Undoubtedly Amazon Pay ICICI credit card is the best entry-level credit card in India. Since I got it more than two years ago, I have earned more than 21,000 cashback. With this experience, let’s review the Amazon Pay ICICI credit card starting from how to get it, is there any fees, how to maximize cashback, and how good the credit card is.

In my experience, the Amazon Pay ICICI credit card is the best credit card I have including the Flipkart Axis Bank credit card and other cards. The cashback without the annual fee is the factor that is putting this card above all other cards.

What is Amazon Pay ICICI Credit Card?

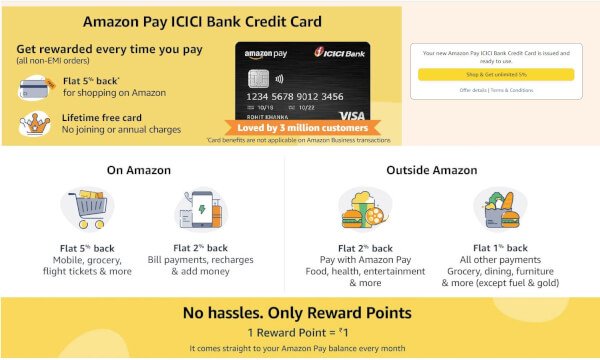

The Amazon Pay ICICI credit card is a credit card issued by the ICICI bank in partnership with Amazon that gives you extra cashback and many other offers when you buy from Amazon and other Amazon partner websites. The cashback ranges from 5% to 1%.

There is no joining fee or annual renewal fees for the Amazon Pay ICICI credit card. However, there is a caveat to this. Read till the end to know more about this.

Who can get the Amazon Pay ICICI credit card?

Anyone who has an Amazon account with good standings and a good credit score is eligible to apply for this card. Final approval is in the hand of ICICI Bank. You don’t necessarily need to have a credit score but if you have one, it needs to be a good one.

Do I need to show income proof/salary slip to get this card?

Typically yes but you can get the Amazon Pay ICICI bank credit card without showing any income proof. So, how to get the Amazon Pay ICICI Bank credit card without showing any income proof or salary slip?

You can get it if you have a good credit history or a long association with ICICI bank or if you already have a credit card with ICICI Bank (easiest option). Let me explain this one by one clearly and I got this card without showing any income proof.

1. By having a good credit history.

If you are a seasoned Amazon customer with a good standing on your Amazon account and you have a good credit history, ICICI will give you based on your history trusting the credit history. All you have to do is upload and fill up the details.

2. By having a long relationship with the ICICI Bank.

If you are having a savings account, or loan account with the ICICI bank for years, the ICICI bank will check and provide you with the Amazon Pay ICICI Bank credit card without any income proof. You should know that the relationship should be a good one.

If you have a savings account just sitting there is not a good relationship or a loan with missing EMI for that matter. You should be consistently transferring money and paying loan EMI properly without missing it.

With this trust, ICICI bank is happy enough to issue you the Amazon Pay ICICI bank credit card without checking your income proof.

3. By already having an ICICI bank credit card (easiest option)

If you already have an ICICI Bank credit card other than the Amazon Pay credit card, you can simply choose the option: already have a credit card with ICICI bank, during the application process or ask the ICICI bank to issue the Amazon Pay ICICI bank credit card link to the already existing card.

I got my card through this option. It was super easy and was issued instantly. However, you may be wondering how I got that other card in the first place without any income proof.

I got my first ICICI Platinum credit for free without any income proof as a student and you don’t need documents except your college ID, PAN, and Aadhaar card. ICICI will issue the card with a credit limit of Rs. 50,000.

What are the major benefits of ICICI Amazon Pay Credit Card?

The most important benefit is the 5% cash back on any order on Amazon.in. This means you will get 5% cashback on any order without any limit. Other than this, for any transaction using this card, you will get 1% cashback with no limit.

Apart from this, you will get 3%, and 2% on partner sites. Check out the list below for more details.

