trading. But if you trade once a month, there will no charges. Other than this, the platform is purely India-based and it has been around since 2016. For now, it supports only BTC, ETH, USDT, and DAI. The interface is very simple. You can click here to sign up on ZebPay.

How to transfer your bitcoin, ethereum to lending platforms like Crypto.com, blockfi, ZebPay, etc?

First of all, for ZebPay, it is really simple to deposit your money as it is Indian based. All you need to do is complete your KYC and deposit your INR from your account to ZebPay wallet. From your ZebPay wallet, buy the coin you want and invest it.

For platforms like Crypto.com, BlockFi, Nexo, Celsius, you need to buy the crypto from an Indian exchange and transfer it to these platforms. Some platforms like Crypto.com, it offers direct buy from debit and credit cards, but Indian credit and debit cards from SBI, ICICI, Axis bank are blocking such transactions. I have tried them all and none of them works. So, I purchased XRP from CoinSwitch and transferred it to these lending platforms. If you don’t know how to buy then you can click here to know how to buy Dogecoin in India. Everything is same except you change the coin and all other process is same.

I hope you liked this article. If you are interested in investing, I think you should look into how to invest in invoice discounting via TradeCred. I have written a detailed review on the TradeCred, click here to check it out to know everything about TradeCred.

Disclaimer

Disclaimer: All investment strategies and investments involve risk of loss. Nothing contained in this website should be construed as investment advice. Any reference to an investment’s past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit. Any ideas or strategies discussed herein should not be undertaken by any individual without prior consultation with a financial professional for the purpose of assessing whether the ideas or strategies that are discussed are suitable to you based on your own personal financial objectives, needs, and risk tolerance. This website expressly disclaims any liability or loss incurred by any person who acts on the information, ideas, or strategies discussed herein. The information contained herein is not, and shall not constitute an offer to sell, a solicitation of an offer to buy or an offer to purchase any securities, nor should it be deemed to be an offer, or a solicitation of an offer, to purchase or sell any investment product or service. Everything discussed here is only for educational purposes. Do your own research before investing.

4 thoughts on “How To Earn Interest On Crypto In India | Best Crypto Lending Platforms in India”