Hello everyone!! Today we will discuss in detail on what are the best credit cards for students in India with no income which includes SBI, HDFC, ICICI, Axis bank credit cards for students. This includes the ICICI bank credit card for students without any fixed deposit and any annual fees. Also, we will discuss more details about benefits, eligibility, fees, limits and limits of usage on all these different types of cards for students. On the side note, we will also learn about how to manage your credit cards and keep it safe from unwanted hands.

Best Credit Card For Students in India

Before going any further, let me list out my best credit cards for students in India below:

- ICICI bank credit card for students.

- SBI credit card students.

- Axis Bank Students credit card.

All the credit cards listed above have no joining fees and annual fees if you apply for it as a student. Contents of the article:

- How to get Credit cards as a student?

- ICICI Bank credit card for students.

- Eligibility, how to get it.

- Benefits.

- Advantages and disadvantages.

- SBI credit card students.

- Eligibility, how to get it.

- Benefits.

- Advantages and disadvantages.

- Axis Bank Insta Easy students credit card.

- Eligibility, how to get it.

- Benefits.

- Advantages and disadvantages.

- Why don’t banks need your income proof for a student’s credit card?

- Will these credit cards report to the credit bureau?

- How can you check your credit score for free?

- How to maintain a good credit score?

- Is credit card insurance required?

How to get Credit cards as a student?

Since you are a student, chances are very high that you do not have any income source or even if you have some source but couldn’t provide as a salary slip. Almost all banks require you to provide income proof in order to give you a credit card or have a good credit history. Since you are a student, you do not have any credit history except if you took some bike or loans for some reason. If you have taken some kind of loan, chances are there that you have a credit history. If you want to know your credit history, you can check out from Paisabazaar, CreditMantri, BankBazaar, etc. Click the links below to check your Credit score.

There are basically three ways you can get a credit card as a student having no income proof or credit history. First one is the ICICI credit for students without any fixed deposit, second one is the credit card against FD and the last one is obtain an add-on credit card from your parents.

I prefer the first one which is ICICI bank credit card for students as the best credit card for students in India as many of the students have difficulties for a fixed deposits of Rs. 20,000 or more. In addition to this, many banks requires a minimum balance of Rs. 5000-10000 which is a big amount for many students.

The second option is the secure credit card against a FD. So, SBI doesn’t have a minimum balance requirement and it will be a right choice if you don’t have a saving account in ICICI or Axis bank as you will need to maintain the average monthly balance. You will need a minimum of Rs. 20000 FD and you will get a credit limit of Rs. 16000 which is too less. To be realistic, it is better you have a FD of Rs. 50,000.

The third option is that you ask your parents for an add-on credit card. Your name will be written on the card but limits will be shared with your parents. Your parents can see what you are spending, how much, etc. Moreover, credit report will not be reported to credit bureau for most banks. So, this is a bad policy if you are looking to build up your credit score.

1. ICICI Bank credit card for students.

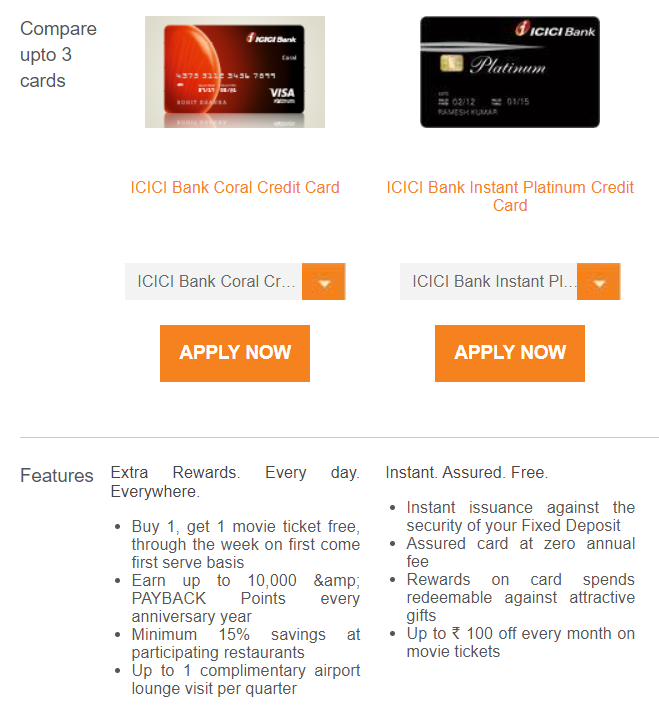

There are two types of ICICI credit cards you can get if you are a student which are ICICI coral credit and ICICI Manchester United Credit card. There is no need to show any income proof and bank statement. All you need to give is your college ID, Aadhar, and two copies of your passport photo. The major benefits include reward points, exclusive offers from major online retailers and free selected airport lounge access. There is no joining and annual fees. If you applied for these cards without the student offers, there will be annual fees.