Is ICICI Amazon Pay credit card really free?

Yes, it is completely free with no joining fees and no renewal yearly fees. However, without Amazon Prime, your cashback rate dwindles down to 3% against 5% for prime users. So, if you are a prime user for quick and free delivery, prime video, prime music and prime gaming, you will get 5% cashback.

Amazon Prime is around Rs. 1,499 per year which was Rs. 999. So, if you are thinking of getting Amazon Prime only for the 5% cashback, we need to dive a little deeper in the mathematics world to check if that is really beneficial for you.

Just to break even, you will need to order Rs. 29,980 per year from Amazon. 5% of Rs. 29,980 will give you Rs. 1,499 cashback which is equal to the annual fee for Amazon Prime. Again if you subscribe to Amazon Prime, you will get all the prime benefits automatically.

I have Amazon Prime and I recommend it for the free delivery, Prime Video, and for boosting the cashback rate to 5%. You can click here to try Amazon Prime for free.

What is the salary eligibility for the Amazon Pay ICICI Bank Credit Card?

There is no base fixed limit to get the Amazon Pay ICICI credit card. However, a salary of a minimum of Rs. 25,000 is recommended with proper documentation of salary slips and bank statements. It is also important to note that you can get this card without any salary proof.

Can I withdraw money from my Amazon Pay ICICI Bank credit card?

Yes, you can withdraw money from your Amazon Pay ICICI Bank credit card at any ATM. However, it is absolutely not recommended to withdraw cash from any credit. There is no grace period and the interest rate is around 36% per annum. The interest starts instantly the moment you withdraw it, till it is fully paid.

How to pay bill for Amazon Pay ICICI credit card?

There are different ways to pay bill for Amazon Pay ICICI credit card: through imobile app, through CRED, through Amazon, through PayTm, and any other bill payment platform. Let’s check each one below:

1. Pay bill via iMobile app

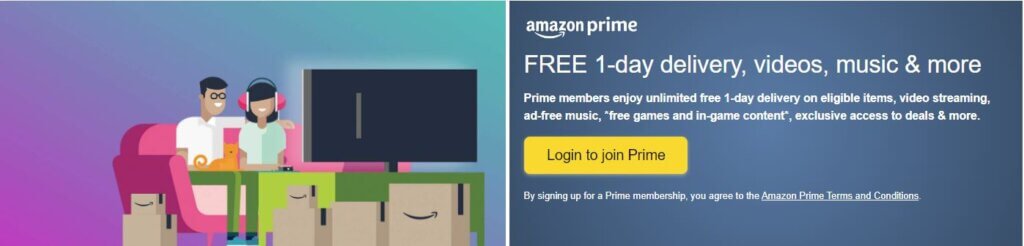

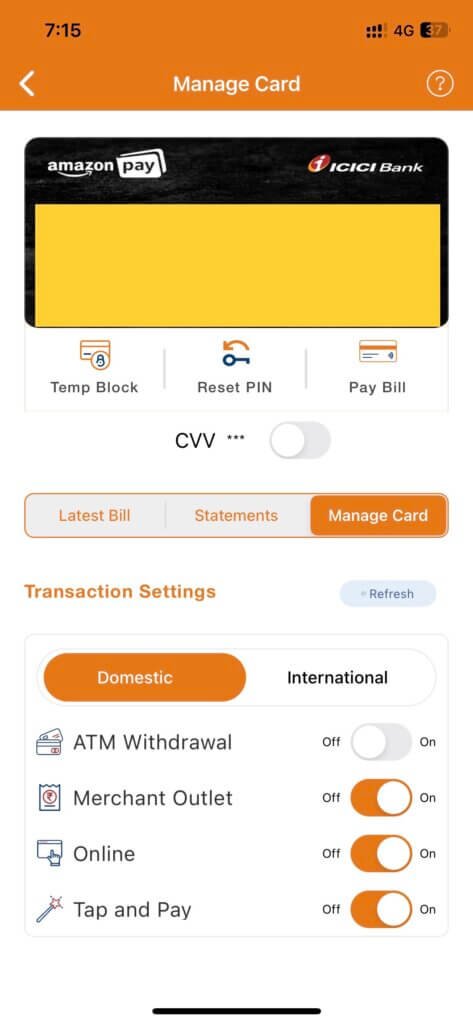

iMobile is the official mobile app for ICICI bank. If you have any relationship with ICICI bank, you will need to install this app and activate it. Once the activation is completed, you can check your current limit, usage, and due bills and can pay the bill in the App itself using UPI, and directly deduct it from the savings account.

