INDMoney is the best all in one investment, advisory, tracking app for stocks, bonds, mutual fund, crypto, credit card, NPS, FDs, etc. In this INDMoney App review, you will know everything about INDMoney and my personal experiences with this app.

If you haven’t heard about the INDMoney App, tell me where you have been. Today, we will review the INDmoney app in detail and we will discuss how to track all your mutual fund, stock, investment, loan, credit card bills in just one place. Keep reading till the end to know the referral code to Rs. 1,000 worth of US Stocks like Tesla, Microsoft, Apple, etc. for free.

INDmoney is a platform where it will fetch all your investment and credit details in one place and tells how much your worth is. It will also make it convenient for you to plan your retirement plan according to your retirements. I have been using this app for some times and overall I am satisfied with it.

INDMoney is so much more than an investment tracking app. It is an all app to invest in US stocks, track your investments, mutual funds, crypto, FDs, etc. Keep reading to know the full INDmoney app review.

- INDMoney App Review

- How to invest in US Stocks using INDMoney?

- What happens when your SBM savings account creation is failed in INDMoney?

- Buying an US stock

- How to track all your mutual funds, stocks, investments, loans, credit card bills in one place?

- What are the minimum requirements for joining INDMoney App?

- How to get free US Stocks for simply spending your credit cards?

- How to invest in mutual funds using INDMoney?

- How to invest in bonds using INDMoney App?

- INDMoney App review – Daily portfolio update in email.

- INDMoney review – INDMoney App Credit Card

- INDMoney Quiz

- Track crypto investments in INDMoney App

- INDMoney review – insurances

- Pros & cons of INDMoney App – INDMoney review

- INDMoney App review – Frequently Asked Questions (FAQs)

- INDMoney App review – verdict

- My Favorite Stock Trading/Investment Tools

INDMoney App Review

As per the official website of INDMoney, it says track, save and grow as its motto. It is a one-stop app to track all your investments and debts in one place automatically. INDMoney will track all your investments in stocks, bonds, mutual funds, etc.

It will also track your credit card details, loans, expenses, and even taxes. After tracking everything, it will show your net worth and it will help you setting up your goals when you retire. On top of all these, you can start investing in stock, mutual funds, bonds, and US stocks directly from the INDmoney App.

INDMoney is most famous being the best app to invest in US Stocks without any fees. Seriously, there are no fees from INDMoney but normal fees like the currency conversion, exchange fees, etc. are there. INDMoney in partnership with SBM bank provides the lowest fees and best exchange rates in India for investing in US Stocks.

How to invest in US Stocks using INDMoney?

Investing in US Stocks using INDMoney is really simple. All you have to do is tap on the + tab on the homepage of the INDMoney App. Once you tap on the icon, you will see a list of investment options available. After tapping on the US stocks button you will list of US Stocks, select the one you want to invest in.

You can invest in fractional shares also which means you don’t need to buy the whole share. Just select the company you want and enter the amount you want to invest in. Now complete the transaction. Congrats, you are now an investor in US Stocks. Follow the steps below to start investing in US stocks.

- Click on the US stocks in the INDMoney App homescreen.

