Are you confused about the NO Cost EMI? Are you thinking if it is really “NO” cost EMI? Well, today, you will know everything about the NO Cost EMI including real hidden costs, how NO cost EMI is possible, how can you avail the feature, why is the actual EMI is more than the stated EMI, etc. in this post. Keep reading till the end to know everything about NO Cost EMI. Do you want to get a free credit card without any income proof? Stay tuned till the end to know about it.

What does NO cost EMI mean?

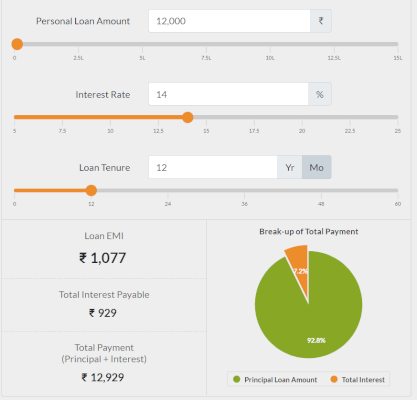

NO cost EMI is a form of EMI (Easy Monthly Installments) where you don’t need to pay the interest on the cost of the product you are buying. For example, if you buy a laptop from Amazon at Rs. 12,000 as EMI for 12 months, you will need to pay only Rs. 12,000 by the end of 12 months EMI. So, theoretically, you will need to pay Rs. 1000 every month for 12 months to complete your EMI. But it is not the actual case. In fact, in your credit card statement, your EMI will show as Rs. 1077 assuming 14% as the interest rate. But, wait, I just said there is no cost on interest but now the statement is showing along with the interest? Keep reading to know more.

If interest is there then how it is “NO” cost EMI?

So, to negate the interest on the EMI, online vendors like Amazon, Flipkart will give you the total interest for the EMI as an upfront discount at the time of payment when buying the laptop. Continuing with the above example, total interest during the whole 12 months EMI is Rs. 929. So, Amazon will give you a discount of Rs. 929 while buying the laptop that costs Rs. 12,000. Hence, you will need to pay Rs. 12000- 929 = Rs. 11071 instead of Rs. 12,000. So, logically, you are paying no interest even though your statement shows with the interest amount. But, your final payment for the EMI will not be Rs. 1077 per month but it will be more than it and it will not remain constant but decreasing every month. But why?

Why is the credit card statement more than the stated amount of EMI?

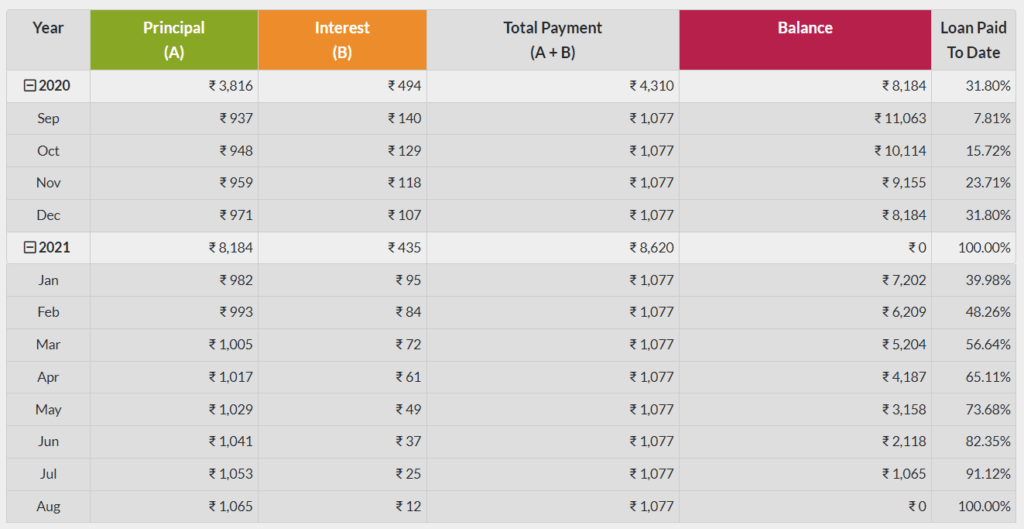

So, you might be wondering if there are any hidden costs with the NO Cost EMI that banks and online websites are cheating on the customers. Actually, it is not cheating but because of the GST (Goods and service taxes). In short, the bank will charge GST taxes only the interests you pay each month during the while EMI period. The amount of GST will keep decreasing as you keep paying the principal amount and interest on the remaining amount decreases each month. Continuing with the above example, in the first month, out of the total Rs. 1077 EMI amount, you are paying an interest of Rs. 140 at (14/12)% of Rs. 12,000. Now, 18% of Rs. 140 will be charged for GST which is Rs. 25.52. So, in total, you will need to pay Rs. 1077+25.52= Rs. 1102.52 as your total EMI amount in the first month.