I ranked the ICICI bank credit card as the number one credit card for students in India because it doesn’t need fixed deposit in order to get this credit card. Check out the full eligibility details below.

Eligibility for ICICI Bank Student’s credit card

As you are seeking the best credit card for students in India, you must be a student of one of the colleges or universities. You also must be above 18 years.

- A valid ID proof issued by your college/institute/university.

- 18 years or above.

- PAN Card.

- Two copies of your recent passport photo.

- A photocopy of Aadhar (optional but recommended).

How to apply for the ICICI bank credit card for students?

For major universities and institutes.

As mentioned above, in order to apply for ICICI bank credit card for students, there is no need for a fixed deposit. You also don’t need to have a ICICI bank account. If your institute is a big reputed institute like IITs or NITs, the ICICI bank representative will visit to your campus and they will organize an application drive. The representatives will handle all the details, all you need to do is provide the above required documents.

If there is no such visit to your institute, you can visit a nearest bank branch and ask for ICICI bank credit card for students which is either Coral credit card or Manchester United credit card. Both are contact less cards and NFC tag enabled cards. If they refused to give you any cards, then you can talk you some of your friends who want credit cards and made repeated requests in the branch, online and customer service. This may give them an idea that their product is in demand and may encourage them to come to your institute.

Apply as secured card against fixed deposit.

If still ICICI bank refuses, then you can open a fixed deposit account with them and you can ask for a secured credit card against the fixed deposit. This is the most easiest and simplest way of getting a new credit card for new users. There is no chance that ICICI will refuse you a credit card. My first credit card was also an ICICI bank credit card against fixed deposit. We will discuss in more details on how to get a credit card using fixed deposit method in below sections.

You can apply in online also by filling up a simple form. It gets more easier if you already have an ICICI bank account or loan or fixed deposit account. Follow the link below to apply for ICICI bank credit card.

https://www.icicibank.com/Personal-Banking/credit-card/apply-online.page

Benefits of ICICI bank coral and Manchester United Credit card.

The benefits will be the same as any other Coral or Manchester United card. Just to revise, let’s have a revise run on the benefits of ICICI bank and Manchester United credit card for students. The first and most attractive benefits of Manchester United card is the chance of going to a Man United match for free. But this quite not possible for one major reason which I will tell you later in other sections.

What makes the ICICI Manchester United card work?

- Opportunity to attend a Manchester United Premier League match at Old Trafford, England

- Private tour of the Manchester United stadium and museum

- Visit to the Manchester United Megastore at the stadium

Top 100 spenders, across cardholders from both variants, will get Manchester United branded shirt every month

The top most spender every month, across cardholders from both variants, gets a signed Manchester United jersey and match ticket

10% discount on merchandise from the Manchester United online store

Complimentary access to domestic airport lounges per quarter in India. Complimentary movie tickets every month under the Buy 1, Get 1 Free offer at BookMyShow. 15% savings on dining bills at over 2,500 restaurants across India through Culinary Treats Programme. Waiver of 1% on fuel surcharge, valid on a maximum spend of Rs 4000 per transaction at all HPCL pumps.

The above benefits are offered in all the cards. The airport lounge access is not offered in all airports but in selected airports. The lists of the airports are given below

Another benefits is that you don’t need to pay any annual fee or joining fee as you would’ve paid if you are not a student which is Rs.499+GST. Apart from these, the usual offers announced at the ICICI website for different brand deals like Amazon, Flipkart, etc. are all applicable.

Advantages and disadvantages of ICICI bank coral and Manchester United Credit card.

Let’s see the disadvantages first so that we can end on a good note.

Disadvantages

The biggest disadvantage of all the above cards is that it does not report your credit score to the credit bureau. I have two ICICI cards one on fixed deposit and Manchester United both are not reporting anything to credit bureau. One is more than two years and the other is also more than six months.

