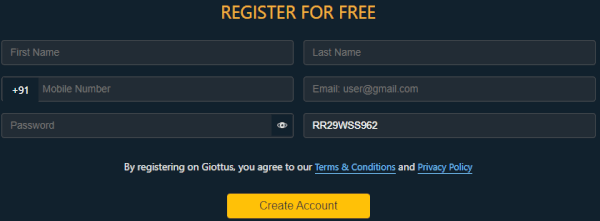

Buying meme coins such as Saitama in India is not an easy task due to the non-listing of such new coins in major popular exchanges in India. Having said this, you can buy Saitama in India in the Giottus crypto exchange in India just like any other major coins like Bitcoin, Ethereum, MATIC, etc. If you don’t have an account on Giottus yet, you can click here to signup and start buying SAITAMA in India without the hustle of installing a wallet, backup phrases, high transaction fees, etc.

By the end of this post, you will understand how to signup on Giottus exchange, complete KYC, and start buying/selling SAITAMA in India. Without a due, let’s start digging to the point.

How to buy SAITAMA in India?

In short, there are two ways to buy Saitama in India – (a) buy Saitama in an exchange like Giottus, and (b) buy Saitama in one of the decentralized exchanges like Uniswap. However, the majority of the exchanges like the CoinSwitch, WazirX, Vauld are yet to list Saitama in India. This is because Indian exchanges are extra cautious in listing new meme coins. Just like Shiba Inu, Indian crypto exchanges listed Shiba only after almost all major foreign exchanges listed Shiba Inu. Late listing means a late entry for most Indian customers.

I know you are one of those few early adopters that want to HODL Saitama early on and bet that it will be another SHIBA INU journey. Just be careful that early birds either get the good grains or get trapped in the hidden trap. But one thing is clear that late adopters don’t get the best chances.

Why is SAITAMA not listed on WazirX, CoinSwitch or Vauld?

A new coin is listed on such exchanges only after careful audits. Only respective exchanges have the exact criteria that are needed to be fulfilled for a new coin to be listed. However, you can assume certain common criteria. Such criteria include but are not limited to – scam coins, real projects, price manipulations, project founding members, coin supply, transaction fees, HODL pattern, etc.

Even though all these criteria are valid, Indian exchanges are extra cautious and will only list when SAITAMA is listed on major international exchanges. This way, there is more assurance that SAITAMA must be safe to list as all other major exchanges are also listed.

However, there are some less popular and brave exchanges like Giottus which allows lesser-known and new coins like Floki Inu, Saitama, etc. to trade. Keep in mind that the Giottus exchange is much smaller than WazirX or Vauld and hence the difference between the buy and sell price is much higher than other popular exchanges.

As you can see in the above photo, at the current price, you need to pay Rs. 1.25 for 3,12,500 but you will get only Re. 1 when you sell 3,12,500. This is a 20% price difference. So, you will need to have a price increase of 20% just to break even. I personally think this is a very high difference.

If you ask an equity trader that the difference between the ask price and bid price is 20%, s/he will have a heart attack. Nevertheless, the share market and crypto market are totally different, so, we should look at it differently. While we are talking about the share market, Upstox is giving away free brokerage for the first month when you signup. The account opening charge is completely free. This is valid only when you sign up using this link here.

Next, we will look at how easily you can sign up on the Giottus exchange and complete your KYC as early as possible.

How to signup on Giottus and complete KYC process easily?

Signing up on Giottus is as easy as any other Crypto exchange and has a similar process. You enter your details like full name, email, PAN Card, Aadhar, Bank statement, and your account will be activated quickly.

Next, you will need to confirm the link through your email and your mobile. After that, you will need to complete KYC verification. In this you will follow the following steps copied from Giottus:

We ask for your PAN and Aadhaar Card only to verify your identity this helps us in adhering to our AML & KYC policies. Security of your information is our topmost priority and have implemented best-in-class systems and processes to safeguard your information.

Please follow the below process to Upload your ID Card Image.

- Kindly Upload you PAN Card and Aadhar Card soft copies in the designated upload boxes.

- In case you do not have a Aadhar card, you can choose to upload your Passport copy (or) Driving License copy (or) Voter id by choosing the relevant id from the drop down box

- Please note: Max image upload size is 5MB. Photocopy images not accepted.

- Accepted File Formats for Upload: *.jpg, *.jpeg, *.png, *.gif, *.bmp

- Not Accepted File Formats for Upload: *.pdf or any other format not listed above

After you upload your ID Card copies, you will be directed to the KYC details page where you have to enter your ID Card details. Please make sure that the First name and Last name are as per your PAN card.

