m.Stock is the perfect stock broker if you hate brokerage charges eating up your profits. M.Stock broker might be the best discount broker for you as a beginner and intermediate trader. I am currently enjoying the free M. Stock brokerage plan, and it definitely matters for small-time traders like me. Read this full m.Stock review to know full details, advantages, and something I don’t like about it.

m.Stock Broker Review

I have been testing m.Stock broker for options trading, I will provide you my honest opinion on it. My overall take is that m.Stock is one of best brokers because of its no-questions-asked zero brokerage fee on all segments be it, equity, intraday, F&O, currency, or e-margin facilities. However, there are some buggy features and some features I really would like m Stock to have so that it is really on par with the other top brokers in the market.

m.Stock account opening charges and pricing

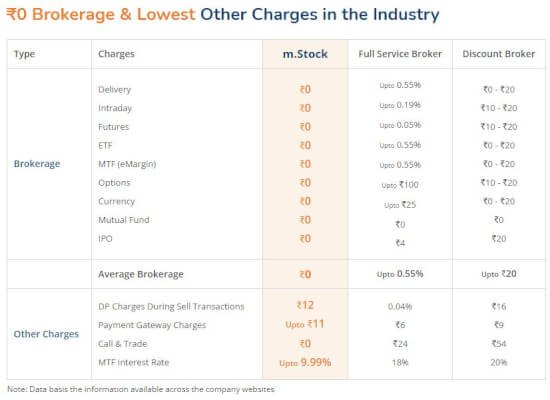

The best thing about m.Stock is the pricing structure and no hidden charges. It boasts about being zero brokerage on all segments, including Futures & Options, Free Intraday, Free Delivery, Free currency training, Free IPOs, Free Mutual funds and free eMargin facility. There are absolutely no brokerage charges on these segments m.Stock offers.

Some of you might be asking what are the conditions and there must be some terms and conditions as well as hidden charges. The answer is NO. The only thing you need to do is choose your account opening options.

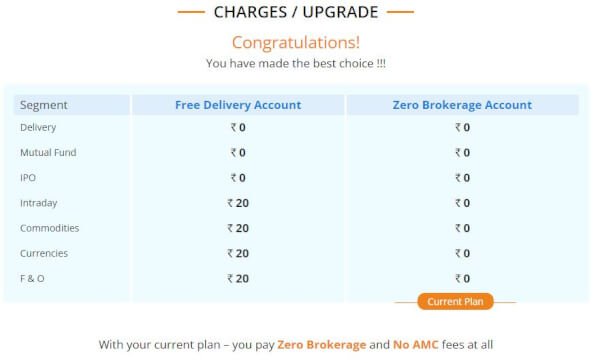

m.Stock types of accounts

There are two types of accounts in m.Stock – (a) Rs. 999, zero brokerage for life, and (b) Rs. 0, free delivery for life account. On top of these two accounts, you can make your m.Stock account AMC free (account maintenance charges) for life by paying another Rs. 999.

In short, if you pay Rs. 999+999+GST = Rs. 2357.64, you will get zero brokerage for life on all segments with zero AMC fee for life. You can trade for life without any brokerage fees. All you need to pay is typical SEBI, DP, Govt. charges.

Or you can only pay Rs. 999 to get zero brokerage for life and pay Rs. 120 every quarter. Or you can pay nothing, enjoy m.Stock just like any other normal discount brokers.

Even with the very basic Rs. 0 account type, you can still enjoy one of the lowest DP charges and lowest eMargin rates in the industry. While the industry average DP charge is around Rs. 16-30, m.Stock charges only Rs. 12. You can place or close a trade with a call to customer care. Normally, discount brokers charge around Rs. 50-150 but for m.Stock it’s free. If you are a swing trader with margins, m.Stock offers one of the lowest interest rates capping a maximum of 9.99%.

You can always upgrade your account to a free brokerage plan and a free AMC for life plan. But you have to pay Rs. 1299 plus GST in case you opt to upgrade against paying Rs. 999+GST while signing up. There are many other typical charges that everyone pays in every other broker like SEBI charges, Exchange charges, GST, etc. You can check out the full pricing structure by following this link here.

Which m Stock account type did I open?

I opened the m.Stock full free brokerage for life + free AMC for life account by paying Rs. 1998+GST. Actually I opened m.Stock account a year back and never used it I was busy with other things. Opening the account was easy, smooth, didn’t encounter any problems. Everything was online and hardly took around 5-10 mins, provided you had the documents ready and your eKYC facility is there.

m.Stock Review: Is it really zero brokerage in m.Stock broker?

Yes, I have been using m.Stock for option buying for some time and there are zero brokerage charges on all the contract notes and it reflects correctly on the wallet ledger. Let’s have a look at a contract note from m.Stock below. You can see there is no brokerage fee there. All other charges are normal charges you anyway pay even if you are using any other brokers like Zerodha, Fyers, Upstox, Dhan, etc.

m.Stock Review: What are things I like about m.Stock?

