Hello everyone, today we will see the Flipkart Axis Bank Credit Card Review – Benefits, Eligibility, How to apply online, limit, charges, etc. Flipkart Axis Bank Credit Card is one of the best credit cards in India with 5% cashback on Flipkart and 1.5% on all transactions with other tons of offers. I will be giving an honest review and experience of Flipkart Axis Bank Credit Card after using it for years. Read till the end to get a tip on how to get more cashback and a trick I used to get accepted without showing the income proof.

In this article about the Flipkart Axis Bank Credit Card review:

- What is Flipkart Axis Bank Credit Card?

- What are the benefits of the Flipkart Axis Bank Credit Card?

- What is the eligibility criteria of Flipkart Axis Bank Credit Card?

- How to apply Flipkart Axis Bank Credit Card?

- Flipkart Axis Bank Credit Card Limit

- What are the charges of Flipkart Axis Bank Credit Card?

- My honest review on Flipkart Axis Bank Credit Card.

- Flipkart Axis Bank Credit Card Delivery Time

- Conlusion

Before starting, if you are using any credit card and you are thinking to apply for the Flipkart Axis Bank Credit Card, then comment down below which card you are using and why are you thinking of switching to Flipkart Axis Bank Credit Card. Ok! Now let’s jump into the main article.

What is Flipkart Axis Bank Credit Card?

The Flipkart Axis Bank Credit Card is just like a normal credit card issued by Axis Bank in partnership with the Flipkart shopping giant. As a partnership, Flipkart is offering huge discounts and cashback only for this specific card user.

This is just another way to attract customers and offer them cashback so that the customers stay on them. To be honest, I like the cashback and I am loving it. So far, I have earned thousands of cashbacks. Read more to know more details. We have seen similar card offers from Snapdeal with HDFC Bank, Amazon with ICICI Bank, Axis, and Freecharge, etc.

This is nothing new but the offers are very attractive that you will miss a big chunk of your free cashback if you are a regular online buyer. For all the details about the benefits, check out the next section.

What are the benefits of the Flipkart Axis Bank Credit Card?

The most important features and benefits of Flipkart Axis bank credit card are the 5% cashbacks all on orders in Flipkart using the Flipkart Axis bank credit card. Besides the 5% cashback on Flipkart, it offers 4% on other partner sites and a flat 1.5% cashback on all other transactions. A detailed list of features and benefits are presented below:

- Flat 5% Cashback on all orders in Flipkart using the Flipkart Axis Bank Credit Card.

There is no minimum cart value nor maximum cart order, you will get 5% flat cashback on any order except EMI orders. You will not get the 5% cashbacks on EMI orders. - Flat 4% cashbacks on orders from partner sites. The partner sites are Makemytrip, Goibibo, PVR, Uber, Ubereats, Urbanclap, Cure.fit. You will not get any cashbacks for orders on EMI.