Similarly in the second month, the interest will be Rs. 129 and GST will be Rs. 23.22. Hence, your total EMI amount in the second month will be Rs. 1077+23.22= 1100.22. You get the idea and it will continue till the last month of your EMI. If you are still confused about the amount of EMI, check out the images below that show in detail. Or you can follow this link here to modify it with your desired amount.

If you want to know how EMIs care calculated, I can explain it but it is out of the purview of this topic and it will be a complex topic. So, let’s stick on the topic of everything you need to know about NO Cost EMI while buying your stuff. The only hidden cost on the NO Cost EMI is the GST on the interests you pay on the principal amount.

How does NO Cost EMI work?

If you are wondering how is the NO cost EMI is possible when you are not paying any interest. The GST is paid to the government directly not the banks and online sites. It is because the sites like Amazon and Flipkart are ready to bear the cost of interest by themselves in partnership with the banks. The banks in turn will give some offers and bonuses when the online shopping sites and banks sign a contract. In other words, banks will continue to charge interest from you while online shopping sites will get more customers in the long term and not everyone will buy as NO cost EMI every time.

Does Bank Charge for NO Cost EMI?

Yes, the bank charges you the interest and GST on the interest as explained above. But you get the interest OFF as an upfront discount from a shopping site like Amazon or Flipkart.

How can I avail the NO Cost EMI facility?

First of all, in order to avail the NO Cost EMI facility, you need to find a shopping place that offers a facility like Amazon and Flipkart. After this, you need to have a credit card of those banks that offers NO Cost EMI in collaboration with the online vendors. It is worth noting that not every bank offers this facility and not all products have the NO Cost EMI.

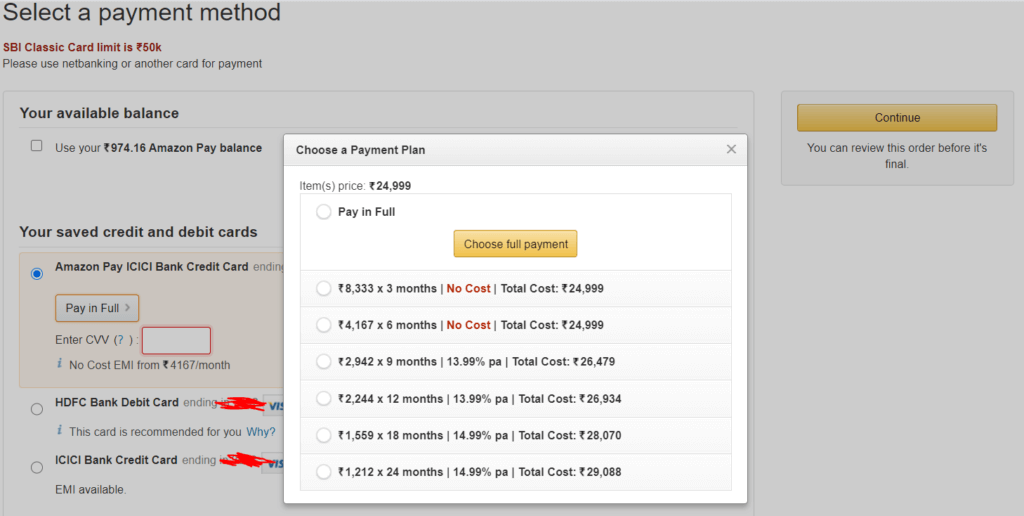

For example, the same bank that has NO Cost EMI offer in Amazon on a product might not be available on another product. So, check out the bank details before buying it. Also, do not forget to click on the NO Cost EMI Tab on the payment page. Check out the photo below on where to click to see NO Cost EMI options. For Amazon, press the “view only ‘No Cost EMI’ options” button and for Flipkart, click on the “NO Cost EMI” tab in the payment page or payment option.