There are many features I really like about m.Stock, let’s discuss all of them one by one.

Zero lifetime brokerage

As discussed above, the best feature is the zero brokerage for a lifetime. For small traders and learners, you can significantly reduce a chunk of your fees by removing the brokerage fees. To make it even clearer, m Stock even provides you with a brokerage savings calculator. You can check it here.

This is even more useful for beginners when you don’t a lot of capital and you are learning many things. During this time, even Rs. 40 for brokerage means a lot. You are starting with 2 or 5 lots and 3-4 trades per day means you are saving an average of around Rs. 200 per day. At this stage, offsetting this amount using m.Stock significantly increases your profit margin and gives you the confidence you need.

Trust me, these small things matter a lot during your confidence-building and learning stages. Your payment for account payment charges are covered with around 48 trades thinking, for each trade you have to pay around Rs. 50 as brokerage fee. If you take 3 trades per day, your account opening fees on m.Stock will be covered within 16 trading days.

When you are learning, I know you will punch more than the required orders and overtrading will be there. That is why I said brokerage is a big chunk of your money.

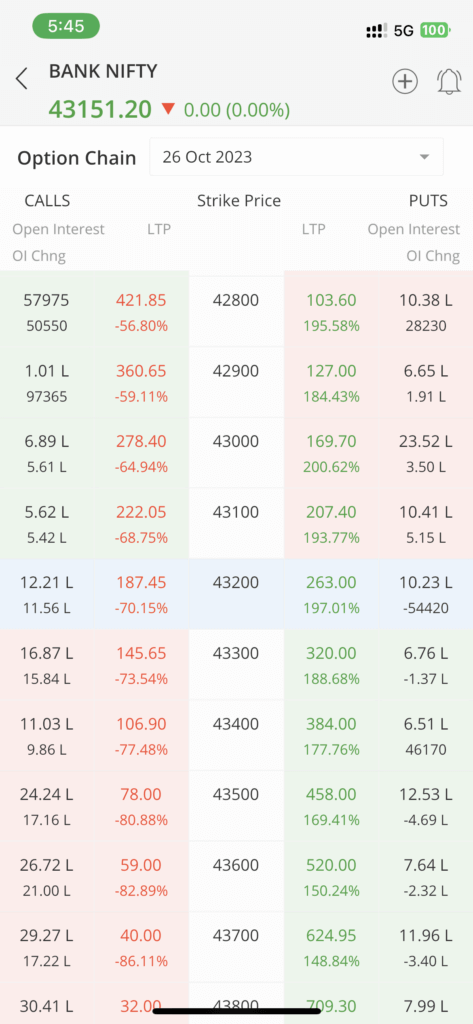

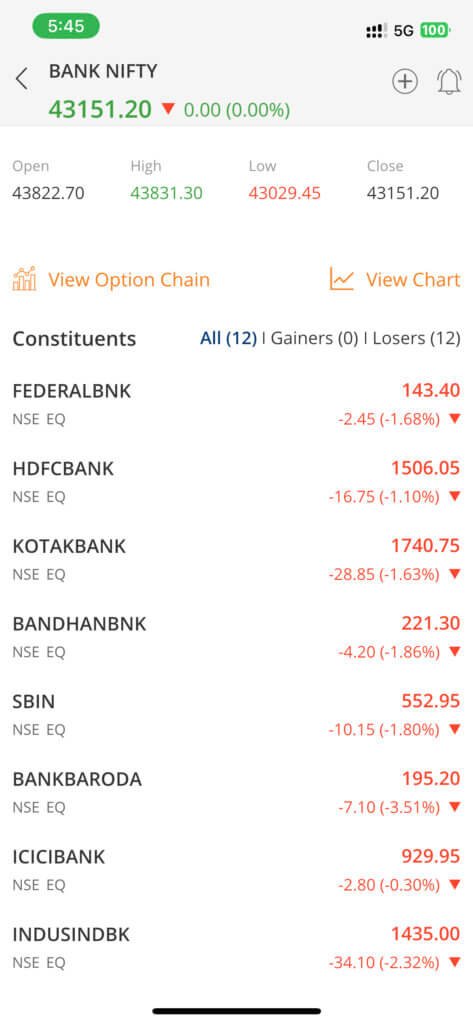

Easy interface in App and Options chains

The mobile app interface is quite easy and the access to options chain is quite handy. Yes, there are other apps better designed than m.Stock. But for the majority of the users, m.Stock interface is simple and good enough.

Free call & trade feature on mStock

mStock offers the call & trade feature for free while most discount brokers charge around Rs. 50-150 per trade. This may sound very strange but for those staying in areas with network problems, this is very important. I have friends saying, yaar, I was in profit then the internet was down for around half an hour and I booked in a loss.