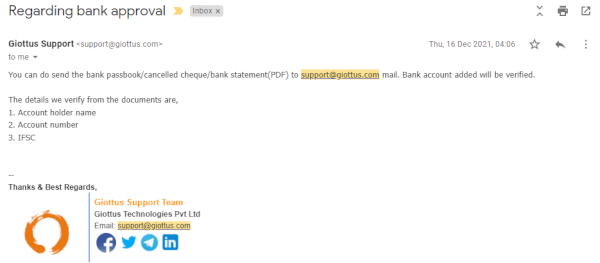

Next, you will need to add your bank details. Once the KYC is complete, you will receive an email from Giottus that your KYC is completed and you will be asked to send your bank statement in the email to activate your bank account. You can just reply to that email with your account statement.

My statement got rejected the first time because my middle name was shortened instead of my full name. So, be careful everything you entered during the signup process is the same in the bank statement. The second time, it got accepted after correcting the error from my side.

The support team was relatively quick to reply and willing to help. However, one thing I noticed is that they don’t check the email trail and reply like the email is a new support request which is a bit not handy. I needed to explain again and again about the previous emails and context. A simple support ticket system will easily solve this problem.

How to add/withdraw money in Giottus?

If you have used other exchanges then you won’t find any problem in adding or withdrawing Giottus. However, if you are completely new, you don’t need to worry about it. I will show you how to add and withdraw INR in Giottus to buy SAITAMA in India.

First, you will need to sign and activate your bank account after completing KYC in the Giottus web app or mobile app. If you haven’t, click here to signup now. Once you complete this, you will see add/withdraw/history on the homepage once you logged in.

Click on add and select the payment method, enter the amount and click next. You will be redirected to the payment page, complete the payment and your account will be credited as soon as possible.

If you are on mobile, click on the middle button with the Giottus logo. You will find your portfolio and your money manager just like the desktop version as shown in the photo below. Every other process is the same with desktop.

Buy SAITAMA in India

Now that you have completed adding money to the Giottus wallet, finally, it is time to buy some SAITAMA from Giottus in India.

Follow the steps below to buy SAITAMA in India using the Giottus exchange:

- Signup, complete KYC, add money to your Giottus wallet.

- Select SAITAMA from the list of coins and click the buy tab.

- Enter either the amount of SAITAMA you want to buy or the amount of INR you want to spend.

- Click “Instant Buy SAITAMA”.

- Boom you just bought SAITAMA in India without the lengthy process of buying from a decentralized exchange.

If you want to buy SAITAMA from one of the decentralized exchanges like Uniswap, I have written a detailed article on how to buy Floki INU in India. The process is the same, so you can click here to know how to buy SAITAMA in India using any of the decentralized exchanges.

Which one is easier to buy SAITAMA – Giottus or decentralized exchange?

Buying SAITAMA from Giottus is much much easier than buying from any decentralized exchanges. In Giottus, all you have to do is signup, add money and buy.

Buying from any of the decentralized exchanges means signing up on Binance, buying ETH, and sending in your wallet. Setting up the wallet backup phrases, connecting your wallet with the exchange, pay insanely high ETH gas fees.

There are many steps that you can’t make any mistakes during the process. One mistake means all your funds are lost and there is no second chance. If you lost your backup phrase, you are done. If you send ETH to the wrong network, your money is gone forever. The gas fees are just too high and are not stable.

Why should you buy SAITAMA using the decentralized exchange?

With all the negative points above, you might be wondering why would you even consider buying there? There is only one reason that is SAFETY. If you bought SAITAMA from Giottus and it decides to shut down one day, you have no control. Giottus or any other exchanges can go bust and just run away with your money. I am not saying they will but just saying the possible scenario.

If you bought using UNISWAP with your own wallet, your SAITAMA will be there in your wallet even if the creators decide to run away. You will see SAITAMA in your wallet forever even if it is worth nothing and no one is using it. Only you can sell/send from your wallet.

If you are looking for systematic crypto investment, I recommend using Vauld. Click here to read the detailed review of Vauld.

Disclaimer

Disclaimer: All investment strategies and investments involve risk of loss. Nothing contained in this website should be construed as investment advice. Any reference to an investment’s past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit. Any ideas or strategies discussed herein should not be undertaken by any individual without prior consultation with a financial professional for the purpose of assessing whether the ideas or strategies that are discussed are suitable to you based on your own personal financial objectives, needs, and risk tolerance.

This website expressly disclaims any liability or loss incurred by any person who acts on the information, ideas, or strategies discussed herein. The information contained herein is not, and shall not constitute an offer to sell, a solicitation of an offer to buy or an offer to purchase any securities, nor should it be deemed to be an offer, or a solicitation of an offer, to purchase or sell any investment product or service. Everything discussed here is only for educational purposes. Do your own research before investing.