The main reason you should never buy any mutual fund plans from PhonePe be it PhonePe SIP or One Time, is because of the fact that all the mutual funds offered by PhonePe are ‘regular’ plans, not direct plans. PhonePe will take a cut of around ~0.8% of your profits as fees. Even though you might think it is less than one percent, this less than one percent over a period of 20 years, you will lose around 23 lakhs for a SIP of 10K per month. Check out the photo below if you don’t believe it. With the reason cleared out, and if you want to know more about the difference between regular and direct plans, and where to invest to get the best return, read the full post. In the end, I will give you some signup bonuses.

What are PhonePe SIP Mutual Funds?

PhonePe mutual funds are the mutual funds offered by PhonePe to buy a lumpsum or SIP through PhonePe. PhonePe allows you to start a SIP as low as Rs. 100 in a vast selection of mutual funds from many different mutual fund houses.

There are two types of mutual funds – regular funds and direct funds. Let’s understand this with an easy example. ABC Limited is a mutual fund house that offers different mutual funds. Through different partners like banks, brokers, and other partners, ABC has to sell these mutual funds.

For promoting the funds, the partners will take a small cut from any mutual funds they bring in. PhonePe is a partner for the different mutual fund houses. These funds you ordered through a partner, which get a cut of your invested amount, are called regular funds.

On the other hand, you can buy these mutual funds directly from ABC Limited and won’t have to pay a cut to anyone. Even some brokers and partners will sell these funds without any commission. In these cases, these mutual funds are called direct mutual funds.

Always, always buy only the direct funds. Nowadays, most of the platforms provide only direct funds. I don’t know why PhonePe would provide the regular plans. I guess they are trying to loot the innocent new investors of that ~1%.

How do we know which mutual fund is regular or direct?

It is very easy to know which mutual fund is regular or direct. All you have to do is search for the word “direct” in the full name of the mutual fund you are searching to invest in. You can see that none of the mutual funds in PhonePe have the term direct. You simply don’t buy anything that doesn’t have the word direct in the name of the mutual fund you are trying to buy, no matter what the agent or anyone else says.

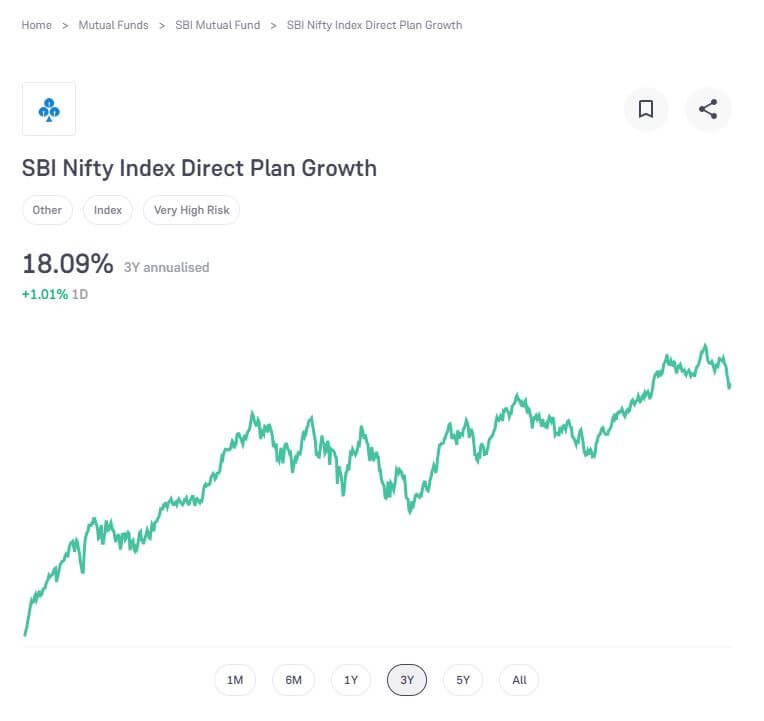

As you can see in the below SBI NIFTY mutual fund via Groww, you can direct with the name of the mutual fund. This is a direct mutual fund.