Did you know that you can 3 credit cards without showing any income proofs and fixed deposits? Check out the blog post below where I explained about it in detail.

Another disadvantage is that you can not enhancement after using it. In order to increase the limit, you have to provide income proof and salary slip. In case of credit card against fixed deposit, you must increase your fixed deposit amount in order to increase your credit limit. If you renew the fixed deposit, your card limit will be increased based on the interest accumulated on the fixed deposit account.

After you get the card, you will get couple of calls from the insurance companies tied up with ICICI asking for card insurance etc. Just say that you don’t want it. If you want you can take it.

Another thing I want to touch is that if you opted for the Manchester United card in the hope that you will get a chance to go there, then please leave that hope. Because, the chance is given only to top spenders so with your Rs. 50,000 credit limit, you can kiss bye bye to your dream of going to Man United Match for free. But, hey! you still get a cool Man United card like below:

Advantages

Now, let’s check out the advantages If your card is the one without FD then, the ICICI bank credit card for student has a credit limit of Rs. 50,000 and is same for everyone. You can use this in any way you want. But, you might want to manage your spending to prevent credit card debt.

The card works perfectly fine as any other card and Rs. 50,000 limit is on par with a salaried person so it is very good. Another plus point is that, all your reward point can be accumulated to a single account and redeem them instead of many reward point accounts for many credit cards.

I listed the ICICI card for students in the first list because it doesn’t require you for a fixed deposit and a decent credit limit.

Are you looking to buy your next smartphone with NO Cost EMI but you are confused about fees, hidden costs, etc.? Check out the article below to know everything you need to know about NO Cost EMI.

2. SBI credit card students

There are two or three types of SBI credit cards you can get as a student. SBI recommends SBI Unnati Credit card for students but I will prefer SBI Simply Save credit card. It provides heavy cashback and other coupons based on the amount of money you spent on the card. The SBI Unnati card is basically a honey trap into the SBI credit card system that you will want to convert to other available cards. All more details are discussed below and why you should and shouldn’t choose the SBI credit cards as your preferred credit card for students.

Eligibility, how to get it

In order to get the SBI credit card for students, you must have a valid student ID and have a fixed deposit with the SBI.

- Valid Student ID,

- PAN Card

- Aadhar (optional).

- Fixed deposit account.

- Address proof.

The address proof can be driving licence, aadhar, hostel certificate. You must have a fixed deposit account in order to get any type of SBI credit card for students. You can open one FD or you can request a credit card against an already existing FD. The credit limit will be in between 80-85% of the FD amount. If your account is already KYC updated, then you don’t need to verify anything, the credit card will be sent directly to the address you have in the SBI account.

How to apply for SBI SimplySAVE & Unnati Credit Card

You can talk to the nearest branch or home branch to open and apply for this credit card. You can apply for the SBI credit card for students by following the link below.

Apply for SBI credit card on SBI Card.

There are ways to get SBI credit cards without opening a FD even if you are a student and you don’t have any income proofs to show. However, in this a 599+ GST fee as you will take the card as a normal credit card holder not as a student. If you want to know how to get such a credit card with no FD and no income proof, stay tune and I will write a new post on this.

For SBI Unnati card, the first 4 years are free of any charge but after that there is an annual fee of Rs.499+GST. After this you better get other higher hand cards instead of this.

But if you are applying for the Simply Save credit card, the fees are free. Having said that make sure you talk this carefully with the branch officer that there won’t be any fee when the card is renewed due post expiry date.

Benefits

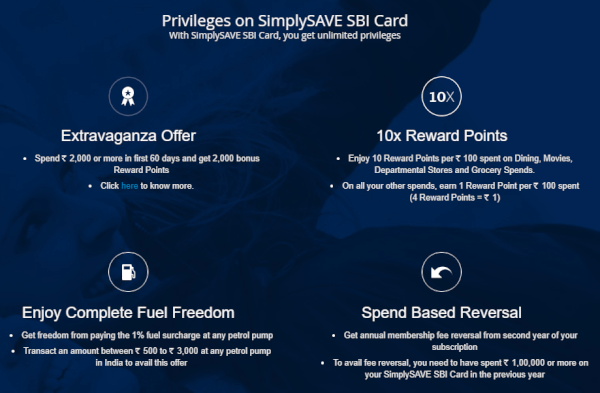

The SBI Simply Save Credit card comes with a bunch of exclusive offers and welcome benefits. You will get x10 rewards on Dining, Movies and other departmental stores. In all cases 4 reward points is equals to Re.1. So, in other cards and other transactions, you will earn 1 reward points per 100 spends but in Simply Save card, you will get 10 reward points.