You can check out the interface of the app below. You can browse different statements, current due, change limits and control your card all from the app.

2. Pay credit card bill via CRED App

This is my favorite way of paying credit card fees not only for the Amazon Pay ICICI credit card but also for every other card I own. You will get cashback for paying the bills on every bill payment.

If you use my link below to sign up on CRED, you will get Rs. 250 for free on your first bill payment.

In CRED you can pay for your electricity bill, gas, water, mobile, and many more. On top of this, you can also shop for different items. There is always some kind of lucky draw, or bidding game going on for big rewards like iPhone 14, MacBook, earpods, TVs. etc.

Trust me you won’t be disappointed, just sign up and feel the difference by clicking the link above. I have written a detailed review of the CRED app, you can check it out by clicking here.

3. Pay through PayTm and other bill payment apps.

You can pay the bill by using PayTm and any other app just by entering your credit card number and making the payment using bank transfer or UPI.

Amazon Pay ICICI Bank Credit card review

So, I got this card more than two years ago and have been regularly using it since then. Till now, I have got more than Rs. 21,000 in cashback. I have no regret about getting the card as the cashback overweight all other things including the Amazon Prime subscriptions.

One thing you have to adjust is that the cashback is not instant. All the cashback you earned this month will be credited at whatever the billing date of your credit card.

Suppose, the billing cycle of your credit card is from the 15 to 14 of each month, all the cash back you earned during the 15 to 14 of each month will be deposited to your Amazon Pay wallet balance on the 14 or 15 of that month once the credit card statement of the month is generated.

Many people have confusions that will this card work offline and in other places or if is it only for Amazon. This is just another credit card, it will work anywhere where any credit card is accepted both offline and online.

I have purchased so many items both online and offline other than Amazon.in.

Airport lounge access is also possible. All you have to do is swipe your card at the airport lounge and you will get free breakfast, lunch, dinner, and unlimited drinks.

Over the last two years, I haven’t had a moment where there is a discrepancy in the cashback calculation or problems in paying the bills or during transactions.

What I don’t like about the Amazon Pay ICICI Bank credit card?

The only thing I don’t like is the difference in the reward rate between prime and nonprime users. But you have to understand that it is a tactic to drive new prime users. Also, with Prime, you will get many other benefits.

Will I recommend Amazon Pay ICICI Bank credit card?

Absolutely YES! This card is the most used credit card for me due to all the benefits. Personally, for me, the rewards heavily overweight the yearly Amazon Prime subscripts. I recommend everyone to get this card for free.

Amazon routinely runs promotional drives by providing cashback of Rs. 200-1000 just for getting the card. Don’t forget to check this one out before applying.

My Favorite Stock Trading/Investment Tools

TradeCred Review – Best Invoice Discounting Platform In India?

Best stock brokers for beginners in India.

Smallcase subscriptions for free.

Best broker and mutual fund investment for beginners – Groww – Click here to signup, activate your Demat account & Get Rs. 100 for free.

Best stock brokers for day trading –Upstox, Fyers.in (Free account, Free AMC)

Best charting platform – TradingView.com

Trusted Forex broker for Indians – Exness.com (Zero swap charges).

Become a crorepati just by investing 5k per month in mutual funds.

Busting the myths of investing in US Market.

How to increase your credit card limit temporarily?

How to invest during a market crash?

Why you should never use PhonePe to invest in Mutual Funds.

Invest in Indian startups using TykeInvest.