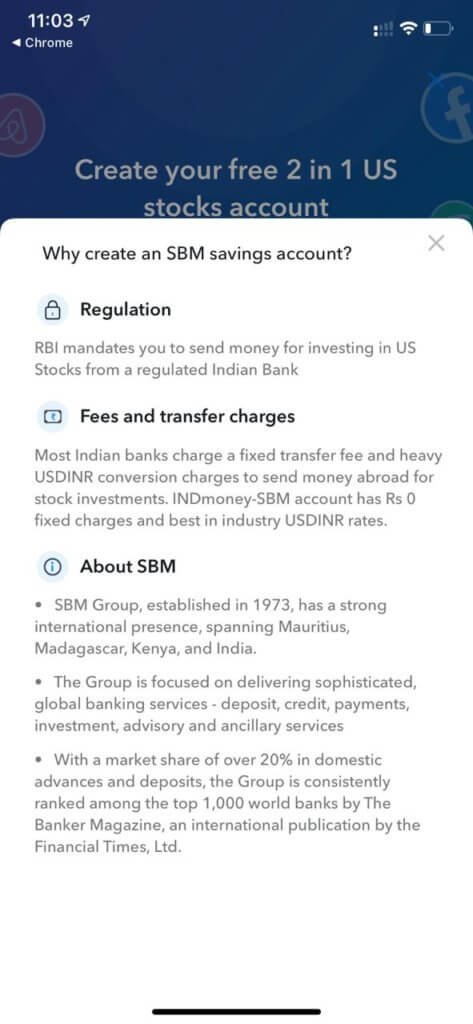

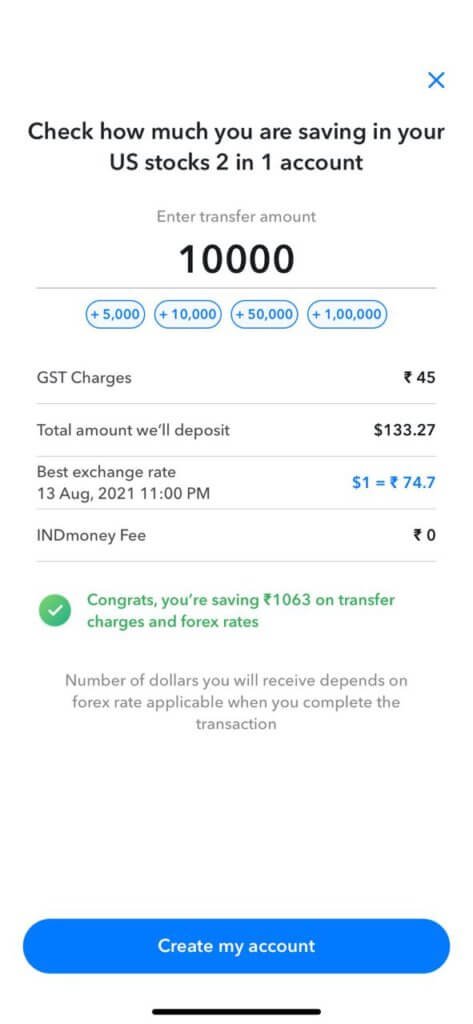

- You will see some introductions about the 2 in 1 accounts from INDmoney and SBM savings account. As you can see in the photo below, you are able to save around 1063 when you deposit 10,000 as compared to other services and banks.

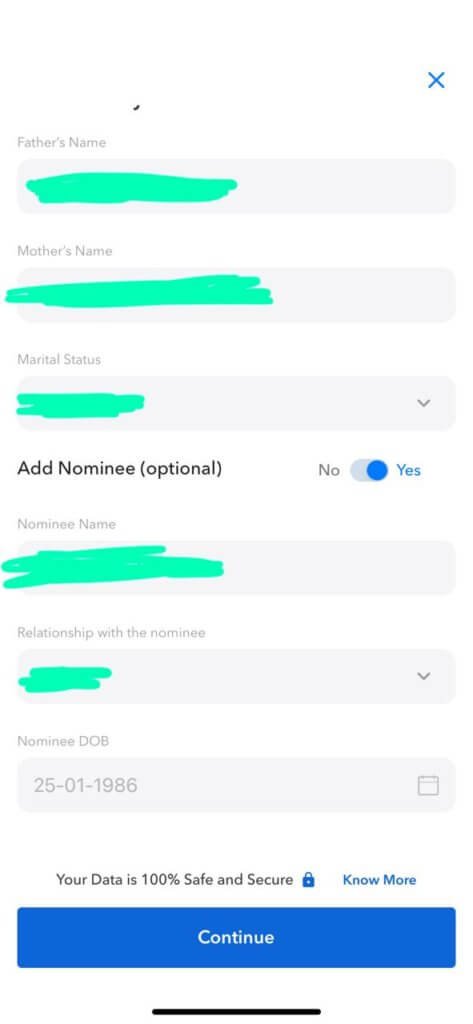

- Tap on create my account and you will options to upload PAN card, Passport and nominate someone.

- Upload your PAN card, Passport and enter your nominee details.

- Now enter your professional details in the signup form of INDmoney app.