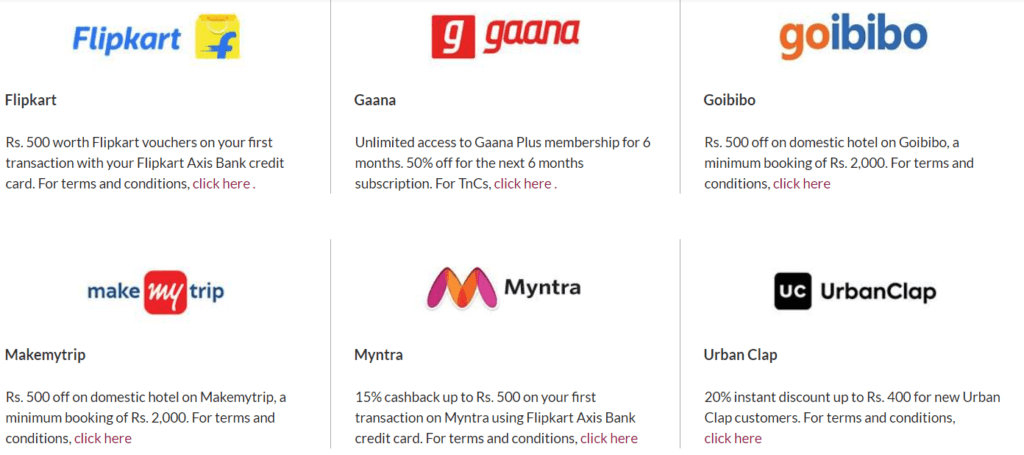

- Welcome gifts worth Rs. 3000. This includes Rs. 500 gift card from Flipkart, 500 on goibibo, 500 off on makemytrip, unlimited 6 months premium access to gaana.com and 50% OFF on the next 6 months. 30% instant discount on urbanclap users and 15% cashback on first order in Myntra.

- 4 lounge access to select domestic airports per year. You can get the list of airports by following this link here.

Check out the below details.

Honestly I am loving the offers. It may have happened only to me but I didn’t get the 15% cashback on first order in Myntra but the normal 4% cashback. Urbanclap I didn’t try, all other offers, it worked like a charm.

Do you want to protect your internet banking and credit card usage online? Check out the following post where I have given 10 mistakes you are doing now that may lead you to trouble while using online banking.

What is the eligibility criteria of Flipkart Axis Bank Credit Card?

One of the most frequent questions I get from others is the eligibility criteria for the Flipkart Axis bank credit card. In this Flipkart Axis Bank credit card review, I will provide you all the details on what are the eligibility criteria for this card. There are only two mandatory requirements for anyone to join the Flipkart Axis Bank Credit card – An Axis Bank account and a Flipkart account.

Currently Flipkart and Axis bank is offering the Flipkart Axis Bank Credit Card only to those Flipkart users with Axis Bank accounts. This means that you need to have an axis bank saving account or salary account. To be clear, you don’t need to link flipkart account with the axis bank account. At the time of singing up, you have to provide the phone number associated with the axis bank account linked to your flipkart account.

Even though these are the formal normal requirements, there are some basic requirements you need to maintain in order to get accepted for the Flipkart Axis bank credit card. This includes but not limited to:

Maintaining a good account history like – good account balance, no fees or penalties of any kind within the recent 4-6 months, etc.

A good account standing in Flipkart like – proper orders not high return or cancelled percentage, no late payment on Flipkart Pay Later account, etc.

On top of all these, you need to have a good credit history if you already have other credit cards. If you don’t have any other credit cards, then you don’t need to worry about. If you are wondering what is your credit score, then the scocre.com provides a very good and detail credit report. You can check yours now by following the link here. Or you can check your credit score in BankBazaar.com.

Besides these, you may need to provide your income details, your personal details like PAN card, Aadhar card and other required documents for verification. In my case, they didn’t ask anything but my verbal confirmation of my residential address. One of my friends needed for physical address verification. The bank or flipkart representative will visit on your address that you provided during the sign up process. Continue reading for more Flipkart Axis Bank Credit card review to know more about how I applied and got accepted.

How to apply Flipkart Axis Bank Credit Card?

You can apply the Flipkart Axis Bank Credit Card through three different ways – by using Flipkart Mobile App, by using the Axis Bank Mobile Banking App and by using the Internet banking of Axis Bank in computers. Next paragraphs will give more details on how to apply for Flipkart Axis Bank Credit Card. Did you know that you can get a credit card without any income proof or salary slip? You can know more about it in this link as I have written about how I got three credit cards without showing any income proof.

Apply Flipkart Axis Bank Credit Card through Flipkart Mobile App

Applying through the Flipkart Mobile App is the easiest and simplest way to apply for the Flipkart Axis Bank Credit Card. I applied by this method and got accepted within 3 days. All you need to do is go the app and fill in the details like the phone number associated with the Axis bank account, you residential address and other details.

Once you finish the process, the Axis bank and Flipkart will instantly tell you if you are accepted or not or eligible for it. In my case, it said I have to verify the details by receiving a phone call from their representative. I received the phone call after two days and next day I got a SMS that I have been approved of the card.

In my case, it was very simple and just a telephonic verification was enough for them to accept my application. This Flipkart Axis Bank Credit Card review may be overly positive about this card because of the fact that everything went very smooth for me. Later I will mention about one of my friends experience.