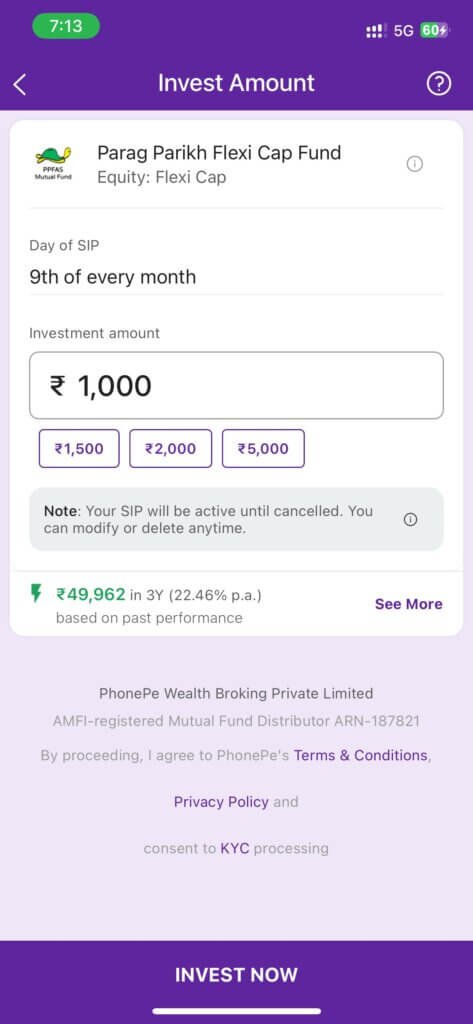

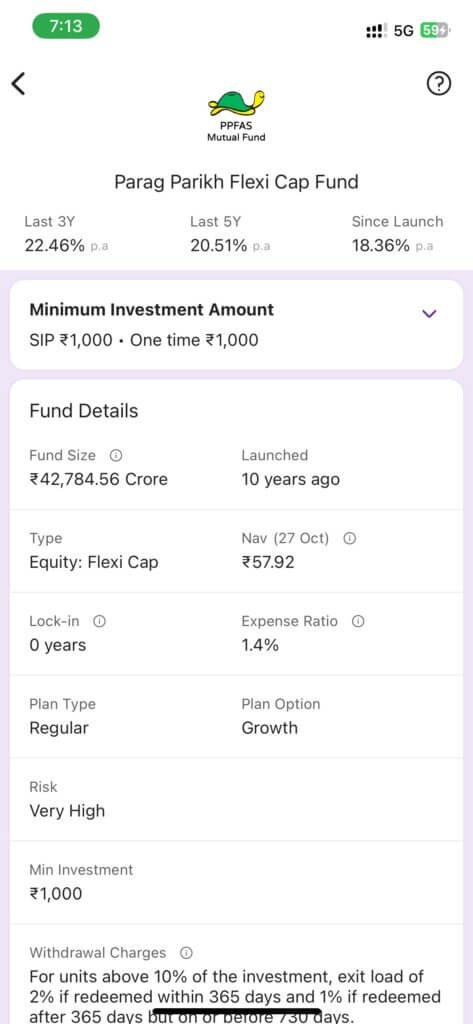

But if you look at the mutual funds listed by PhonePe, none of them will see the word direct in the names of mutual funds. Have a look at the below funds from PhonePe. If you tap of the ?, you will see full details saying Plan Type as Regular. All the PhonePe SIPS are of regular type not direct types.

Why you shouldn’t buy any mutual fund from PhonePe SIP?

As I have stated above, all the mutual funds offered by PhonePe are regular funds. You might be thinking you are a small investor, and less than 1% is not a big deal for you. The average difference of around 1% in the return rate between regular and direct plans for a period of 20 years is a very big amount. As you can see in the above photo, there is a difference of around 23 lakhs over the 20-year period if your SIP is 10K per month.

I don’t know about you, but I wouldn’t waste 23 lakhs at all. And I think you shouldn’t too.

If PhonePe thinks it will be successful in the mutual fund market by offering regular plans when the market leaders are offering direct plans. This is a 100% fail plan from the beginning.

Which platform is the best to invest in Mutual Funds?

I personally use Groww for my mutual funds, and this is my favorite, and it is best for any beginners. I will also give some other alternatives with very good reasons why you should also invest in other platforms as well.

Best App to Invest in Mutual Funds:

1. Groww

It is the simplest and easiest app to sign up to start investing in mutual funds. You can complete the signup process completely online and start investing instantly once your account is confirmed. It offers only direct plans so you don’t need to worry about regular or direct plans.

Groww is currently giving Rs. 100 for free to anyone who activates their Demat Account after signing up. Click here to signup on Groww, activate your account and get Rs. 100 for free.

2. ETMoney

ETMoney – It is the investment and analyzing platform from the TimesIndia group. It offers easy-to-understand different mutual funds and very detailed stats that you can easily understand. It also offers direct plans.

Click here to signup now on ETMoney App.

3. Fyers

Fyers.in – Fyers.in is mainly a stock trading platform, but you can also invest in mutual funds. The reason I am investing here is because of advanced features from Fyers that let you pledge your mutual funds. Pledging is another totally different topic, which I will discuss later in another blog post. But remember, if you plan to be a serious investor in the coming years, pledging might become important for you. For now, Groww doesn’t have this feature, but they are saying that it will be implemented soon. PLedging in Fyers.in is free

Click here to sign up on Fyers.in for free with free AMC for lifetime.