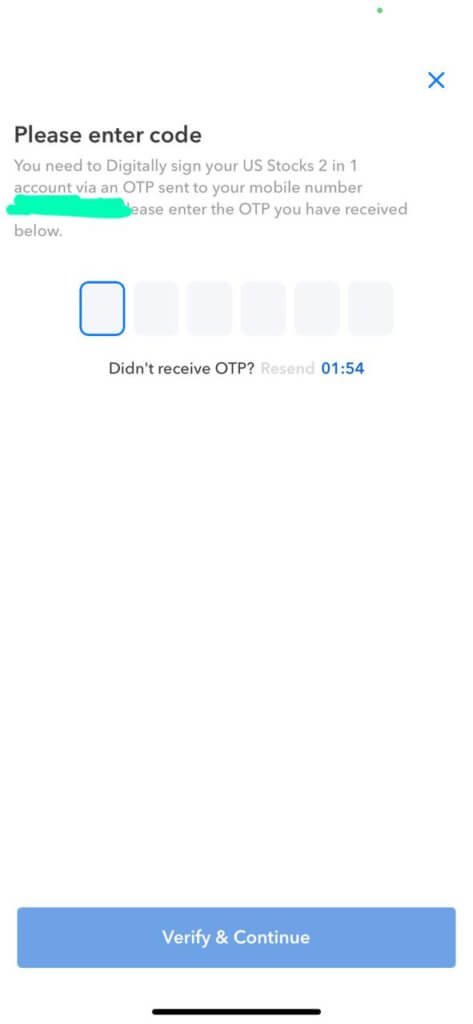

- Once you complete this step, you will need to verify your application with the OTP that you will receive in the mobile number you used during the sign up of INDMoney App.

- Once you verify it, you will see a page showing your account creation is pending.

- After few hours, you will receive an email about the activation of your account.

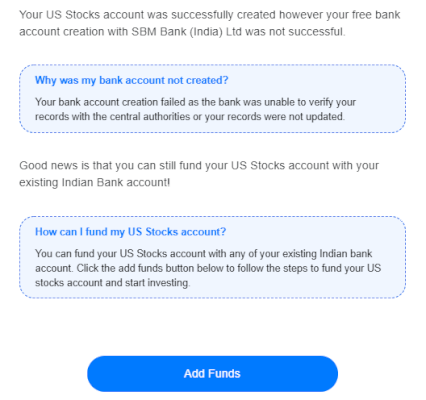

Unfortunately, my SBM Savings account creation was not successful but the US account was successful. This means you can still add funds and buy US Stocks but with a little higher fees from the bank side. All other fees concerning the INDMoney will remain the same. You can see the reason why the bank account was not created.

What happens when your SBM savings account creation is failed in INDMoney?

UPDATE: Earlier, I reported that my account activation was failed and is not possible to apply again. However, after some time, INDMoney sent me an email saying my account is now activated. So, I guess you have to wait a little more. However, read the email exchange below for more information.

I contacted INDMoney and they told me that is a one-time opportunity but still, I can add funds from other bank accounts. You can check the whole email exchange below:

Dear ****,

Thank you for writing to us.

Once SBM 2 in 1 account fails then you cannot apply again.

You can add funds from any other your bank account.

Kindly let us know if there is anything else we could assist you with.

Loving INDmoney? Refer your friends to join INDmoney to help them improve their financial life well and earn rewards.

Regards,Team INDmoney

Finzoom Investment Advisors Pvt. Ltd.616, 6th Floor, Suncity Success Tower, Golf Course Extension Road, Gurugram, Haryana – 122005 | www.indmoney.com

Confidentiality & Disclaimer:

This message contains confidential information and is intended only for the individual named. If you are not the named addressee you should not disseminate, distribute or copy this e-mail. Please notify the sender immediately by e-mail if you have received this e-mail by mistake and delete this e-mail from your system.

On Sat, 14 Aug at 6:37 PM , *************** <*************> wrote:Topic => US Stocks

Sub topic => Account Opening & Basic Details

Query => What are the requirements for opening a US Stocks account?

Description => My 2 in 1 account opening was failed in the bank side. What can I do to successfully open it now? Kindly help

Platform => iOS

User subscription: 0

User subscription plan: None

Buying an US stock

Once you add money to your US account, you can select any stock to buy. Tap on the US stock on the homescreen, then select any stock you want to buy.

After that, you will find two options BUY and SIP. Based on your requirement, tap either Buy or SIP and enter your price details as shown below. Next, complete your transaction. Your stock will be shown in your dashboard after some time.

Do not worry US market is different so it may take sometime to reflect on your account. That’s it, VOILA! You have successfully invested in the US market from India.

Why I am not investing in US markets?