Apply using the Axis Bank Mobile Banking App

You can easily apply for the Flipkart Axis Bank Credit card through the Axis bank mobile app. Go to apply section and then tap on the credit card section. Wait to load the page completely then tick on the shopping category. Now, you will see a bunch of credit cards. Search and select the Flipkart Axis Bank Credit Card. Fill up all the details, some of which are pre-filled as you are already an Axis Bank Customer. Once you finished it, you can expect a phone call from the Axis Bank representative within 3 working days.

S/he will talk through all the details and requirements as well the documents you need to submit. The representative will also tell you a tentative date of physical verification. But the exact date of physical verification will be informed by the local branch representative. One of my friends applied through this way and he had his physical verification within the next working day. Check out the following images to make it more simple if you are facing issues.

Apply for Flipkart Axis Bank Credit Card by using the Internet banking of Axis Bank on computers

The process is similar to the above-mentioned method but it is just in a computer browser. Log in to your internet banking account and go to apply section and then apply for the credit card by filling in all the details just as I mentioned in the above-mentioned way. All other process is similar.

Flipkart Axis Bank Credit Card Limit

The Flipkart Axis Bank Credit Card limit depends purely on the bank’s decision which is Axis Bank. This is applicable to all types of credit card. There is no definitive defined limit as you may get more than 1 lakh or less than 30000. I got a limit of Rs.65,000 while my friend got a limit of Rs. 31,000 and some got more than 1.5 lakhs. It depends on your previous credit card history, your amount of salary and as well as your account balance average.

How to make sure your application for the Flipkart Axis Bank credit card is accepted?

So, there are chances that your application might be rejected for some reason. Luckily, as I am trying for this Flipkart Axis Bank Credit Card review, I did simple yet very helpful trick so that Axis Bank will accept my application.

Did you know that Axis Bank as something called pre-approved offers? If not you can see that after login in to your account both in web app and mobile app. See the photo below to see it.

This offer is made available to customer is a high average balance and good account standing. So, before applying, I consistently maintained a good average amount in the account and regularly made transaction from the account. After 3-4 months, you will likely see a pre-approved credit card offer in the pre-approved section. Do not apply there yet.

Now, you have to maintain and transact money in the saving account until you get such a pre-approved credit card offer. Once you see the offer, go to the apply credit card section and apply for the Flipkart Axis bank credit card. This gives some advantages as Axis knows you have an already pre-approved offer.

I applied by doing this and got accepted even without a physical verification. But you make to make sure that your saving account is KYC updated in recent months.

What are the charges of Flipkart Axis Bank Credit Card?

There is an annual fee of Rs. 500 + GST for the Flipkart Axis Bank Credit Card. With 18% GST which is Rs.90, it is Rs. 590 per year as annual fee. There is no other hidden fees. But there are other normal fees like interest rate, late fee fine, over the limit use charge cash withdrawal charges. Axis bank has a full detail page on all the fees. You can check on all types of fees by following the link here.

You don’t need to worry about the extra charges if you are a normal credit card user. By normal credit card user I mean using less than the limit, paying the bills timely, not withdrawing cash using credit card, etc. If you not using your credit card this way then any credit card is a bad credit card for you.

My honest review on Flipkart Axis Bank Credit Card.

Honestly I really like this Axis Bank Flipkart credit card. It has a very minimal fee and a very simple cashback system. If you a regular online shopper, then you can easily maximize your cashbacks by using this card.

Regarding the annual fee, let us do some mathematics. Are you ready?

So, the fee is Rs. 590 including the GST. Consider you order all your items from only flipkart. In order to get Rs. 590 as cashback in a calendar year, you need to have an order value of Rs. 11,800 in Flipkart. Now, lets consider that 50% of your orders are from Flipkart and 25% are from preferred partner sites and the remaining 25% are from other sites. Then, you need to order items of Rs. 7613 from Flipkart, 3807 from partner sites and all other sites each which gives a total value of Rs. 15226.