4. Upstox

Upstox is one of the largest stock brokers in India, backed by Tata, and it is one of the brokers with advanced features. Similarly, Upstox also allows the pledging of mutual funds. But it charges a fee. Upstox is offering free account opening and a Rs. 1000 credit on brokerage fees for the first 30 days on your tradings.

Don’t miss this offer and click here to sign up on Upstox.

What to do if you are already invested in PhonePe mutual funds?

By now, you know that investing in mutual funds via PhonePe is not a good idea, but you are already investing in it. Now what to do? There are two ways you can do this if you are already invested in mutual funds via PhonePe: 1. You can safety switch to the direct fund version of the same fun by using INDMoney (conditions apply) and (b) stop the SIP and start a new one in one of the above options given above.

Now, let’s discuss in detail.

Switch the regular plan to a direct plan with Apps like INDMoney

(a) INDmoney App is an investment tracking app that allows you to track all your investments, loans, in one place. The only requirement is that your credit score must be above 650. INDMoney App has a feature where you can switch your regular funds to direct funds in just a few clicks. Watch the video below to know full details.

However, there are certain conditions you should know before complaining that it is not working for you. First, your regular funds should not be in a locked-in period where you can not redeem or switch your funds for the locked-in period. Generally, the lock-in period is around 3-5 years. I, myself, have one regular fund, which I started before I knew the details, which I can’t switch till now.

Secondly, you should enable auto-tracking of your funds in the INDMoney app. Properly enable the required permissions.

Stop the PhonePe SIP and start a new direct SIP with apps like Groww, Upstox, etc.

The second option is simply to stop the current SIP and withdraw the amount if there is no lock-in period. If there is a lock-in period, then you simply keep the amount there but stop the SIP. If you are a big investor, make sure that you take care of your short-term capital gain and long-term capital gain taxes if you withdraw the invested money.

After you stop your investments in PhonePe, simply sign up in any of the options given above like Groww, ETMoney, Fyers, etc., and start a new investment there. It is as simple as this.

Now, I will answer some FAQs’ that everyone asks frequently.

Is it good to invest in mutual funds through PhonePe?

No. PhonePe offers regular funds instead of direct funds which takes a commission on your invested amount that lowers your returns overall. Instead, invest in mutual funds in a direct fund through apps like Groww, ETMoney, INDMoney, Upstox, Fyers, etc.

Which is better mutual fund, direct or regular?

A direct mutual fund is always better than a regular mutual fund because in the case of regular mutual funds, the platform you are using takes a small cut of your investment amount. Always invest in direct mutual funds.

How do you know if a mutual fund is direct or regular?

Any mutual fund without the word “direct” in the full name is not a direct mutual fund. You will see the word direct in the full name of the mutual fund no matter what any agent tries to convince you. For example, SBI Nifty Direct Growth Plan is a direct mutual fund while SBI Nifty Growth is a regular plan.

Can we invest in PhonePe SIP?

Yes, but you shouldn’t invest in SIP through PhonePe as it offers only regular plans rather than direct plans. For more details, read this post carefully.

Is it safe to invest in mutual funds through PhonePe SIP?

Yes, but you shouldn’t invest in mutual funds through PhonePe as it offers only regular plans rather than direct plans.

Is PhonePe mutual fund direct?

No, it is regular, and you shouldn’t invest through PhonePe.

How to cancel PhonePe SIP?

- Tap Investments at the bottom of your PhonePe app home screen.

- Tap my portfolio at the top of the screen.

- Select the relevant SIP.

- Select pause under the status section.

Which is better, Etmoney or Groww?

I would prefer Groww as a beginner and as an investor overall as Groww offers stock investment, trading, and IPO other than mutual funds, while ETMoney seems to focus only on mutual funds. But, ETMoney offers much better, in-depth information about mutual funds.

My Favorite Stock Trading/Investment Tools

TradeCred Review – Best Invoice Discounting Platform In India?

Best stock brokers for beginners in India.

Smallcase subscriptions for free.

Best broker and mutual fund investment for beginners – Groww – Click here to signup, activate your Demat account & Get Rs. 100 for free.

Best stock brokers for day trading –Upstox, Fyers.in (Free account, Free AMC)

Best charting platform – TradingView.com

Trusted Forex broker for Indians – Exness.com (Zero swap charges).

Become a crorepati just by investing 5k per month in mutual funds.

Busting the myths of investing in US Market.

How to increase your credit card limit temporarily?

How to invest during a market crash?

Why you should never use PhonePe to invest in Mutual Funds.

Invest in Indian startups using TykeInvest.