If you are a small retail investor seriously thinking about investing in the US Market using the INDMoney, I suggest you kindly check out the fine details before onboarding with the idea of investing in the US market.

I have written a very detailed article about the myths of investing in US stocks. You should check it out by clicking here or by following the link below. During this INDMoney App review, I dug deeper about investing in US stocks using INDmoney, and finally, I have decided that I will hold off this for some time until my portfolio in Indian sector is enough for me.

INDMoney App is not a trading app rather it is an investment app. Make this difference clear to you.

How to track all your mutual funds, stocks, investments, loans, credit card bills in one place?

I installed INDMoney for review and fall in love with it. If you are investing in many brokers like Groww, Zerodha, Upstox, etc. you might be having a hard time tracking all your investments and loans. With INDmoney, tracking all these investments just became very simple. All you need to do is download the INDmoney app and complete the signup process.

Just like any other finance-related apps, you will need to provide your ID details and PAN card details. After this, you will be asked to provide details about your investments like the email linked to your transaction and PAN associated with the investments and loans.

Does INDMoney really track all your investments correctly?

I have been using the INDmoney App for more than two weeks at the time of writing this post and during the INDmoney app review, the INDmoney does not track all your investments accurately.

My savings account details are missing while one of my friends has his savings account tracked automatically. My stocks portfolio is only 25% tracked while that friend’s portfolio is completely missing.

He tried uploading manually but had no success. While you can add the details manually then it becomes like any other app. Anything useful feature becomes a premium feature that is not so very attractive to new users.

Having said this, it offers basic tracking and gives you an idea of what are your investments and your risk profiles. It will also send notifications for news of stocks you have investments via mutual funds. If you have PPF, EPF, bonds, etc. These features overall will give an overall idea of what are your investments and what is your worth in one place.

During INDMoney App review, and after some updates, my friends’ details are also tracked properly.

What are the INDMoney app fees?

There is absolutely no fee in INDMoney app for tracking your basic investments. However, if you are subscribing to a premium plan it will charge you as per the fees listed on the website. The premium plan starts from 399 per month all the way to 14,999 per month.

Premium users will get real-time stock advice, prime chat options, warning on high-risk investments, investment opportunities on commission-free products, and tax advice. Personally, I wouldn’t buy the premium features unless you really need them.

Apart from these charges, if you are investing in US stocks, there will be extra charges. There are many charges including deposit, withdrawal, tax, etc. However, the brokerage fee is free including buying and selling US Stocks. Intraday trading is enabled however, short selling is not allowed in INDMoney App.

What are the minimum requirements for joining INDMoney App?

The only requirement for joining INDMoney is to have a credit score of more than 650. Other than this, you need to have a valid PAN card, ID, email, mobile number, and bank details. Make sure you have the above details before signing up. INDMoney will check your credit score automatically during the sign-up process. You don’t need to worry about it.

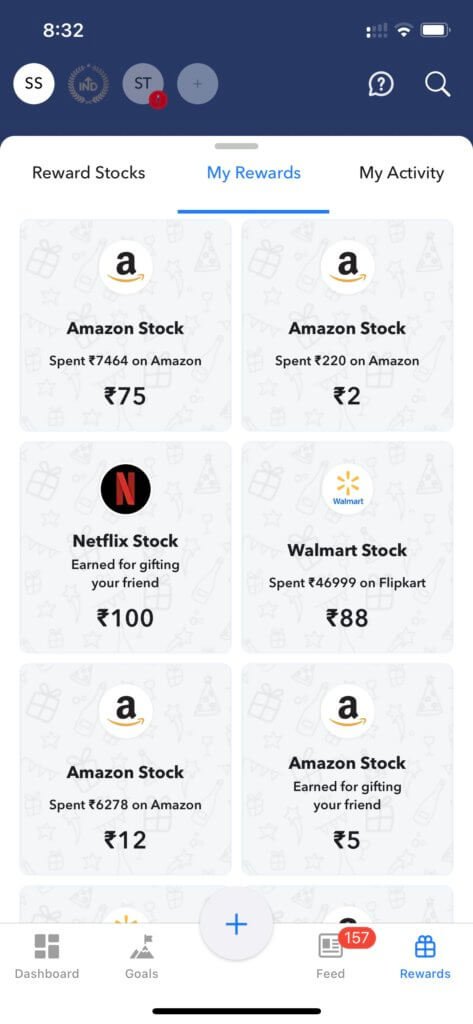

How to get free US Stocks for simply spending your credit cards?