So, 0.05*11800=590

0.05*0.5*x+0.04*0.25*x+0.015*0.25*x=590 which gives the value of x as Rs. 12556. Since, 50% of 12556 is from Flipkart then the order value from flipkart is Rs. 7613 and similarly, the order value from the preferred sites is 3807 and Rs. 3807 for all other sites.

Yes, some of you might ask, what if you preferred to buy from Amazon or any store other than Flipkart? My simple answer is that if the same product is available in Flipkart as the same amount and you know you are getting 5% cashbacks, then, why would anyone buy from another store?

A total of Rs. 15226 in a calendar year is like Rs. 1270 per month which I think most of you uses in online shopping.

Check out the below NFC protectors. This will help you prevent from unauthorized access of your card contactless.

How to squeeze the maximum benefits.

How to get more cashback by using the Axis Bank Flipkart Credit Card?First of all, let me be clear that there is no cheat code or hacking involve in this. This is very simple and anyone can do it. The simple trick is ordering other people’s items by using your card from your account. This way you will get the cashback and they will get their products without any problems.

How the cashback system works?

The cashback you obtained this month will be credited in next month’s bill. For example, you earned a cashback of Rs. 200 this month, this Rs. 200 will be credited in the next month’s bill. So, in the next month, let’s say to use a total of Rs. 5000 then the actual amount of bill you have to pay is Rs. 5000-200 i.e. Rs. 4800.

You can see the image below that a cashback of Rs. 1111 has been credited in the month of Nov’2019 because I have earned it on the month of Oct’2019. Now, whatever the amount I use during November month cycle, I have to pay Rs, 1111 less than it.

Now, I hope everybody understands how the cashback system works because I got a lot of questions from my friends asking about this. During the Flipkart Axis Bank Credit Card review, many users are confused about the amount of cashback. It is primarily because other banks rewards system is different for each bank and some banks offer 1 rewards points equals 1 rupee or 4 points equals 1 rupee, etc. But for the Axis Bank Flipkart Credit Card, there is no rewards point but a cashback system and each cashback is equal to one rupee.

Was there any difficulty while using this card?

Yes, I have to be lying if I said no. But it was only once at the very start of using this card. The problem was that I was supposed to activate the card by sending a text SMS. I sent the SMS, and I thought it is activated. Then when I tried to purchase an item during the big billion days, it failed. I had to send the SMS again, but the flash sale was already over by that time.

Other than this, I never experienced any problem. The only one problem I mentioned above, I called the helpline number and I had to wait like 15-20 minutes because it was during busy days. But, once I got to talk to the representative she handled the problem very calmly and was very helpful all the time.

If you are facing problems like your debit cards or credit cards are blocked for 3D secure transactions online, then I have posted an article on how to unblock 3D secure blocked cards. Check here to know more. It applies to all types of cards like debit cards, credit cards, MasterCard, Visa, or Rupay from all banks.

Can I use Flipkart axis bank credit card on amazon?

Yes, you can use Flipkart Axis Bank credit card on amazon. I have used it and worked perfectly fine. Apart from Amazon, I have used it in airport stores, other online stores, and as well as international transactions for taxi service in Paris as well. So, you can be sure that the Flipkart Axis Bank credit card can be used on Amazon and all other transactions where any merchant accepts any other credit card.

Flipkart Axis Bank Credit Card Delivery Time

As per the Axis Bank, the delivery time for the Axis Bank Flipkart Credit Card is within 14 days. However, in reality if you are staying outside major cities, expect it to be delivered after 14 days even months.

Conlusion

After reviewing all the benefits of Flipkart Axis Bank Credit Card, along with the fees and other charges of the Axis Bank Flipkart Credit Card, I have to strongly recommend this card. There is hardly any card better than this card at this price range which offers the same benefits. You must get this card. One other card I have an offer if not this card is the Amazon Pay ICICI credit card. So, go ahead and apply for the Flipkart Axis Bank Credit Card and get the benefits. If you think I have missed something during this Flipkart Axis Bank Credit Card review, then comment down below and I will add all other details as updates.

4 thoughts on “Flipkart Axis Bank Credit Card Review – Benefits, Eligibility, How to apply online, limit, charges, everything you need to know”