You will also get 2000 reward points when you spend Rs. 2000 within first 60 days of the card’s activation.

Another exciting offer is the annual fee reversal (applicable when you are paying the annual fee) where the annual fee is reversed if you spend more than Rs. 1,00,000 in the card on the previous year.

In case of Unnati card, you will get Rs.500 cashback if you spend Rs. 50000 in the first 15 days. This is quite a difference from the Simply Save credit card. Other benefits are almost same for both cards and you can see them below.

There is another SBI card called SBI Student Plus Advantage Credit Card you can get this card with a fixed deposit and there is a fee of Rs.499 and most of the benefits are same. I think it is just not worth the fee while you can get a similar card without any fee.

Despite all the benefits, the need for a FD makes the SBI credit for students as the #2 in the list of best credit cards for students in India. The ability to get a credit card without an FD and without showing any income proof is a much preferred way for many students.

Other general benefits

- You can use your SBI Card Unnati in over 24 million outlets across the globe, including 3,25,000 outlets in India. Use your card to make payments at any outlet that accepts Visa or MasterCard.

- Contactless Advantage. Daily purchases now made easy with SBI Card Unnati/SimplySAVE. Simply wave your card at a secure reader to transact (Maximum of Rs. 2000). Even if the card is waved multiple times at the reader, the unique security key feature of Visa payWave will ensure that only one transaction goes through. If you are afraid of unauthorized transaction of you card, there are RFID blockers in Amazon. I recommend the following item. Check it out in amazon here.

Advantages and disadvantages

First of all you don’t need to pay any fee for these cards so it is a plus point. Second, you will get all the perks and benefits just as same as those paying users. Based on their offers, there are other welcome benefits like coupons for Amazon and it is very good. There is no minimum cart value to apply these coupons.

Coming to disadvantages, the SBI Unnati card is free only for the first 4 years and after that you will be charged with Rs. 499 and GST. The card doesn’t offer much of a cashback offer as compared to other cards. For SimplySAVE card, their customer care will constantly call you to increase your credit limit but in order to increase the limit, you have to change the card status from student to a normal user which means you will need to pay the annual fee.

But it is still good and you can get cashback offers from Amazon, Flipkart from time to time. This is still one of the best credit cards for students in India without any fees.

Another reason I don’t like about the SBI Unnati is that it is trying to entrap general customers to high interest cash withdrawals and drawing checks against the limit, etc. This is one of the reason why I place in second place in the list of best credit card for students in India. General rule of thumb is that you should never withdraw cash or draw a check on your credit card limit because it has high fees and interest rate. Always use it for general purchase.

3. Axis Bank Insta Easy credit card

This credit card from Axis bank the third in the best credit card for students in India and there are many reasons for it being at the last position. There is no so much perks apart from the usual reward points. This card does not have any annual fee which is a good thing. Check out all other fees and charges like interest rate, late fee, etc. by clicking the link here.

Eligibility

The basic eligibility for Insta Easy Credit Card is to have a minimum FD of Rs. 20,000 and maximum of Rs. 25,00,000 except tax saver FDs, flexi-deposits and fixed deposits in the name of any HUF, society, trust or company.

Documents required for Insta Easy Credit Card:

Documentation for Insta Easy Credit Card is an easy process. The applicant just needs to have a fixed deposit at any Axis Bank branch with no requirement of income proof, additional identity proof or additional address proof if the current address is same as the bank’s record.

A Fixed Deposit at any Axis Bank branch.

Minimum Fixed Deposit of Rs. 20,000; Maximum of Rs. 25,00,000.

There is no Income proof required.

No additional address proof (if current address is same as per bank’s record).

Any additional identity proof is not required.

All that is required is a Fixed Deposit at any Axis Bank branch.

How to apply Axis Bank Insta Easy Credit Card for Students

Applying for the Axis Bank Insta Easy Credit Card is very easy. All you have to do is approach to an Axis Bank Branch and ask them for an Insta Credit card. The process is more simpler and easier if you already have a FD account with the Axis bank. If you do not have a saving account then you will need to open one with the minimum balance requirements. You can also open any FD from online banking and via mobile app.