INDMoney is rewarding credit card users for simply using their credit cards. INDMoney App keeps introducing new and exciting features to its users. I have been on continuous INDMoney App review and it keeps suprising me.

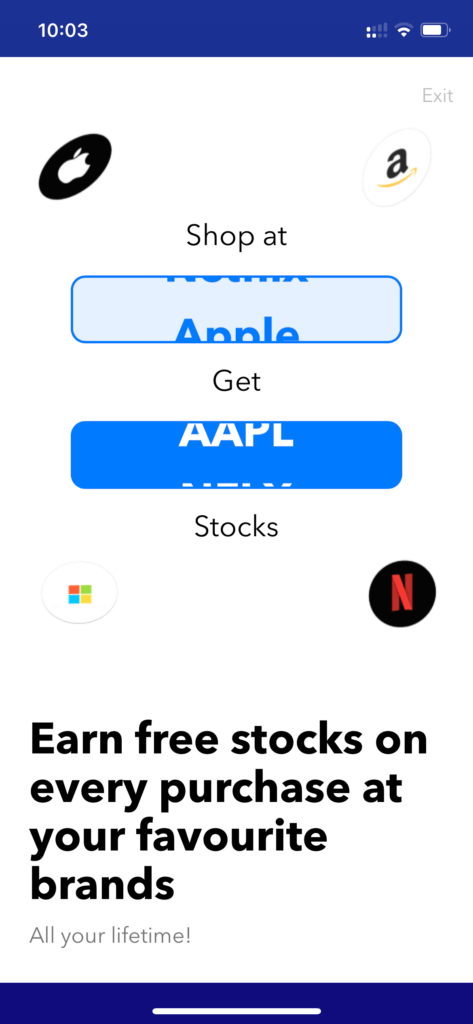

If you use your credit cardsin US listed companies, you will be rewarded with stocks of those companies when the monthly statement arrives.

For example, if you spent 10K in makemytrip for flight booking, 2k on apple app store, 5k on Flipkart and 3K on Amazon, you spent a total of 20K total in companies listed on US market. You will get 1% of spent amount as US stocks of those companies in that respective ratios.

However, you don’t get any rewards on other comanies that are not listed in US stock market. As you can see below, I have got a bunch of US stocks for free from INDMoney App. I do nothing but buy normal stuffs that I need online using the credit cards I already have.

How to invest in mutual funds using INDMoney?

Investing in mutual funds using INDMoney is as easy as buying any products on Amazon. On the dashboard scroll down and tap on the start now under the mutual fund section. You will see a list of mutual fund types. From there you can select based on return rate, tax saving, better than FD, etc.

From that select the mutual fund you want. How to select a mutual fund is a whole new topic. Comment down below if you want me to write a post about selecting a mutual fund. Now you have selected the mutual fund and on that page, you will see the NAV price, returns over a range of years, and all other details.

Now, you can select either SIP or lump-sum. Select it and enter the amount you want and complete the transaction. If you select SIP and this is the first time, you will need to activate auto-debit in your bank’s internet banking.

That is it and it is that simple. SIP is a very powerful investment method where it can convert your small amount of money to even crores if you consistently invest in it.

Note: INDMoney is SEBI registered so, you don’t need to worry about anything.

How to invest in bonds using INDMoney App?

Investment in bonds through INDmoney is not user-friendly and needs to ask an advisor first. It is better you invest through other methods like GoldenPi. You can track your investments using INDMoney and can easily manage your net worth and investments portfolio as a whole.

The beauty of INDMoney is that you can any other investments you have such as the savings account balance, real estate, PMS, EPF, AIF, PPF, etc., and easily track each investment and as an overall investment strategy.