As you can see only the Amazon Pay ICICI Credit Card is eligible for NO Cost EMI for that particular product in Amazon while Flipkart has only the Flipkart Axis Bank Credit Card. Do not confuse with the normal ICICI credit card and Amazon Pay ICICI Credit Card, Axis Bank Credit Card, and Flipkart Axis Bank Credit Card. They are different.

Get a credit card

Now that you have found an online shopping place where NO Cost EMI is offered, the next step is to get a credit card from a bank that is in association with the online vendor. Two cards that always have NO Cost EMI offered in Amazon and Flipkart are Amazon Pay ICICI Credit Card and Flipkart Axis Bank Credit Card respectively. Both the cards can be used like any other normal credit card but it has many benefits if you buy from Amazon and Flipkart respectively.

If you want to know more about these cards, I have written a detailed review on the Flipkart Axis Bank Credit card and if you want to know more, check the link below. For Amazon Pay ICICI Credit Card, I will write a detailed post in the coming months. You will get information about how to apply, minimum requirements, review based on personal experience, etc. It is worth your time.

If you are wondering, how can you get a credit card without showing any income proof, check out how I got 3 credit card without showing any income proof by following the link below:

Are you a student who wants to know which credit card is the best for students in India? Check out the link the below:

Check out alternatives if you don’t have a credit card.

You can check out other alternatives but I couldn’t find any offer with NO Cost EMI but there are plenty of services with EMI. But, if you are still interested in normal EMI you can check out ZestMoney and Cashe. Keep in mind that these companies do not offer NO Cost EMI but normal EMI.

Select the product and choose EMI option or add your new card in the EMI tab. For Amazon, check out the photo below. As you can see, my card is already added so, you can choose to pay in full or pay in EMI with NO Cost EMI option enabled. If you haven’t added the card yet, select EMI as payment option by scrolling down in the list of payment options in the payment page and add your card then choose NO Cost EMI.

The process is same with Flipkart too. You need to select the EMI option in the respective card at the payment option page as shown below.

When will the EMI start after ordering the product?

You will start paying your EMI from the next month. So, after ordering the product, your bank will deduct the whole amount from your card limit and it will be converted to EMI within the next 3 working days. The EMI amount will come in combination with other transactions in the monthly statement as a whole. So, according to your billing cycle, you will start paying your EMI due from the next month onwards.

Let’s say that you order a laptop on EMI on the billing cycle of 15, March to 14 April, you will need to start paying your EMI from the Month of May. Make sure that you have enough balance and budgeted already the amount needed to pay every month including the GST.

Do you want to know a trick that you can pay your EMI after two months?

Yeah everybody loves tricks specially when it is about saving money or deferring payment. If you want to start paying your EMI after two months of purchasing a product, then you have to follow the specific instructions below.

This trick has one important factor – the billing cycle date. I will explain with an example. Let us say that your credit card billing cycle is 15-14th of every month. So, every 15th you get your monthly statement. If you want to pay your EMI after 2nd Month of ordering the product, you will need to buy the product one or two days before the end of the billing cycle. It best works if you buy one day before the billing cycle end date. If you buy on the 13th then it will take 2-3 days to convert to EMI. But your monthly statement is already generated on the 15th.

After the 15th, your EMI statement will come so the monthly EMI statement will come next month which means you only have to pay next to next month. I have experienced this myself with the Axis Bank Flipkart Credit Card. The first-month statement will come as the whole amount instead of EMI but you don’t need to pay anything. Pay the amount – the principal amount. This is confirmed by the Axis representatives and I have done myself.

What are the benefits of NO Cost EMI?

There are many benefits of NO Cost EMI which are given below:

- NO need to pay interest which means less money to pay back as you get the interest as upfront discount.

- No need to bear the whole amount at once but in a monthly installment basis.

- There is no need for down payment.

- Zero processing fee.

- No additional fees.

- No hidden fees.

Are you looking to buy a laptop in EMI? Check out the best laptops below Rs. 30,000 with SSD or below Rs. 50,000:

Or, are you looking for best LED monitors below Rs. 7000? Check out the link below:

Are you facing problems like getting 3D Secure blocked because you entered the OTP wrong multiple times? Has your debit or credit cards blocked for any reason? Check out the blog post below on how to unblock 3Dsecured blocked cards?

Stay tuned for more such posts and comment down below if you have any questions.

3 thoughts on “Everything You Need To Know About NO Cost EMI”