Did you know billions of dollars every year falls onto the hands of hackers due to your ill preparedness while using internet bank online or mobile banking. I have laid out 10 things you are doing it wrong while using internet banking or online banking. If you want to know more then check out the link below.

Benefits

There is no benefits that you will find it attractive. The only benefit is the fuel surcharge offer. But I recommend to never swipe your card in a oil pump.

Advantages and disadvantages

There is not so much to discuss because, the card is a simple card without any perks or benefits. Also, if there is no benefit then everything is a disadvantage.

Why don’t banks need your income proof for a students credit card?

First of all, banks need to know if you can pay back the money the banks lending to you in time. So, if you are a salaried person, they know you have a stable income source and bank can always get their money. It is in a way a guarantee that you will pay back their money. So, if you can not provide any income proof, there is no way banks will know that you are a reliable person.

Another way bank will know you are a good burrower is that you have a good credit history. But, in order to have a good credit history, you will need to have a credit card or some sort of loan previously. Since, you are a student, chances are low that you will have one of those.

Banks won’t need salary proof if they have some kind of security with them even so that they can collect the due money in case you are not paying. So, FD is your money with them and if you fail to repay the bills, bank will automatically deduct the money from it and cancel your credit card. This is why bank don’t need any income proof while issuing secure credit cards against FD for students.

As an exception, the ICICI bank is offering free credit cards without any sort of FDs or good credit history. This is why I gave the ICICI bank credit card for students as the #1 position in the list of best credit cards for students in India.

Are you looking for the best laptops under Rs. 50,000 with SSD? Check out the post below:

Are you looking for the best laptops under Rs. 50,000 with SSD? Check out the post below:

Will banks report to credit bureau for such secure credit cards?

Based on my experience, ICICI bank does not report your credit history to credit bureau. SBI and Axis bank reports to the credit bureau. However, please remember that it will take 4-6 months to first appear in the credit score. Do not check your credit score via banks website because they will charge you for that. Instead use the websites I have listed above to check your credit score.

For those trying to build a good credit history, you might want to consider SBI SimplySAVE as the #1 of the best credit cards for students in India as it will report your credit history in time.

How to maintain a good credit score?

Maintaining a good credit score is not a very tough task. All you have to do is use your credit card reasonably.

- First of all, never miss a full payment of all the dues.

- Second, keep utilization rate not more than 30-50% of the credit limit.

- Third, do not apply for credit cards or loans multiple times within a short period of time like within two months.

- Fourth, keep multiple accounts like two or more credit cards, personal loans, home loans, etc.

But the most important thing is to always pay the full due on time. The best credit card for students in India which, in my opinion, is the ICICI bank credit card seems not to report your credit history to the bureau. By thinking that it is not reporting, do not think of not paying the bills or messing up, who knows it will report later.

Is credit card insurance required?

Keep in mind that you will receive multiple calls asking to sign up for a credit card insurance for an amount like Rs.599 per year. For a person with very broad liability it absolutely makes sense to cover your credit card with an insurance. But for a common people, it is a waste of money. Having said this, if your card is stolen and is used for unauthorized transactions, then an insurance will be very helpful to you. In my opinion, it is your choice and there is no harm in having one if you are likely to have an accident with your credit card.

Since, we are discussing about the best credit cards for students in India, most of the students are at risk of their credit card being stolen in hostels or rents. So, I will suggest to have an insurance.

Nowadays, many health insurance companies have combo pack which includes the credit card insurance. You can check out the following insurance plans for more details.

Do you want your car or two wheeler insured? Check out the Reliance two wheeler insurance and GoDigit Car Insurance.

Conclusion

In this lengthy post, we have discussed in detail about what are the best credit cards for students in India and why ICICI is in the number one and best of all. Also, we have discussed about SBI SimplySAVE and Unnati card for students and how to get it with a simple FD in the bank branch. Last card is the Axis Bank Insta easy credit card and why it is in the last position.

In addition to this, the following is also discussed:

Why don’t banks need your income proof for a students credit card?

Will these credit cards report to credit bureau?

How can you check your credit score for free?

How to maintain a good credit score?

Is credit card insurance required?

What are your thoughts on the above list of best credit cards for students in India and which bank do you want to add or remove. Comment down below and let me know why you want to do it. Stay tuned for more exciting posts and in the meantime read the related posts below.

4 thoughts on “Best Credit Cards For Students In India With No Income”