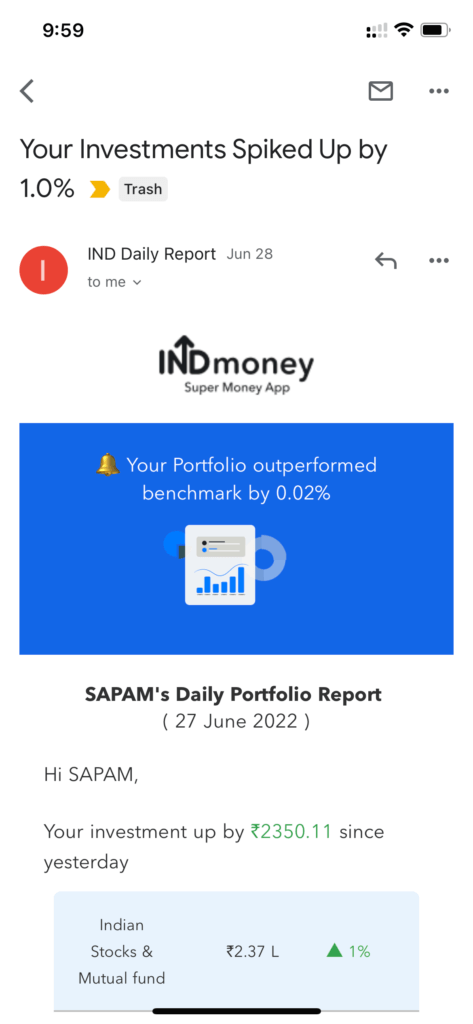

INDMoney App review – Daily portfolio update in email.

One of the best feature of INDMoney App is the daily portfolio update directly to your inbox. It will aggregrate all the investments and will inform you about daily PNL of your investments.