In this case, you can always close your positions by simply calling customer support. You need to note the trades you took, and your account details to complete the trade.

The very low-interest rate on eMargin facility max at 9.99% on mStock

With eMargin facility you can avail X4 on your capital on delivery holdings. m.Stock offers the lowest interest rate starting from 6.99 to 9.99%. Another advantage is the unlimited holding period for your MTF trades. Most brokers will limit the holding to a year but with m.Stock you can hold as long as you want. You just need to make sure of the interest rates. You can read full details about eMargin facility by clicking here.

m.Stock doesn’t complicate things

m.Stock doesn’t overcomplicate things by providing too much information. There are brokers bombarding users with information after information, confusing the new traders. That is why I said, m.Stock might be the best broker for beginners.

You can check out the advantages from the web story below:

m.Stock Review: Things I don’t like about m.Stock

There are some things, features, bugs, and missing features I don’t like about m.Stock and let’s see all of them one by one.

You need to tap twice for buy or sell page to appear from the options chain.

When you are browsing the Options Chain on mStock, and want to buy or sell a specific options, you have to repeat the process two times for the next page to appear. To better understand, watch the video below, when I tap the buy button nothing happens, then tap it again, then the next page appears.

m.Stock has other buys, and they need to fix it quickly.

I am yet to find Options Chain in the Desktop version of mStock

In mobile Apps, you can easily find options chain but on desktop, I have yet to find that feature. If you click on the BANKNIFTY or NIFTY, it will directly go to the chart. In the chart, there is nothing other than the trading view chart. m Stock needs to really work on these missing basic things. During this m Stock review, I will give the lowest points on this.

Other brokers like Fyers, Dhan have integrated TradingView and other features along with Options Chain in both mobile and desktop apps. But m.Stock developers seem to have stuck in mobile OS. Seriously, all brokers are introducing new features like the Option strategy features, payoff charts and other advanced features but in the case of m.Stock, where is the Options Chain in Desktop?

The contract note links on the Desktop are often broken

If you go to the report section and want to access your contract notes, when you click on the links, it is often broken and fails to open. While writing this m.Stock review, I found it out, and for the past 4-5 days, it failed to open the page. But I tried taking the screenshot, it is suddenly working now. I hope mStock has fixed the problem.

Excessive promotion of refer & earn feature

A major portion of the app screen is dedicated to the live running feed of users inviting their friends and getting rewards. I understand this is a part of their promotion to have more userbase but sometimes, there are two promotions: one in the running feed and another banner at the end of the homepage promoting it. Sometimes, it feels really too much.

Yes, the referer will get a reward of Rs. 555 and m.Stock will get more user but it should be done in a better way. And yes, if you signed up with my link, I will get Rs. 555 when you open m.Stock account with lifetime free brokerage plan.

Click Here To Open m.Stock Account With Zero Brokerage For Life.

m.Stock Review: Need to implement and improve the product overall

m.Stock is a relatively new broker, and it is very good for new users in the market, but there are many features that need to be improved for it to be on par with the other established brokers. Let me list some of them below:

- Fix the bugs in the app.

- Check out the problems listed above.

- Provide better P&N features with more visually appealing data like other brokers do.

- Provide other basic features and market analysis tools.

- Have a better social media presence and feature tutorials on YT.

m.Stock Review: Do I recommend it?

Yes, I will recommend beginners to use m.Stock to trade. You will notice and agree with me that your fees are a big problem. Even if you don’t agree with me now, you will notice once you trade it.

Overtrading will be there for sure and when you are learning and applying different strategies you tend to spend more on fees. During this time, you will have small profits and big losses. These small profiles will again be eaten away by the brokerage fees.

Even when profitable, it is always good not to pay brokerage fees. I also recommend it for swing traders with MTF features with the lowest interest rates. I am sure over time, new features will be introduced and the bugs will be fixed. Check out the link below to sign up now:

What do you think of m.Stock review? Email us your opinion and douts, and we will check it out.

My Favorite Stock Trading/Investment Tools

TradeCred Review – Best Invoice Discounting Platform In India?

Best stock brokers for beginners in India.

Smallcase subscriptions for free.

Best broker and mutual fund investment for beginners – Groww – Click here to signup, activate your Demat account & Get Rs. 100 for free.

Best stock brokers for day trading –Upstox, Fyers.in (Free account, Free AMC)

Best charting platform – TradingView.com

Trusted Forex broker for Indians – Exness.com (Zero swap charges).

Become a crorepati just by investing 5k per month in mutual funds.

Busting the myths of investing in US Market.

How to increase your credit card limit temporarily?

How to invest during a market crash?

Why you should never use PhonePe to invest in Mutual Funds.

Invest in Indian startups using TykeInvest.

1 thought on “m.Stock Review: Might Be The Best Broker For Beginners & Intermediate Traders”