INDMoney review – INDMoney App Credit Card

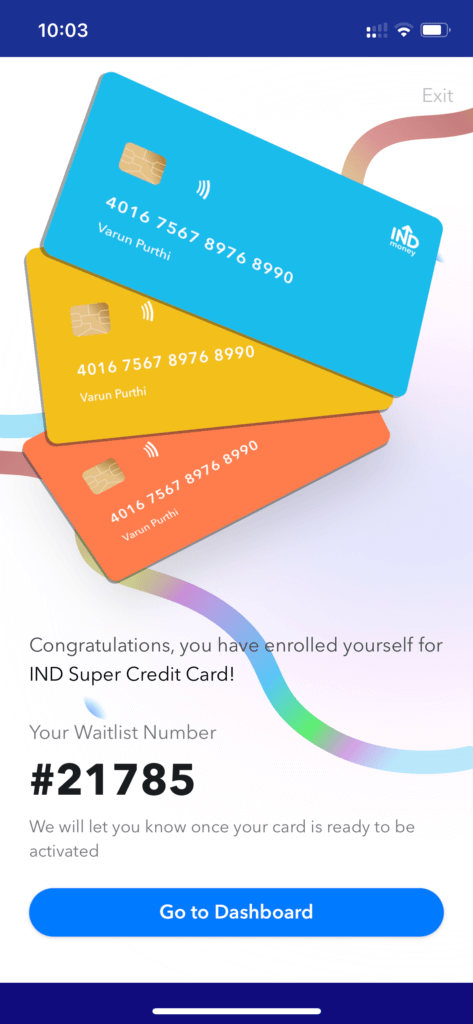

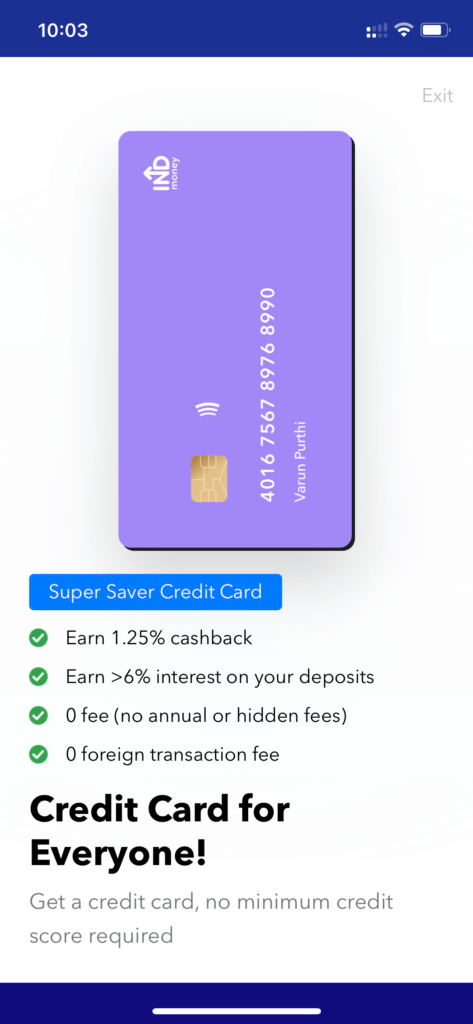

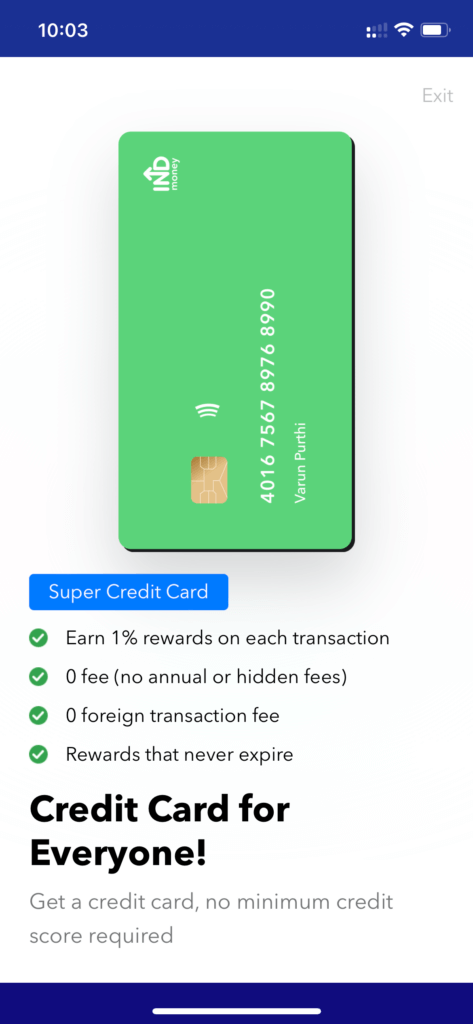

INDMoney will introduce its own credit card in the near future. I have enroled it and in a waitling list of 21785. The INDMoney credit card will have no joining fee and annual fees. Check out some of the benefits of INDMoney App credit card below:

- No joining and annual fee.

- Two types – credit cards against FD and normal Credit card.

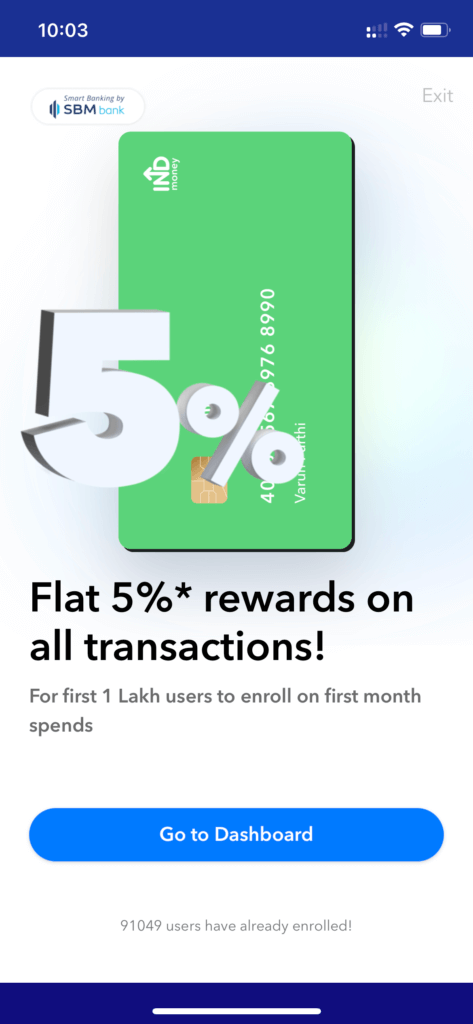

- 5% rewards on all transactions for the first 1 lakh users.

- 1% rewards on all transactions.

- No foreign transaction fees.

- No expiry on all rewards.

- >6% interest rates for cards against FD.

- Free US stocks on every purchase at your favorite brands.

I will write more about the INDMoney App review specifically about INDMoney Credit Card.

INDMoney Quiz

It is a new feature in INDMoney App where you can answer simple quizes and if you answer quickly, you get tokens to enter a lucky draw to win US stocks. I have participated it bu haven’t won a dime.

Track crypto investments in INDMoney App

You can all your popular crypto investments in the INDMoney App itself. Unfortunately, you have to enter all your transactions (buy&sell) manually. Once you entered it, it will start tracking automatically.

Remember to enter the sell details otherwise it won’t track properly.

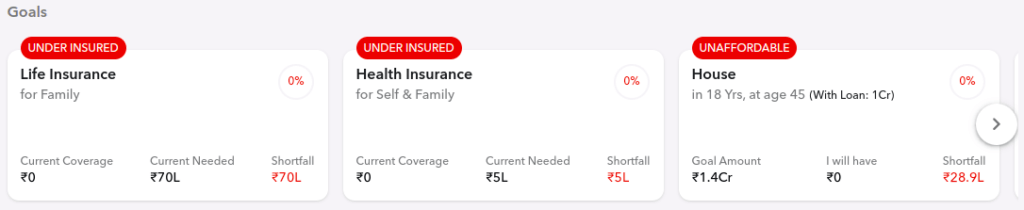

INDMoney review – insurances

You can enter your requirement details and it will show different health and home insurnaces. Based on your choice you can buy it. It avoids all complexity and you can easily buy the insurance.

Pros & cons of INDMoney App – INDMoney review

Pros

- All in one investment and liability tracking platform.

- Auto-track all your investments.

- Manually add other investments.

- Easy to use UI.

- Set-up goals and invest based on that amount.

- Subscribe to family plan and manage wealth as a family.

- Buy cryptos using INDMoney coins.

- Refer a friend and get free INDMoney coins.

Cons

- Auto-track doesn’t work sometimes.

- It fails to sync all my investments in stocks.

- Infancy stage and lots of changes in a short period of time like from virtual US stocks to crypto.

- Many users reports problems regarding investing in US stocks.

- Looks like many investments options but provides very few to invest in that platform (hopefully, it will change soon).

- Too frequent changes in the INDCoins section specially in the rules and withdrawal section.

- You can sell and re-buy with the INDCoins. You can only buy once and withdraw to your bank account.

- Any really useful, you will need to subscribe to premium plans.

- 2 in 1 account creation for investing in US stocks is a one time opportunity. Once you failed to create account in SBM account, you are left to add funds from other accounts in which the fees are higher than the other methods.

INDMoney App review – Frequently Asked Questions (FAQs)

INDMoney App review – verdict

I really like using the INDMoney App with regards to knowing where are my overall investments, what are my liabilities, and my total worth. How much do I need to invest to achieve my goal within the time limit? However, I personally won’t use INDMoney as an investment platform because it is like a jack for all master of none. INDMoney provides too many investment features but none of them are designed to be very attractive to users.

You just can’t simply compete with other apps like groww, upstox, etc. which are made specifically for investments. INDmoney should first try to master one thing and expand in other things before touching all the sections without providing the best services in any of the investment options. Having said that I would recommend using it for tracking all your investments in all sectors. Click here to sign up on INDMoney, use the code: SAPOAIRTSL, and get free TESLA US Stocks. Best if you click using your smartphone and install the app.

My Favorite Stock Trading/Investment Tools

TradeCred Review – Best Invoice Discounting Platform In India?

Best stock brokers for beginners in India.

Smallcase subscriptions for free.

Best broker and mutual fund investment for beginners – Groww – Click here to signup, activate your Demat account & Get Rs. 100 for free.

Best stock brokers for day trading –Upstox, Fyers.in (Free account, Free AMC)

Best charting platform – TradingView.com

Trusted Forex broker for Indians – Exness.com (Zero swap charges).

Become a crorepati just by investing 5k per month in mutual funds.

Busting the myths of investing in US Market.

How to increase your credit card limit temporarily?

How to invest during a market crash?

Why you should never use PhonePe to invest in Mutual Funds.

Invest in Indian startups using TykeInvest.

Disclaimer: All investment strategies and investments involve risk of loss. Nothing contained in this website should be construed as investment advice. Any reference to an investment’s past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.

Any ideas or strategies discussed herein should not be undertaken by any individual without prior consultation with a financial professional for the purpose of assessing whether the ideas or strategies that are discussed are suitable to you based on your own personal financial objectives, needs and risk tolerance. This website expressly disclaims any liability or loss incurred by any person who acts on the information, ideas or strategies discussed herein.

The information contained herein is not, and shall not constitute an offer to sell, a solicitation of an offer to buy or an offer to purchase any securities, nor should it be deemed to be an offer, or a solicitation of an offer, to purchase or sell any investment product or service. Everything discussed here is only for educational purposes. Do your own research before investing.

5 thoughts on “INDMoney Review – My Experience In Investing, Tracking”